Key Points:

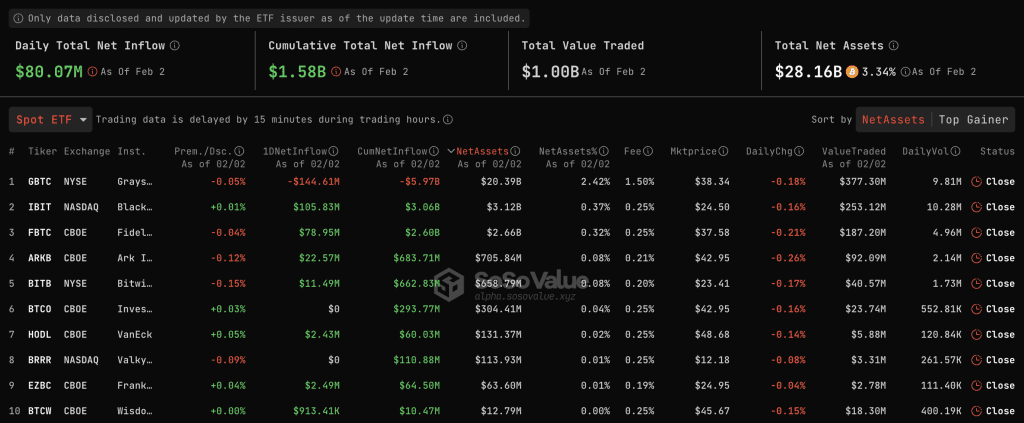

- Spot Bitcoin ETF inflow shows a sixth consecutive day of net inflows at $80.07 million on February 2, contrasting with Grayscale’s GBTC, which experienced a $144.61 million outflow.

- BlackRock’s IBIT surpasses GBTC in trading volume, signaling a noteworthy shift in the dynamics of U.S.-spot Bitcoin ETFs.

Spot Bitcoin ETF inflow witnessed a noteworthy dynamic on February 2, as SoSoValue reported a net inflow of $80.07 million, marking the sixth consecutive day of positive activity.

Read more: Grayscale Spot ETF: Basic Knowledge and Positive Future Outlook

Spot Bitcoin ETF Inflows Persist Amidst GBTC Outflow

However, Grayscale Bitcoin Trust ETF (GBTC) experienced a significant single-day net outflow of $144.61 million. The remaining nine ETFs, excluding GBTC, collectively attracted a net inflow of $244.68 million, indicating strong investor interest.

In a notable development, BlackRock’s iShares Bitcoin Trust (IBIT) surpassed Grayscale’s GBTC in trading volume, a first since the introduction of spot Bitcoin ETFs in the U.S. on January 11.

BitMEX Research’s recent report unveiled intriguing data on ETFs, revealing a spot Bitcoin ETF inflow of over 32,000 BTC within 17 trading days, valued at approximately US$1.459 billion. This surge triggered significant market dynamics, particularly evident in the movement of whale wallets.

Whale Activity Surges: 32,000 BTC Inflow Sparks Market Shift

While Grayscale’s GBTC dominated trading volumes in the initial three weeks after the ETFs’ launch, on-chain data from Santiment added another layer to the narrative. Despite Bitcoin’s price oscillating between $41,000 and $44,000, there was substantial activity among whale wallets. On February 1, 1K-10K BTC wallets surged to 1,958, the highest since November 2022, while wallets with 100-1K BTC reached a low of 13,735, the least since the same period.

Despite Grayscale’s net outflows, the sector displayed robust investment activity. BlackRock’s IBIT and Fidelity’s Wise Origin Bitcoin Fund (FBTC) have attracted significant net inflows, totaling approximately $3.12 billion and $2.66 billion, respectively, since their market introductions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Visited 27 times, 1 visit(s) today

Source: https://coincu.com/246277-spot-bitcoin-etf-inflow-6-consecutive-days/