- Key Point 1

- Key Point 2

- Key Point 3

Initiated by Dennis Porter, the Texas Strategic Bitcoin Reserve Bill (SB 21) progresses with a second reading in the House scheduled for May 20, 2025. The Texas Senate had previously passed the bill on March 6, 2025.

The bill seeks to establish a pioneering state-managed Bitcoin reserve in Texas. Supported by a significant legislative framework, it represents a key step toward governmental cryptocurrency adoption.

Texas Advances Bitcoin Reserves: Legislative and Market Insights

The Texas Strategic Bitcoin Reserve Bill (SB 21) proposes creating a reserve funded through various channels like appropriations and donations. The reserve aims to invest primarily in Bitcoin, signifying broader state-level integration of the cryptocurrency. The bill mandates transparent reporting and security via cold storage. The Texas Comptroller will manage the reserve with guidance from an advisory committee, ensuring it aligns with broader state interests.

Market analysts predict shifts in how states manage financial assets, seeing this as indicative of increased acceptance of Bitcoin. The bipartisan nature of support suggests potential ramifications for state-level economic policies. Dennis Porter, the Satoshi Action Fund co-founder, emphasizes the urgency of passing the bill before the legislative session adjourns.

“The 2nd reading is coming May 20th which is the necessary step before it goes for the final house floor vote. Time is running out. The legislature will adjourn two weeks later!” — Dennis Porter

Precedent-Setting Proposal Could Transform State Economies

Did you know? Texas could become the third U.S. state to establish a Bitcoin reserve, following in the footsteps of Wyoming and New York, highlighting a trend towards state-level acceptance of digital assets as legitimate investments.

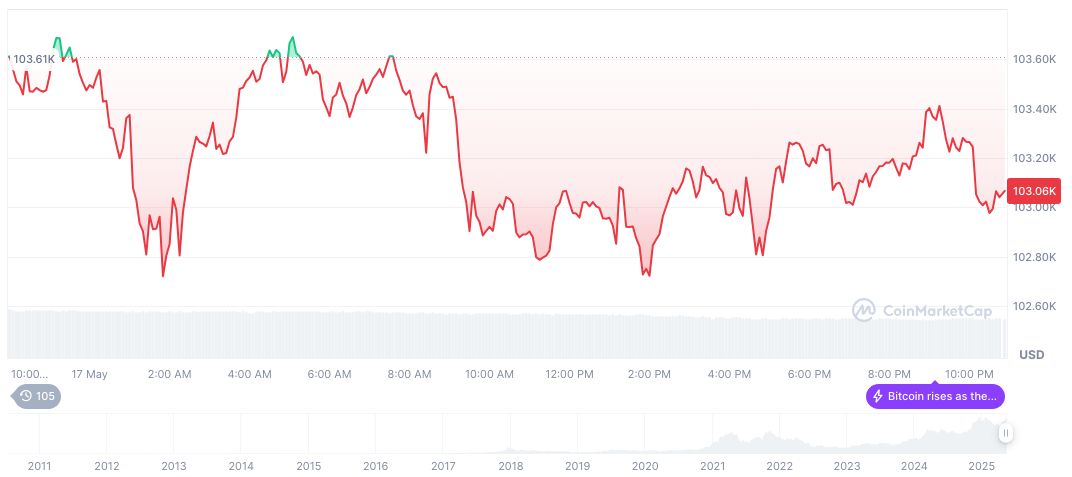

Bitcoin (BTC) reports a market cap of 2.09 trillion USD and a price increase of 2.59% over 24 hours, according to CoinMarketCap. Prevailing trading volumes stand at 37.69 billion USD, while Bitcoin maintains a 62.34% market dominance.

Insights from the Coincu research team suggest that if SB 21 passes, Texas may set a precedent for governmental Bitcoin adoption. This could influence financial strategies and regulatory landscapes in other states. The focus on Bitcoin reserves reflects state interest in mitigating economic uncertainties through asset diversification.

Source: https://coincu.com/338299-texas-bitcoin-reserve-bill-vote/