- Trump leads major prediction markets, but concerns over potential manipulation remain

- Bitcoin recorded volatility ahead of the election, with possible gains if Trump wins

With just one day until the U.S. presidential elections, former President Donald Trump is emerging as the frontrunner across major prediction markets. On Polymarket, for instance, Trump led with 56.5% of the odds while Vice President Kamala Harris trailed with 43.6%, at press time.

A similar trend appeared on Kalshi, with Trump holding a 52% edge over Harris’s 48%. Taken together, both prediction markets seemed to highlight growing confidence in Trump’s potential return to the Oval Office.

Prediction market controversy

However, amid Trump’s rising odds in the prediction markets, suspicions have emerged regarding potential manipulation.

Concerns center around specific accounts, notably one labeled “Fredi9999,” which analysts and on-chain investigators believe may belong to a single investor actively working to shift the odds in Trump’s favor.

This has sparked broader questions about Polymarket and Kalshi’s transparency and the accuracy of its predictions.

Adding to these worries, Mark Cuban suggested that foreign investments could be skewing the results. Especially since U.S. citizens are restricted from participating on such platforms, further complicating the reliability of these betting odds.

“From all indications, most of the money coming into Polymarket is foreign money, so I don’t think it’s an indication of anything.”

Kalshi’s founder defies rumours

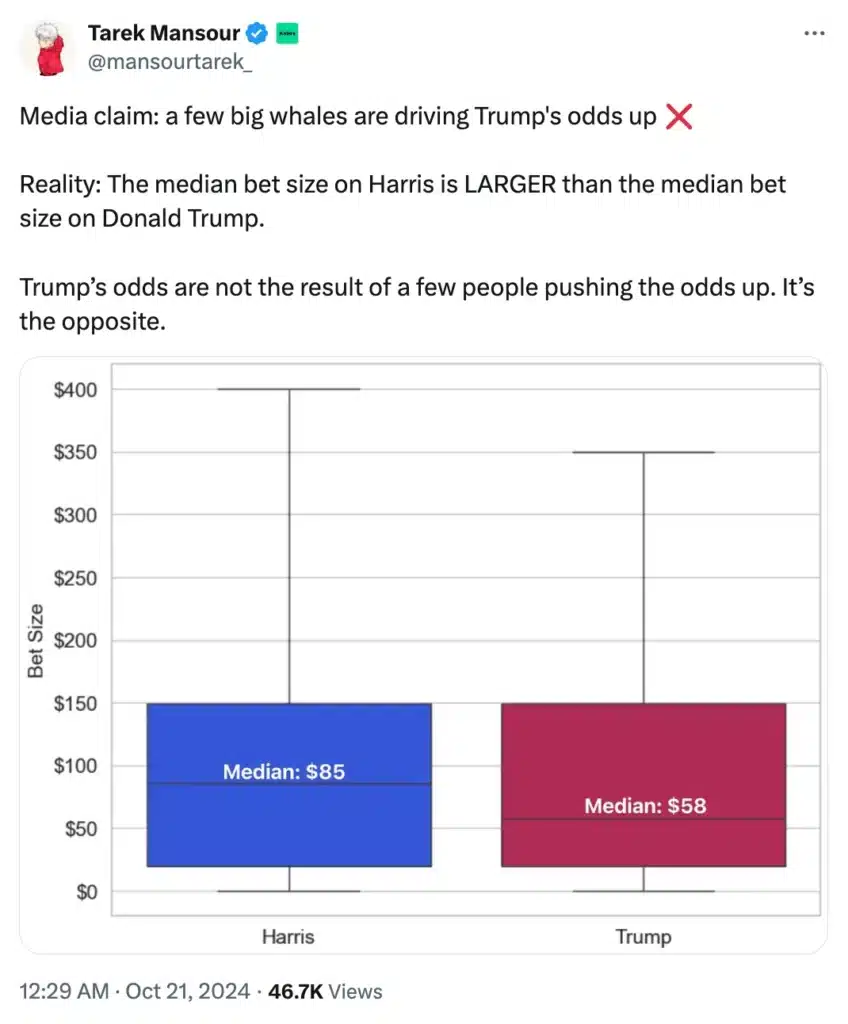

In response to these rumors, co-founder Tarek Mansour took to Twitter to assert that Trump’s odds are not artificially inflated by a select group of individuals.

Instead, he emphasized that the situation is quite the contrary.

Source: Tarek Mansour/X

The role of crypto in this election cycle has been notably distinct, with industry leaders actively engaging in campaign contributions. It may have begun with the Winklevoss twins, founders of Gemini, who made headlines by each donating $1 million in Bitcoin to support Trump.

On the other side, Harris gained backing from Ripple’s co-founder Chris Larsen after he contributed $10 million in XRP to her campaign.

These significant donations highlight how crypto executives are increasingly influencing the political landscape through digital asset contributions.

Crypto community divided ahead of election

This divide was clearly visible when various crypto execs went public to back their preferred candidates.

For instance, Anthony Scaramucci, an entrepreneur at SkyBridge, expressed his support on X, and said,

“Harris will win.”

On the contrary, Dan Held, noted,

Source: Dan Held/X

How is the election affecting Bitcoin?

In the meantime, Bitcoin [BTC]’s price movement has been notably turbulent in the final week leading up to the U.S elections.

After peaking at $73,000, BTC depreciated on the charts, with the crypto valued at $69,085.85, at press time. However, this might change soon. Historically, Bitcoin has tended to follow a bullish path during favorable election odds for Trump, hinting at a possible price surge if he secures the win.

In fact, some analysts are expecting a surge towards $100k if Trump emerges victorious.

Thus, as Election Day approaches, all eyes are on how the outcome might influence BTC’s trajectory.

Source: https://ambcrypto.com/trump-leads-harris-on-polymarket-bitcoins-price-will-be-affected-if/