A surprising correlation has emerged between Bitcoin’s value and the U.S. presidential election odds. According to analyst, Bitcoin (BTC) has responded to changes in the 2024 U.S. Presidential race odds sparking speculation among investors.

The Bitcoin-Election Correlation

When compared with the Polymarket data, it reveals that as Donald Trump’s lead in the odds hit approximately 56%, the Bitcoin chart illustrated a bullish path. On the contrary, when Kamala Harris gained momentum and her odds rose to approximately 43%, the cryptocurrency immediately exhibited a bearish turn.

If Trump odds rise: #Bitcoin immediately pumps.

If Harris odds rise: #Bitcoin immediately dumps.

Expect some extreme volatility! pic.twitter.com/qwj98yGL1a

— Crypto Rover (@rovercrc) November 4, 2024

Crypto Rover, a noted market analyst, shared on his X (formerly known as twitter) post that this dynamics has created a state of heightened alert among investors. As the analyst explained, Trump-driven confidence appears to trigger a BTC rally, while Harris’s odds provoke a swift downturn. This correlation may stem from investor’s perceptions of how each party would influence the crypto regulation policies.

Bitcoin‘s immediate response to the election odds makes the trend more significant. The volatility is not just theoretical as it abrupts into market moments that make trading highly speculative. The crypto market, known for its unpredictability, now seems to be tied to political changes and developments. This scenario adds another layer of complexity to the crypto industry.

Election Year Strategy

These insights are crucial for crypto traders as they navigate a market that’s becoming increasingly sensitive to political outcomes. Given BTC’s historic reactions to various forms of global news, the prospect of high volatility could make or break trading portfolios. Analysts are urging caution, given the fast-paced swings that can arise based on mere shifts in political sentiments.

History Repeating Itself?

In 2016, when Trump won the U.S. Elections, BTC’s value surged by 2,714%, and with the current trend, it seems like history might be repeating itself.

The last time Trump won the U.S. election, #Bitcoin pumped +2,714%.

If history repeats, #Bitcoin will be worth $2 MILLION by 2025. pic.twitter.com/0uLPoc9FQy

— Crypto Rover (@rovercrc) November 4, 2024

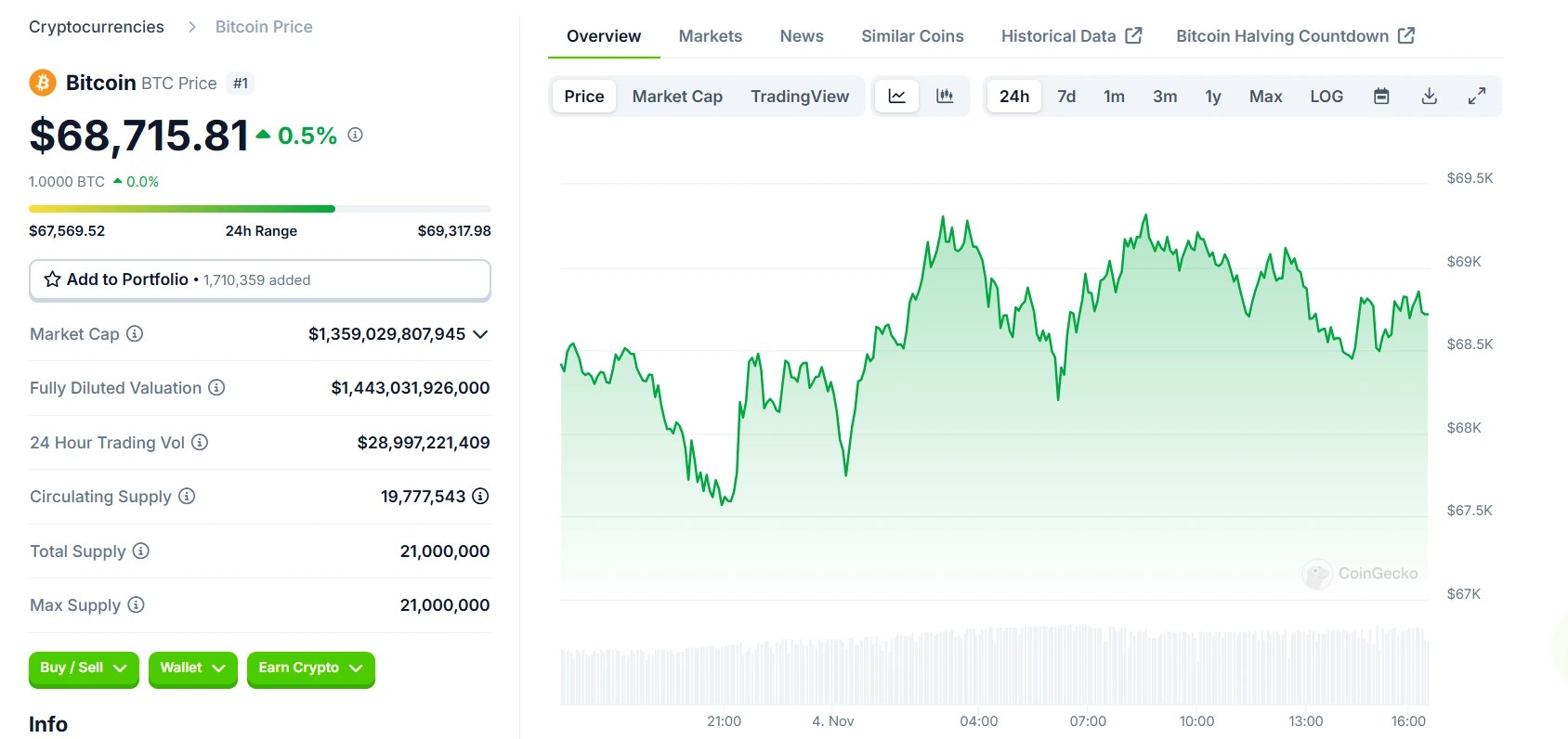

With a 0.4% surge of voters in favor of Trump, the BTC price has also rallied by 0.5%. With this surge, at press time, the price of BTC is $68,715.81. This proves that surge in votes for Trump will lead to surge in BTC price.

Some analyst predict that if this trends holds, Bitcoin’s price could rise to $1 million or more by November 2025.

Will this trend persist, or is it just a situation driven by the elections? Only time will tell, but for now, it appears that the crypto community is keeping their eye on the U.S. politics.

Also Read: Cardano’s Bodega Enters Prediction Market, Challenging Polymarket

Source: https://www.cryptonewsz.com/bitcoin-reacts-correlation-us-election-odds/