Michael Saylor’s MicroStrategy, now known as Strategy, made another Bitcoin purchase between May 5 and May 11 for $1.34 billion. This marks one of the company’s largest BTC purchases this year, bringing its total holdings to 568,840. Meanwhile, the Strategy stock is back above $400 amid

Strategy Stock Jumps As Company Acquires 13,390 BTC For $1.34B

In a press release, Strategy announced that it has acquired 13,390 BTC for $1.34 billion at an average price of $99,856 per Bitcoin. The company has also achieved a BTC yield of 15.5% year-to-date (YTD).

The Strategy Stock is up almost 2% in pre-market trading, trading at around $423. MicroStrategy’s stock recently climbed above the psychological $400 level thanks to Bitcoin’s price surge. Both assets share a strong positive correlation due to the company’s exposure to the flagship crypto.

MarketWatch data shows that the MSTR stock price is up 43% year-to-date and is currently one of the best-performing assets in 2025, even ahead of BTC, which boasts a 10% gain this year.

Meanwhile, following this latest purchase, Strategy now holds 568,840 BTC, which it acquired for $39.41 billion at an average price of $69,287 per Bitcoin. Michael Saylor’s company remains the public company with the largest Bitcoin holdings, well ahead of the second-placed MARA Holdings.

This purchase comes just a week after MicroStrategy acquired 1,895 BTC for $180 million. It also marks the company’s second-largest Bitcoin purchase in 2025. In March, it acquired 22,048 BTC for $1.92 billion, its largest purchase so far this year.

The company is likely to purchase more Bitcoin in the coming weeks after it increased its capital plan from $42 billion to $84 billion. Strategy plans to use this capital to acquire more BTC.

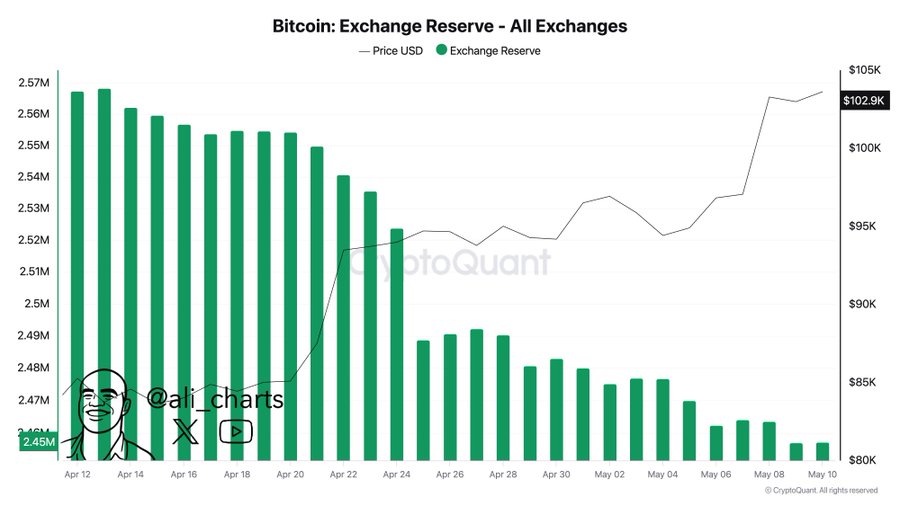

With the Bitcoin price back above the psychological $100,000 level, other whales besides Saylor’s company have also been actively accumulating BTC. Crypto analyst Ali Martinez revealed that these whales withdrew over 110,000 Bitcoin from exchanges over the past month.

Stock To Still Rally $700

In an X post, market commentator Michael Sullivan suggested that the Strategy stock could still rally to $700. This came following his comment in which he sarcastically stated that the MSTR stock isn’t correlated with the Global M2 money supply and won’t reach $700 per share by the end of July.

Amid this bullish outlook for the MSTR stock price, Bitcoin critic Peter Schiff has again warned against Strategy’s Bitcoin move. He stated that the company’s next purchase would likely push its cost average above $70,000.

He suggested this could be disastrous as the next leg down in Bitcoin will likely push the market price below their average cost. Schiff added that this is not good considering how much Saylor and his company have borrowed to buy Bitcoin.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/microstrategy-acquires-13390-bitcoin-for-1-34-billion/

✓ Share: