- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Wall Street embraces ‘Suitcoiners’ for strategic dialog.

- Fears arise over Bitcoin’s structural integrity.

Eric Balchunas, senior ETF analyst at Bloomberg, recently highlighted the use of “Suitcoiners” by Wall Street professionals to describe institutional Bitcoin enthusiasts. Cryptocurrency communities are closely monitoring potential implications.

The adoption of the term “Suitcoiners” underscores Wall Street’s increasing interest in Bitcoin, raising concerns about potential shifts in Bitcoin’s economic dynamics. Analysts continue to assess the potential threat to Bitcoin’s structure if institutional investors overpower traditional holders.

Wall Street’s Growing Alignment with Bitcoin Investments

A recent acknowledgment by Eric Balchunas of Bloomberg has brought attention to the term “Suitcoiners,” now circulating among Wall Street professionals. This term refers to institutional entities, including ETFs and governments, adopting Bitcoin. Some experts foresee this as indicative of a growing alignment within traditional finance circles towards Bitcoin investments. Concerns are emerging regarding potential structural shifts within Bitcoin markets as more institutions join. There is a belief that institutional influence might distort or control Bitcoin’s trajectory, similar to the hypothesized impact of stock voting on corporations, which remains largely unrealized.

Institutional investors are becoming increasingly interested in cryptocurrency, which could significantly alter the market dynamics. — Eric Balchunas, Senior ETF Analyst, Bloomberg.

Institutional investors are becoming increasingly interested in cryptocurrency, which could significantly alter the market dynamics. — Eric Balchunas, Senior ETF Analyst, Bloomberg.

Bitcoin’s Stability Under Institutional Influence

Did you know? In 2020, only 10% of Bitcoin was held by institutional investors. Today, this figure exceeds 30%, highlighting a substantial shift over five years.

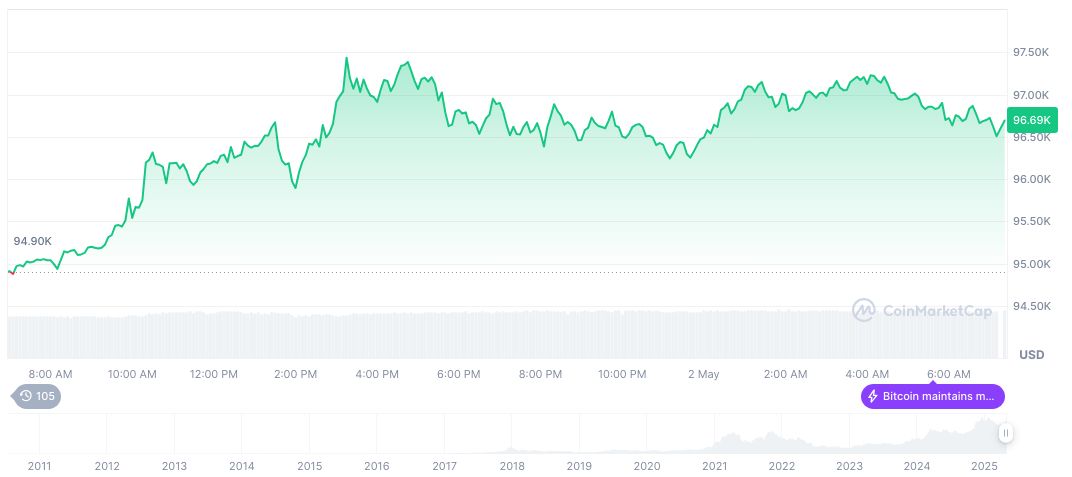

Bitcoin (BTC) currently trades at $96,858.03 with a market cap of $1.92 trillion. Dominating the market with a 63.85% share, Bitcoin’s 24-hour trading volume dropped by 4.63% to $30.7 billion. The data, sourced from CoinMarketCap as of May 2, 2025, reflects a 0.61% rise in Bitcoin’s price over the past 24 hours, with an overall 14.30% increase over the last 30 days. Research from Coincu suggests that, despite short-term volatility, institutional dominance may encourage regulatory oversight, affecting Bitcoin’s volatility.

Research from Coincu suggests that, despite short-term volatility, institutional dominance may encourage regulatory oversight, affecting Bitcoin’s volatility.

Source: https://coincu.com/335346-wall-street-suitcoiners-bitcoin-discussion/