- Announces the Bitcoin ETF application by Truth Social, detailing Trump’s key role.

- Explores the potential influence on Bitcoin markets and investor interest.

- Discusses Truth Social’s financial strategies towards digital assets.

Truth Social, operated by the Trump Media & Technology Group, has submitted an application for a Bitcoin ETF. This marks a strategic move into digital financial products for both the social media platform and Donald Trump, signaling an increased engagement with the cryptocurrency sector. “Cryptocurrency is evolving, and Truth Social’s filing is part of a broader trend reflecting how major players are looking to bridge the gap between traditional finance and digital assets,” said an industry insider. The filing indicates a significant shift toward regulated investment vehicles in the crypto space. Industry participants suggest that this initiative could prompt higher market acceptance of digital assets among mainstream investors.

Truth Social, operated by Trump Media & Technology Group, has filed for a Bitcoin ETF through a submission to BlockBeats News on June 4th. This move follows an increasing interest in digital financial products.

Potential Market Impact and Investor Response

In financial markets, strategic acceptance by the system potentially elevates Bitcoin’s status among institutional investors. Analysts also note *this may renew discussions around the growing intersection* of social media and financial products. Community response suggests mixed anticipation as stakeholders await further information.

The regulatory filing indicates Truth Social’s potential to introduce cryptocurrency investments to its user base. It includes Yorkville America Digital, LLC as sponsor, with Foris DAX Trust Company managing custody.

Community response suggests mixed anticipation as stakeholders await further information.

Market Data Insights

Did you know? Approval of BlackRock’s Bitcoin ETF in early 2024 significantly increased BTC’s institutional traction, mirroring trends seen with this filing.

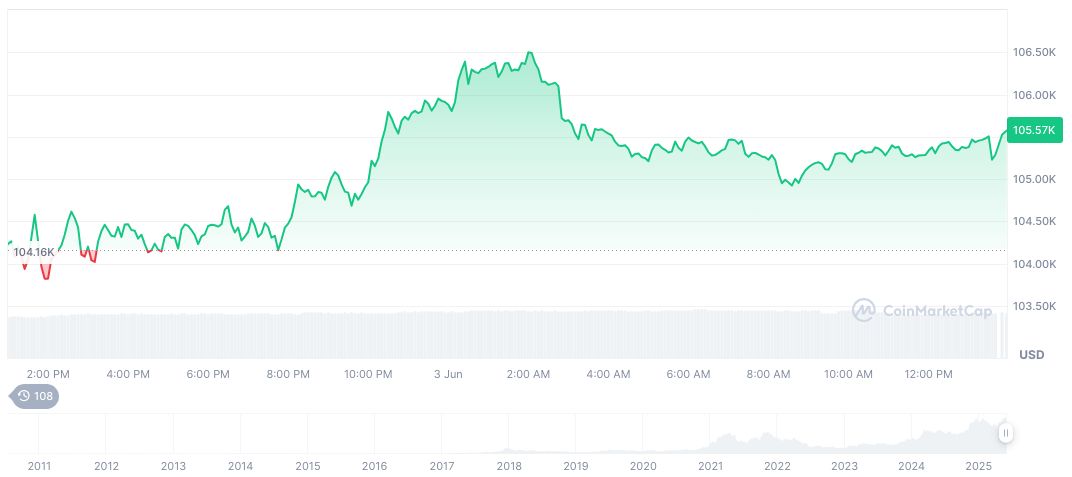

As reported by CoinMarketCap, Bitcoin is currently valued at $105,924.79, with a market cap of approximately $2.11 trillion. It dominates 63.25% of the market, bolstered by a 24-hour trading volume of $46.73 billion, reflecting a 3.25% change. Price alterations over the past 90 days reflect an increase of 17.21%, indicative of ongoing investor interest and market activities.

Based on Coincu‘s analysis, the filing might lead to higher adoption rates of Bitcoin-focused investment products if approved. Acknowledging recent historical trends, major players like BlackRock and Fidelity have already demonstrated that similar launches can increase BTC demand significantly. This adoption could foster regulatory dialogues around cryptocurrency futures and derivative markets, thus impacting broader market structure.

Source: https://coincu.com/341463-truth-social-bitcoin-etf-filing/