Bitcoin (BTC) and altcoins have experienced sharp declines due to the US government shutdown and dwindling expectations for the Fed’s December interest rate decision.

However, after the lockdown ended and expectations for a FED interest rate cut increased, the market started the new week with recovery.

Bitcoin, which fell to $80,000 on Friday, rose above $86,000, while altcoins also experienced small recoveries.

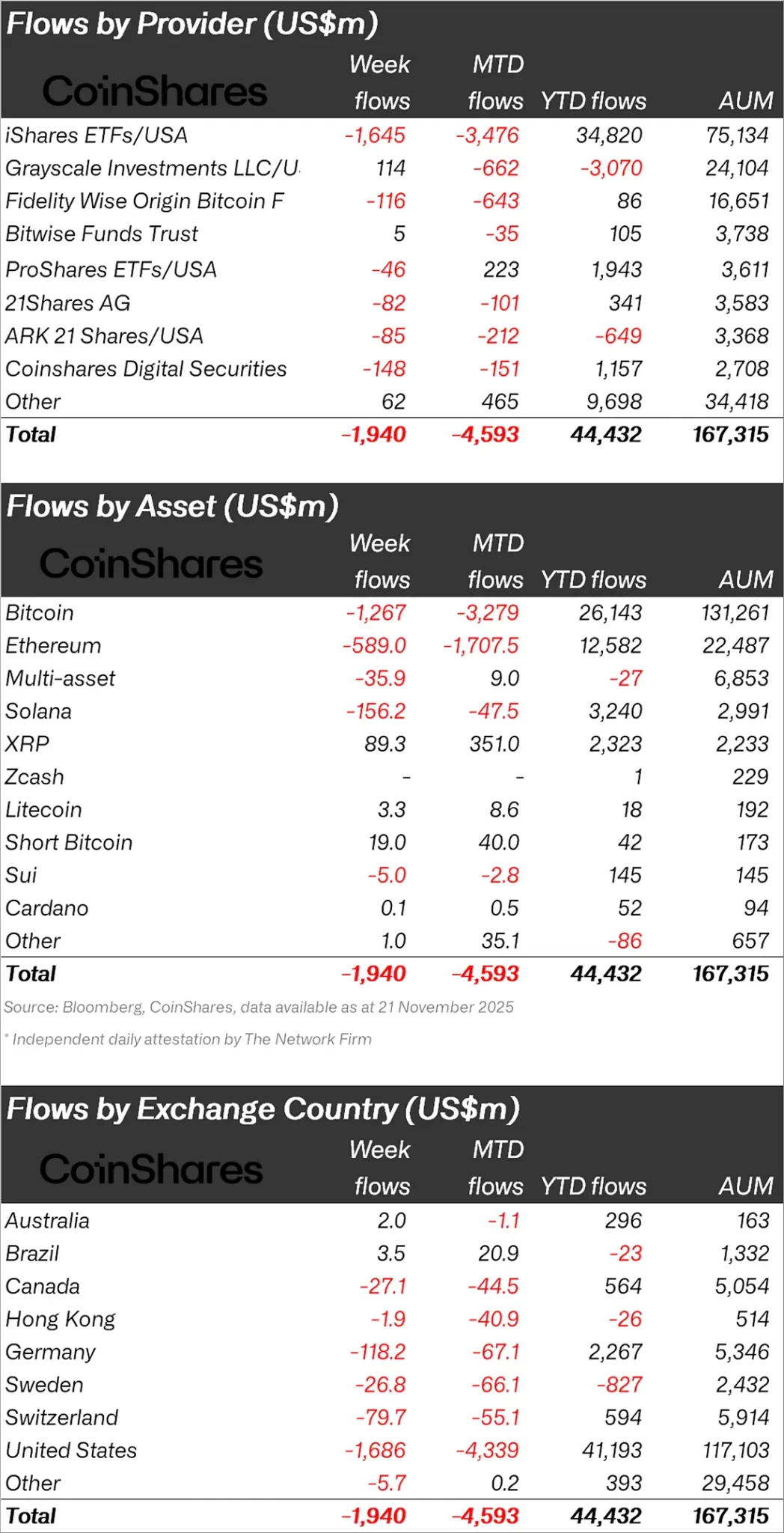

While wondering whether the rise will continue, Coinshares published its weekly cryptocurrency report and stated that there was an outflow of $1.94 billion last week.

“Cryptocurrency investment products saw $1.94 billion in outflows last week, bringing the four-week total to $4.92 billion. This was the third-largest outflow since 2018.”

Outflows Concentrate on Bitcoin and Ethereum!

When looking at individual crypto funds, it was seen that the majority of outflows were in Bitcoin.

While Bitcoin experienced an outflow of $1.26 billion, Ethereum (ETH) experienced an outflow of $589 million.

When we look at other altcoins, Solana (SOL) continued to rise for the second week, while XRP experienced inflows due to ETF influence.

While XRP saw an inflow of $89.3 million and Litecoin (LTC) $3.3 million, Solana saw an outflow of $156.2 million and Sui (SUI) $5 million.

“Bitcoin saw most of the outflows last week, totaling $1.27 billion, but also experienced the biggest recovery on Friday with inflows totaling $225 million.

Ethereum saw a total of $589 million in outflows. Ethereum experienced a small recovery on Friday with $57.5 million in inflows.

Solana saw $156 million in outflows, while XRP bucked the trend with $89.3 million in inflows last week.

When looking at regional fund inflows and outflows, the USA ranked first with an outflow of $1.68 billion.

Following the USA, Germany experienced an outflow of $118.2 million and Switzerland $79.7 million.

In the face of these outflows, Australia experienced a small inflow of $2 million and Brazil $3.5 million.

*This is not investment advice.