- CEO Paolo Ardoino announces Tether’s Bitcoin reserve investment shift.

- Tether focuses on stable assets amid global uncertainties.

- Community remains divided on asset reallocation strategies.

Tether CEO Paolo Ardoino announced on September 7, 2025, that the company has invested a portion of its Bitcoin reserves into an entity named XXI.

This move underscores Tether’s strategy to diversify investments amid global uncertainties, involving assets like Bitcoin, gold, and land, though specific market impacts remain uncertain.

Tether’s XXI Investment Aims to Secure Bitcoin Stability

Paolo Ardoino stated that Tether invested part of its Bitcoin reserves into XXI. This move reflects the company’s ongoing effort to redirect profits toward stable assets like Bitcoin, gold, and land. As Ardoino emphasized, the intent is to safeguard against economic uncertainties.

“Tether did not sell any Bitcoin, but instead invested part of its Bitcoin reserves into XXI. As the world becomes increasingly darker, Tether will continue to invest part of its profits in safe assets such as Bitcoin, gold, and land. Tether is a stable company.” — Paolo Ardoino, Source

Community and industry reactions to Ardoino’s announcement are varied. Some view this as a prudent financial strategy, while others voice concerns over transparency in Tether’s financial maneuvers. Nonetheless, the absence of significant market disruptions suggests a steady state for Bitcoin and Tether’s trading assets.

Bitcoin Market Data and Strategic Insights

Did you know? Tether’s recent moves echo its previous investments in gold, which align with traditional perceptions of gold as a “safe haven” asset amidst global economic uncertainties.

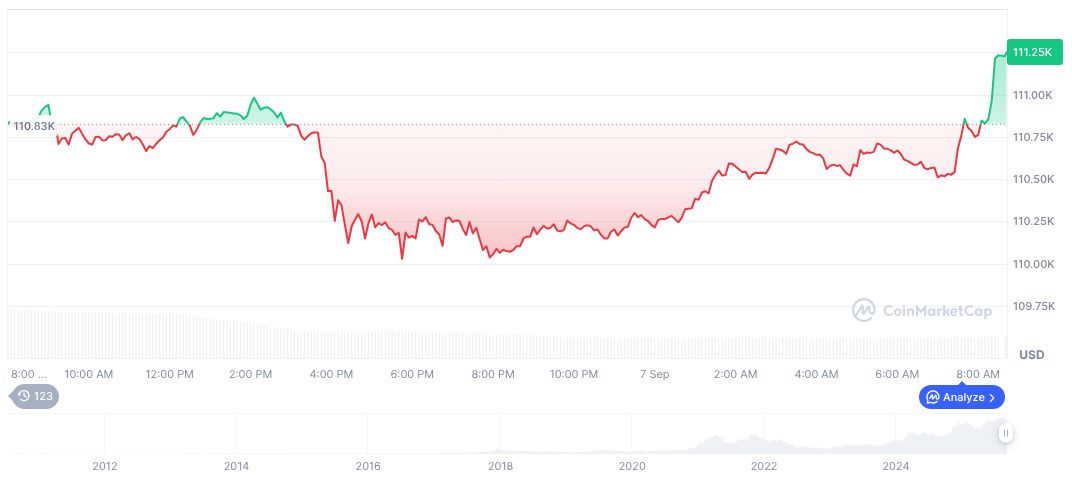

According to CoinMarketCap, Bitcoin’s market cap stands at 2.21 trillion USD, with the current price reaching 111,145.56 USD. The 24-hour trading volume decreased by 12.28%, reflecting tempered market activity. Bitcoin’s market dominance is currently at 57.84%, with minor positive price changes over the past 90 days.

The Coincu research team suggests that Tether’s strategic allocations could influence the broader crypto market’s view on asset diversification. Although the specific implications remain to be observed, Tether’s reassurance about stability may bolster investor confidence in traditional and digital safe assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/tether-invests-bitcoin-xxi/