- Strategy issues $2.5 million shares for Bitcoin purchases.

- Shares offer a 10% annual interest rate.

- Market reacts positively to the announcement.

Strategy announced on June 2, 2025, that it is issuing 2.5 million shares of “10.00% Series A Perpetual Stride Preferred Stock” to fund Bitcoin purchases. The funding move aims at supporting Bitcoin acquisition and enhancing general corporate functionality.

Notably, Strategy’s share offering will consist of a non-cumulative dividend rate of 10% annually, with dividends distributed quarterly starting September 30, 2025. The decision aims to bolster Bitcoin acquisition strategies, potentially strengthening Strategy’s market position. Details emerged that Barclays, Morgan Stanley, Moelis & Company, and TD Securities are engaged as joint book-running managers for the process.

Positive Market Response Boosts Strategy Stock Price

Market sentiment appeared to favor Strategy’s strategic direction, reflected by a positive reaction in MSTR stock prices. Regulatory filings revealed Strategy’s intention to leverage stocks via a prospectus supplement and accommodate further details on the SEC’s website.

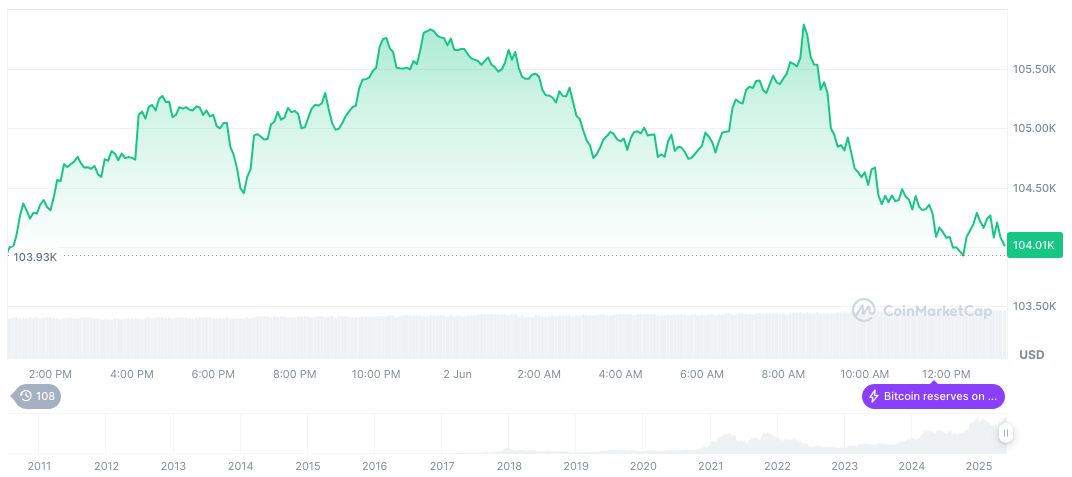

Bitcoin’s price stands at $105,937.18 with a market cap of $2.11 trillion, maintaining 63.45% market dominance according to CoinMarketCap on June 2, 2025. Current trends reveal a 10.23% increase over the past 30 days, suggesting a robust short-term momentum. The circulating supply now reaches 19,873,603 BTC.

“We are excited to propose our initial public offering of the STRD Stock, which will allow us to further enhance our corporate capabilities and Bitcoin holdings.” – CoinCentral

Bitcoin’s Price and Impact of Institutional Investments

Did you know? Strategy’s recent share issuance reflects a continuous trend toward leveraging traditional financial instruments for cryptocurrency investments, amidst dynamic regulatory landscapes.

Coincu research suggests this strategic issuance could prompt shifts in Bitcoin’s market perception, potentially impacting regulatory and technological spheres as corporate investments in cryptocurrency expand. Historical data implies sustained institutional interest may reshape long-term market frameworks.

Bitcoin’s price stands at $105,937.18 with a market cap of $2.11 trillion, maintaining 63.45% market dominance according to CoinMarketCap on June 2, 2025. Current trends reveal a 10.23% increase over the past 30 days, suggesting a robust short-term momentum. The circulating supply now reaches 19,873,603 BTC.

Source: https://coincu.com/341266-strategy-stride-shares-bitcoin-funds/