- U.S. shutdown risk rises, impacting crypto markets and inflationary outcomes.

- Bitcoin shows increased volatility amid economic uncertainties.

- Market responses await clarity on federal and fiscal policies.

The U.S. government faces a potential shutdown, with Kalshi estimating a 56% likelihood, as Senate Democrats and Republicans clash over budget healthcare provisions, heightening economic tensions.

A shutdown may impact crypto and financial markets, causing volatility in assets like Bitcoin, with potential changes in liquidity and monetary policy considerations watched by investors.

56% Shutdown Probability Shakes Financial Markets

The probability of a U.S. government shutdown has reached 56%, increasingly affecting market sentiment. Per Kalshi’s prediction markets, Senate Majority Leader Chuck Schumer emphasized Democrats’ readiness to let federal funding expire in the absence of critical healthcare provisions. Speaker Mike Johnson and Senate Minority Leader Mitch McConnell maintain their opposition, focusing on streamlined budgets without additional healthcare spending. Both historical precedents and prior budget negotiations indicate how high federal shutdown odds can influence financial market stability.

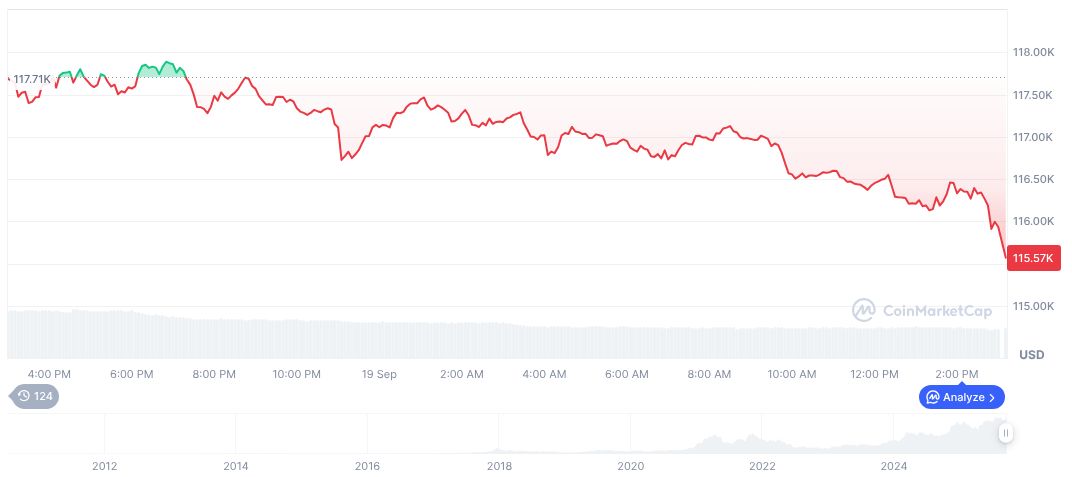

Market sentiment is notably shifting as federal shutdown risks grow. Potential impacts include liquidity adjustments and volatile trading patterns in Bitcoin and Ethereum, akin to previous fiscal incidents. Volatility is coupled with record market cap contractions, setting a backdrop of financial unpredictability. The current state of political negotiations signifies an inflection point for future fiscal policy directions. Financial organizations, such as the Federal Reserve, closely observing these developments, might adjust their economic forecasts accordingly.

Democrats will not back down from essential healthcare protections. If Republicans refuse to work with us on a bipartisan bill that supports American families, we are prepared to let the funding deadline pass. – Chuck Schumer, Senate Majority Leader, U.S. Senate

Bitcoin’s Market Role Amid Economic Turmoil

Did you know? U.S. government shutdown threats in 2013 and 2018-2019 caused substantial shifts in macroeconomic conditions, often leading to Bitcoin volatility and temporary downturns in stablecoin transactions.

Bitcoin (BTC) trades at $115,650.65, with a market cap of 2.30 trillion. Its dominance stands at 57.02%, according to CoinMarketCap. Recently, trading volumes reached 41.02 billion, down 37.14%. Over the past 30 days, Bitcoin’s price increased by 1.49%, following a 90-day rise of 11.56%. Supply remains at 19,923,131 BTC from a maximum of 21 million as of September 19, 2025.

Coincu research indicates the ongoing shutdown deliberations may influence U.S. market dynamics, overshadowing crypto predictions and possibly altering FOMC’s future actions. With Bitcoin at the center of hedging strategies, attention mounts on macroeconomic outcomes, which could shape Federal Reserve policies and all major asset classes in anticipation of fiscal adjustments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-shutdown-risk-bitcoin-volatility/