- Strategy plans an aggressive Bitcoin acquisition led by Michael Saylor.

- Aims to acquire up to 1.5 million BTC soon.

- Potential market shift due to massive Bitcoin buy.

Michael Saylor, Executive Chairman of Strategy, announced on August 1 during a CNBC interview the potential acquisition of 1.5 million bitcoins, representing over 7% of total supply.

This substantial purchase aligns with Strategy’s ongoing commitment to Bitcoin as digital capital, potentially impacting BTC prices and attracting further institutional interest.

Strategy to Boost Bitcoin Holdings with $100 Billion Investment

Strategy’s decision, led by Michael Saylor, to acquire up to 1.5 million BTC reflects the company’s long-term strategy of considering Bitcoin as pivotal digital capital. Currently holding over 628,791 BTC, Strategy aims to increase its share to 7.14% of Bitcoin’s total supply, making it the largest corporate BTC holder. This potential accumulation involves substantial capital, exceeding $100 billion, given current market prices.

Market implications include a potential increase in Bitcoin’s price as Strategy’s buy could enhance BTC’s scarcity and market demand. The move might also attract more institutional investors, aligning with Saylor’s goal to lead institutional adoption of digital assets.

Reactions from financial circles have been muted, with no official comments from major figures in the crypto space like CZ of Binance or Arthur Hayes. However, Michael Saylor emphasized their intent to continue buying Bitcoin as conditions allow, highlighting their commitment to the digital asset.

Historical Purchases Triggered BTC Price Surges, Analysis Shows

Did you know? During Strategy’s earlier Bitcoin acquisition phase (2020-2023), BTC prices experienced significant growth, underscoring the potential market impact of such large-scale purchases in the future.

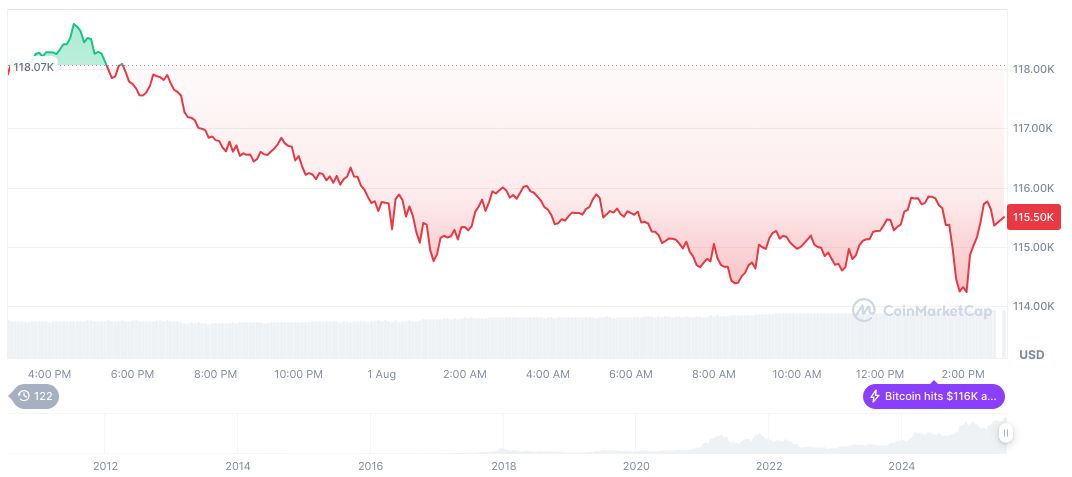

Bitcoin (BTC), at $113,894, shows a 2.4% drop in 24 hours per CoinMarketCap. It holds the top spot with a $2.27 trillion market cap, noting an 18.12% growth over 90 days and a 60-day increase of 8.64%.

Coincu research suggests the Strategy’s acquisition plan could spur regulatory scrutiny and spark more institutional entry into the crypto market. Past Bitcoin acquisitions by Strategy have contributed to notable BTC price rises, potentially setting trends for future corporate purchases.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/strategy-bitcoin-acquisition-plan/