- HR 5166 requires the Treasury to manage federal Bitcoin.

- Fiscal 2026 financial services and appropriations affected.

- Collaboration with NSA on security aspects mandated.

On September 5, 2025, Ohio Congressman David Joyce introduced HR 5166 in the U.S. Congress, a bill proposing a federal custody plan for Bitcoin, including a Strategic Bitcoin Reserve.

This marks a significant shift in U.S. financial strategy, signaling potential impacts on technology and finance sectors, while bringing further legitimacy to digital assets within government portfolios.

Congressional Mandate: Treasury to Develop Bitcoin Custody Strategy

The announcement of HR 5166 marks a significant step, involving the U.S. Congress in federal Bitcoin management. Congressman David Joyce filed the bill, which mandates creating a custody and management plan for digital assets, including a strategic Bitcoin reserve. HR 5166 impacts fiscal 2026.

Immediate changes involve the Treasury Department’s task to submit a comprehensive strategy within 90 days of enactment, affecting government interactions with Bitcoin. The bill formalizes custody responsibilities but does not specify funding for Bitcoin purchases.

Market and community reactions remain muted, with no major statements from key figures or industry influencers. However, the bill’s introduction has garnered attention for its potential implications in the blockchain and financial sectors, notably involving digital asset management.

This bill is a significant step forward in formally recognizing Bitcoin as a strategic asset for our federal reserves. – H.R. 5166 Congressional Bill Text

Bitcoin’s Role in U.S. Reserves: Historical and Future Perspectives

Did you know? The U.S. government’s Bitcoin custody history primarily involves asset auctions following forfeitures, a stark contrast to the proposed strategic reserve under HR 5166.

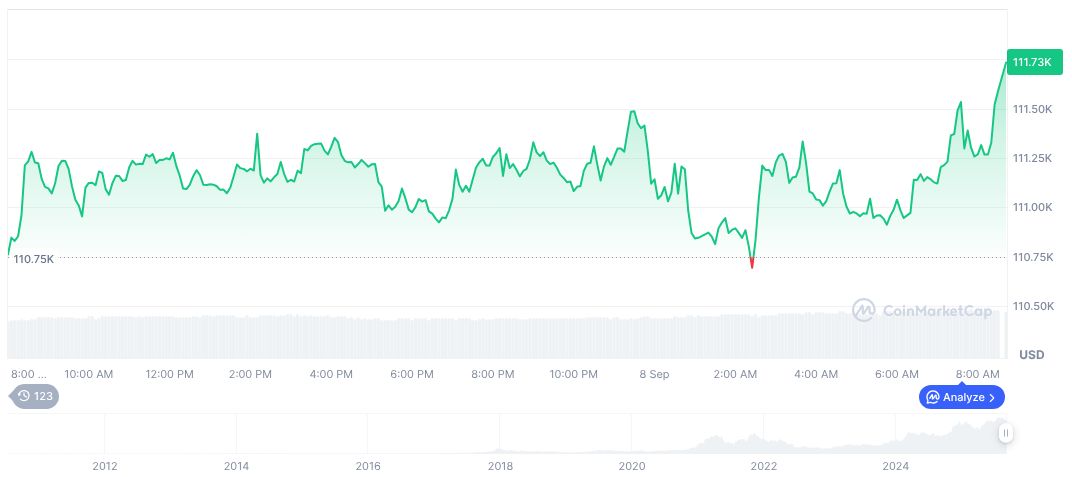

As of September 9, 2025, Bitcoin’s price stands at $111,634.92, with a market cap of $2.22 trillion, according to CoinMarketCap. It commands a 57.52% market dominance. Trading volume has surged 62.91% in 24 hours, while the 90-day price change is up by 1.50%.

Insights from Coincu’s research suggest potential impacts on Bitcoin’s role in national reserves. This legislative move could influence financial policies and the digital asset market’s technological landscape. Bold steps towards digital currency integration might enhance regulatory clarity and security protocols.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/bitcoin-custody-bill-congress/