Key Takeaways

Are institutions buying Bitcoin and Ethereum during the crash?

U.S. institutions aggressively bought BTC and ETH during the sell-off, viewing it as a buying opportunity.

What kind of leverage is driving the market now?

Institutional investors are using market-neutral leverage strategies like basis trades, not high-risk retail bets.

Bitcoin [BTC] and Ethereum [ETH] saw strong institutional buying even as the market faced its biggest one-day liquidation ever.

Data from CME and Coinbase showed that instead of pulling back, hedge funds used the crash to increase their exposure, turning the sell-off into a buying opportunity as BTC and ETH began to recover.

Institutional buyers step in as BTC crashes

During Bitcoin’s sharp drop from $123,000 to $110,000 on the 10th of October, a surprising trend emerged: institutional investors were buying.

Source: CryptoQuant

The Coinbase Premium Index, which tracks price differences between U.S.-based Coinbase and global exchange Binance, surged to its highest level since March 2024. In fact, the recent spike was indicative of large U.S. players actively accumulating BTC while others were panicking.

Looks like major investors now see market dips as buying opportunities, not warning signs.

The market has Ethereum’s back, too

ETH saw a similar – and even more dramatic – response.

Source: CryptoQuant

On the 10th of October, as crypto prices plunged, Ethereum’s Coinbase Premium Gap shot up to a record-breaking 6.0, the highest level of 2025.

This means ETH was trading much higher on Coinbase than on Binance, so U.S. institutions were aggressively buying the dip.

Source: TradingView

At the same time, the ETH/BTC pair also rebounded sharply in the aftermath, rising from around 0.033 BTC on the 11th of October to nearly 0.036 BTC by the 13th.

This recovery showed Ethereum outperformed Bitcoin in the post-liquidation bounce.

A new kind of leverage is taking over BTC

There’s more to the momentum, though.

Source: CryptoQuant

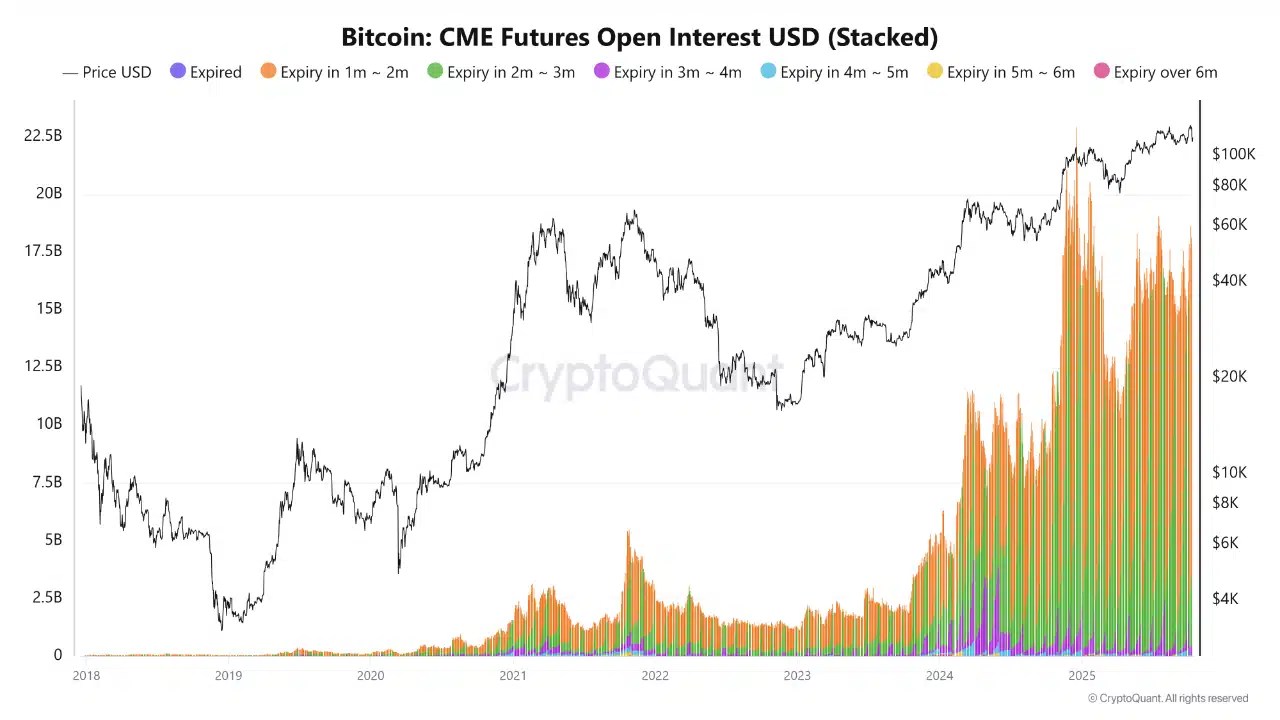

Bitcoin Open Interest across all exchanges hit a record $34.9 billion, with one-third of that on CME, the go-to platform for hedge funds and asset managers.

Unlike retail cycles that relied on directional bets, this growth stems from basis trades and other market-neutral positions aimed at steady returns.

Source: CryptoQuant

These positions aim to earn steady returns, not chase wild price swings. With stable Funding Rates and short-term contracts dominating, it’s clear that institutional players are now using leverage as a tool for risk-managed yield.

Source: https://ambcrypto.com/this-is-how-institutions-profited-from-btc-and-eths-price-crash/