- Strategy purchased 4,225 bitcoins, sparking market interest.

- This raised Bitcoin’s perceived value by institutional investors.

- Potential effects on the cryptocurrency market and investment patterns.

ChainCatcher News reports that Strategy purchased 4,225 bitcoins between July 7 and July 13, investing $472.5 million at an average price of $111,827 per Bitcoin.

This purchase by Strategy indicates a significant institutional interest in Bitcoin, potentially influencing market dynamics and investor sentiment.

Strategy Buys 4,225 BTC: Market Implications Explored

Strategy’s recent acquisition of 4,225 bitcoins marks a notable investment move within the cryptocurrency market. This purchase, spanning a one-week period, demonstrates a significant financial commitment to Bitcoin as a key asset, potentially reinforcing its standing among institutional investors.

The acquisition has increased market attention toward Bitcoin, potentially impacting its demand and price dynamics. Existing patterns in cryptocurrency investments may see shifts as traders and investors respond to this development, considering potential volatility or value growth in Bitcoin investments.

Arthur Hayes, Former CEO, BitMEX, — “Institutional investors are starting to realize that Bitcoin isn’t just a speculative asset; it’s a hedge against inflation and a way to diversify holdings.”

The broader cryptocurrency community has observed mixed reactions, with some industry players expressing optimism about Bitcoin’s price trajectory. While officials at Strategy have not made public announcements about their intentions, the market has noted increased interest from related sectors, possibly indicating future similar acquisitions.

Bitcoin’s Institutional Popularity Rises Amid Strategy’s Move

Did you know? The recent purchase by Strategy echoes historical trends seen with firms like MicroStrategy, whose own significant Bitcoin buy-in previously highlighted institutional interest.

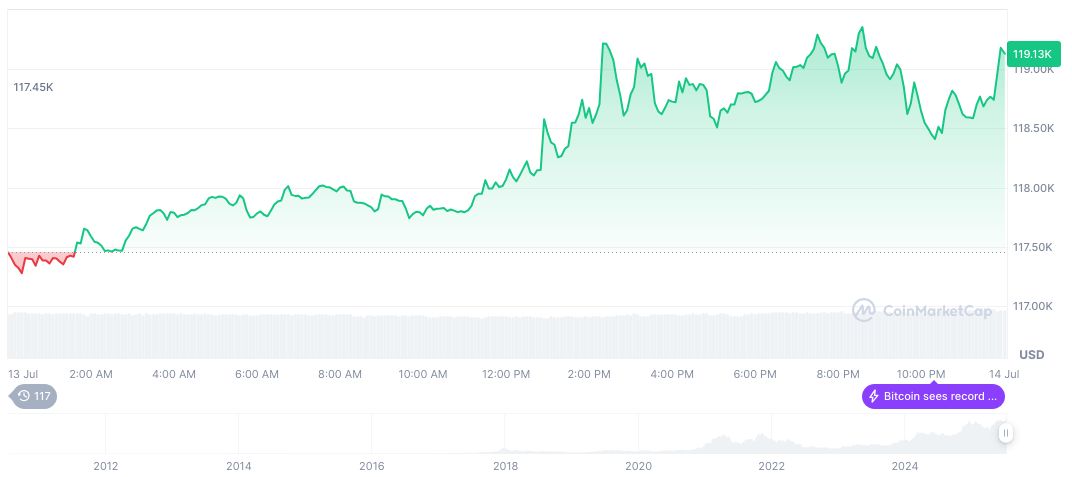

According to CoinMarketCap, Bitcoin (BTC) is currently priced at $119,995.33, with a market cap of $2.39 trillion. Bitcoin maintains a 63.86% market dominance and shows a positive price change of 42.61% over 90 days. Trading volumes have surged by 288.65% in the last 24 hours.

The Coincu research team suggests that Bitcoin’s increasing adoption by institutional investors could further solidify its position as a hedge against economic uncertainty. Observers anticipate potential regulatory advancements if trends continue, with technology integrations promising enhanced blockchain capabilities and market resilience.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/348666-strategy-4225-bitcoins-purchase/