- Bitcoin mining companies in Texas face production declines due to power restrictions.

- Riot mining fell 12%; MARA dropped 25% in June.

- CleanSpark’s production increased even with Texas power constraints.

The Electric Reliability Council of Texas’s (ERCOT) power restrictions in June 2025 have led key Bitcoin mining companies like Riot and MARA Holdings to report decreased production in the area.

The decline in production highlights the increasing impact of energy regulations on Bitcoin mining profitability and operation efficiency.

Texas Power Cuts Slash Riot and MARA Bitcoin Output

Riot Platforms and MARA Holdings reported a decrease in Bitcoin production in June 2025, with Riot logging a 12% decrease to 450 Bitcoins and MARA a 25% drop to 211 Bitcoins. These declines are attributed to the power restrictions initiated by ERCOT’s Four Coincident Peak program, designed to manage grid demand during summer months. CleanSpark, however, showed a different trajectory, reporting a 6.7% increase, mining 445 Bitcoins in June, despite the challenging conditions. This resilience is credited to their energy-efficient strategies. ERCOT’s efforts underscore a regional push to balance energy demand amidst rising consumption from the cryptocurrency sector. This program aims to stabilize grid pressure during peak times, revealing industry adjustments to external energy policies. “Our initiatives to manage peak power demand this summer are essential in alleviating stress on the grid,” noted an official from the Electric Reliability Council of Texas (ERCOT). Market reactions emphasized vitality among industry veterans. While no official statements have been released by company executives, industry insiders express concern over the ongoing regulatory environment and its long-term effects.

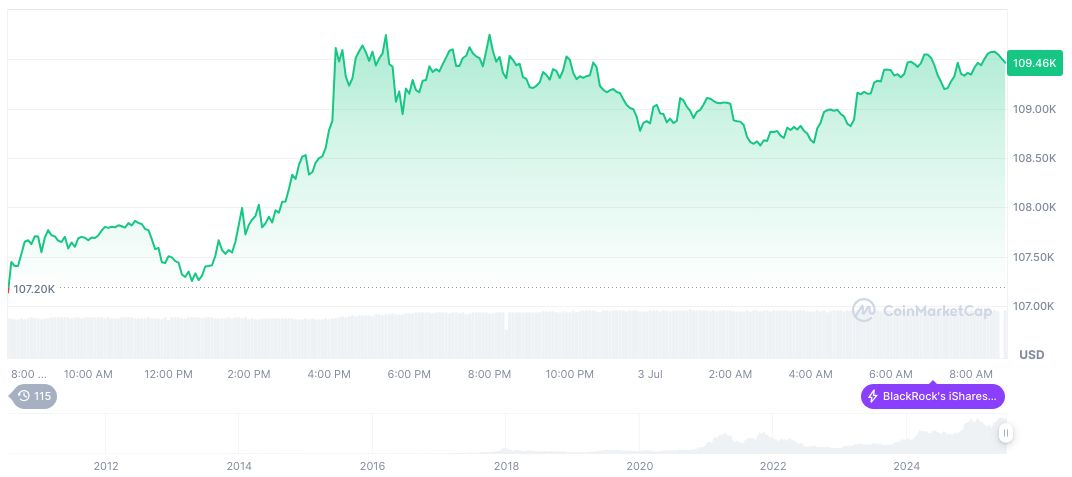

According to CoinMarketCap, Bitcoin (BTC) is valued at $109,309.39, with a market cap of $2.17 trillion and a 24-hour trading volume of $49.54 billion. The Bitcoin market reflects a 0.49% gain over the past 24 hours and a 1.67% increase over the past week. The dominance remains high at 64.43%, suggesting a strong position despite power-related disruptions.

Coincu insights point to regulatory pressures compelling miners to innovate technologically, seeking sustainable energy sources. Historically, these changes lead to infrastructure investments and operational shifts, potentially moderating BTC’s supply volatility over time.

Bitcoin Maintains Market Dominance Despite Power Concerns

Did you know? ERCOT’s power restriction initiatives highlight a continued strategy to address Texas’s ongoing grid challenges, frequently exacerbated by burgeoning Bitcoin mining activities.

According to CoinMarketCap, Bitcoin (BTC) is valued at $109,309.39, with a market cap of $2.17 trillion and a 24-hour trading volume of $49.54 billion.

The Bitcoin market reflects a 0.49% gain over the past 24 hours and a 1.67% increase over the past week. The dominance remains high at 64.43%, suggesting a strong position despite power-related disruptions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/346730-texas-power-restrictions-bitcoin-mining/