Strategy’s once-aggressive Bitcoin accumulation has slowed to a near standstill, according to new data from CryptoQuant.

The firm, the largest corporate holder of Bitcoin, has sharply reduced its purchases throughout 2025, raising questions about the sustainability of last year’s treasury accumulation boom.

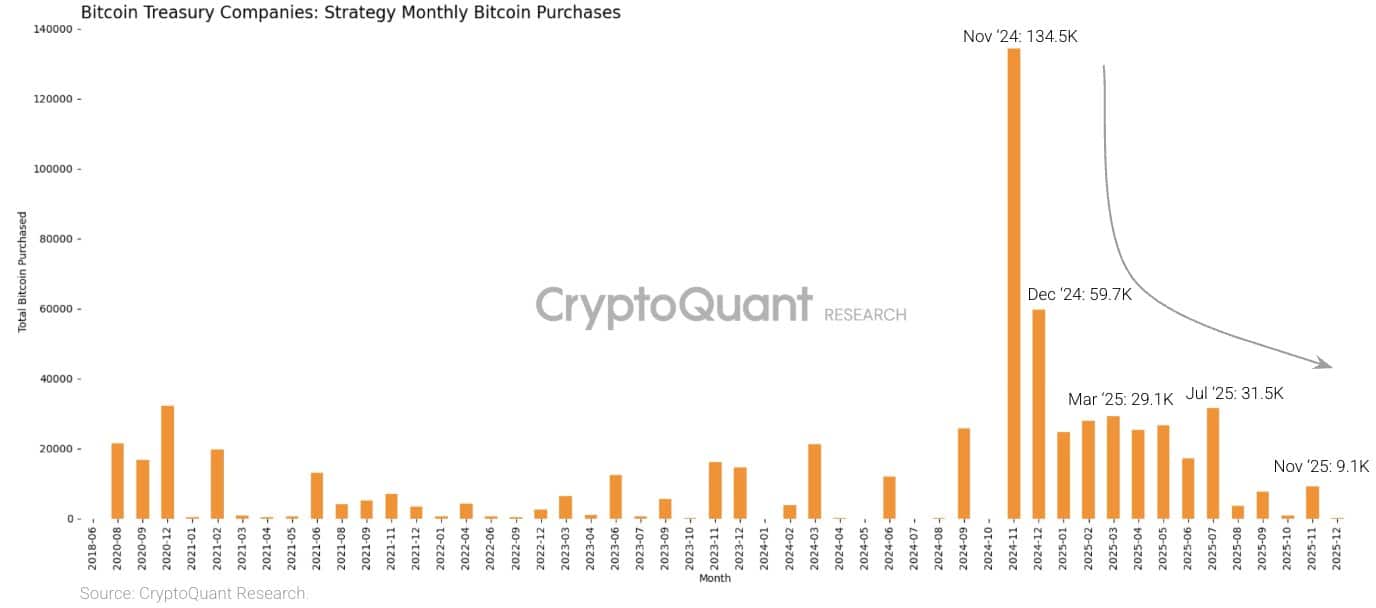

CryptoQuant’s latest chart shows monthly Bitcoin purchases by Strategy falling from a peak of 134.5K BTC in November 2024 to just 9.1K BTC in November 2025.

Source: CryptoQuant

Early December data show that only 135 BTC have been bought so far, making this one of Strategy’s weakest purchasing months in years.

A dramatic shift from 2024’s buying frenzy

Late 2024 was defined by unprecedented corporate appetite for Bitcoin.

Strategy’s 134K BTC purchase in November 2024 marked the largest monthly acquisition in its history and helped fuel broader institutional narratives around digital assets.

But as 2025 progressed, Strategy consistently cut its buying pace:

- Dec 2024: 59.7K BTC

- Mar 2025: 29.1K BTC

- Jul 2025: 31.5K BTC

- Nov 2025: 9.1K BTC

- Dec 2025 [so far]: 135 BTC

The reduction reflects a 93% decline from the 2024 peak, signalling a major policy shift in how Strategy approaches treasury allocation.

Bitcoin Treasury demand cools across the broader market

Additional data from BitcoinTreasuries.net shows this slowdown isn’t happening in isolation.

While the number of entities holding Bitcoin rose to 357 — up 4 over the past 30 days — the total BTC held in treasuries fell by 1.16% over the same period.

Source: BitcoinTreasuries

Despite more entities entering the space, aggregate BTC held across treasuries slipped to 4.00M BTC, suggesting that new entrants are not buying at the scale necessary to offset reduced accumulation from major players like Strategy.

Market implications: reduced corporate absorption of BTC

Corporate and treasury buyers were a major tailwind for BTC supply dynamics in 2024. Strategy’s outsized purchases contributed to scarcity narratives and strengthened long-term holder supply.

With these purchases shrinking, the market loses a significant source of consistent buy-side pressure.

While ETFs and long-term holders still dominate structural demand, the fading role of corporate treasuries means less aggressive supply absorption.

Final Thoughts

- Strategy’s sharp pullback signals the end of 2024’s treasury-accumulation surge, shifting institutional demand dynamics for Bitcoin.

- With total BTC held in treasuries trending lower, ETF flows, and macro sentiment now play a larger role in supporting long-term market structure.

Source: https://ambcrypto.com/strategys-bitcoin-buying-collapses-93-in-2025-as-treasury-demand-cools/