- American Bitcoin listed on Nasdaq

- Company founded by Donald Trump Jr. and Eric Trump

- Plans to raise up to $2.1 billion through a stock offering

The Trump family-owned American Bitcoin Corp has officially debuted on Nasdaq under the ticker ABTC after merging with Gryphon Digital Mining and applying to raise $2.1 billion.

This move underscores a growing trend of cryptocurrency firms seeking traditional market support, potentially boosting Bitcoin’s market impact as investor confidence sees a positive shift.

Trump’s $2.1B Bitcoin Firm Debuts on Nasdaq

American Bitcoin, co-founded by Donald Trump Jr. and Eric Trump, debuted on the Nasdaq Stock Exchange following a merger with Gryphon Digital Mining. Planned to trade under the ticker ABTC, the firm has a major focus on Bitcoin mining.

Their plan to raise up to $2.1 billion through a stock offering aims to attract significant investor interest. Currently, the company holds 2,443 Bitcoins as part of its strategic asset accumulation.

“With our Nasdaq listing, we are elevating this mission onto the global stage, giving investors a vehicle we believe will strengthen the U.S. financial system and help build a more resilient national economy.” – Donald Trump Jr., Stockholder, American Bitcoin Corp

Bitcoin IPO Impact and Regulatory Insights

Did you know? Notable IPOs of Bitcoin firms on major exchanges often led to increased institutional interest, potentially impacting Bitcoin’s market adoption and price volatility historically.

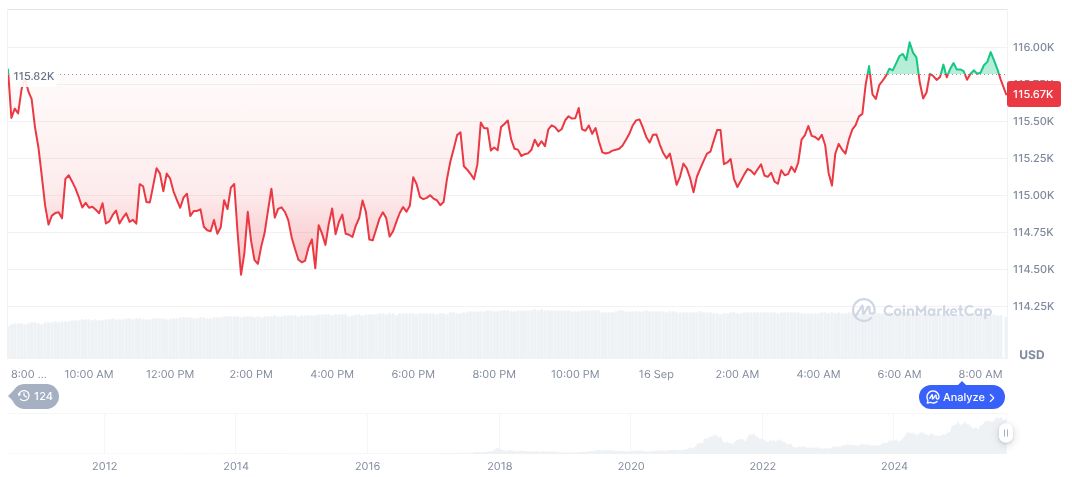

Bitcoin currently trades at $116,937.12, exhibiting a 1.14% price increase over the past 24 hours, according to CoinMarketCap. Its market cap stands at formatNumber(2329609646312, 2), demonstrating strong investor interest.

Insights from the Coincu research team indicate potential regulatory scrutiny due to high-profile ownership. The listing could accelerate Bitcoin’s role in traditional finance, bridging digital assets and conventional investment platforms.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/trump-american-bitcoin-nasdaq-listing/