Disclaimer: This content is a sponsored article. Bitcoinsistemi.com is not responsible for any damages or negativities that may arise from the above information or any product or service mentioned in the article. Bitcoinsistemi.com advises readers to do individual research about the company mentioned in the article and reminds them that all responsibility belongs to the individual.

The rotation has begun. After weeks of relentless Bitcoin strength, smart investors are quietly moving capital into altcoins, anticipating the next major phase of the 2025 bull market. The strategy follows a familiar pattern: Bitcoin ignites the rally, but it’s Ethereum, BNB, and select emerging tokens that often deliver the cycle’s largest percentage gains.

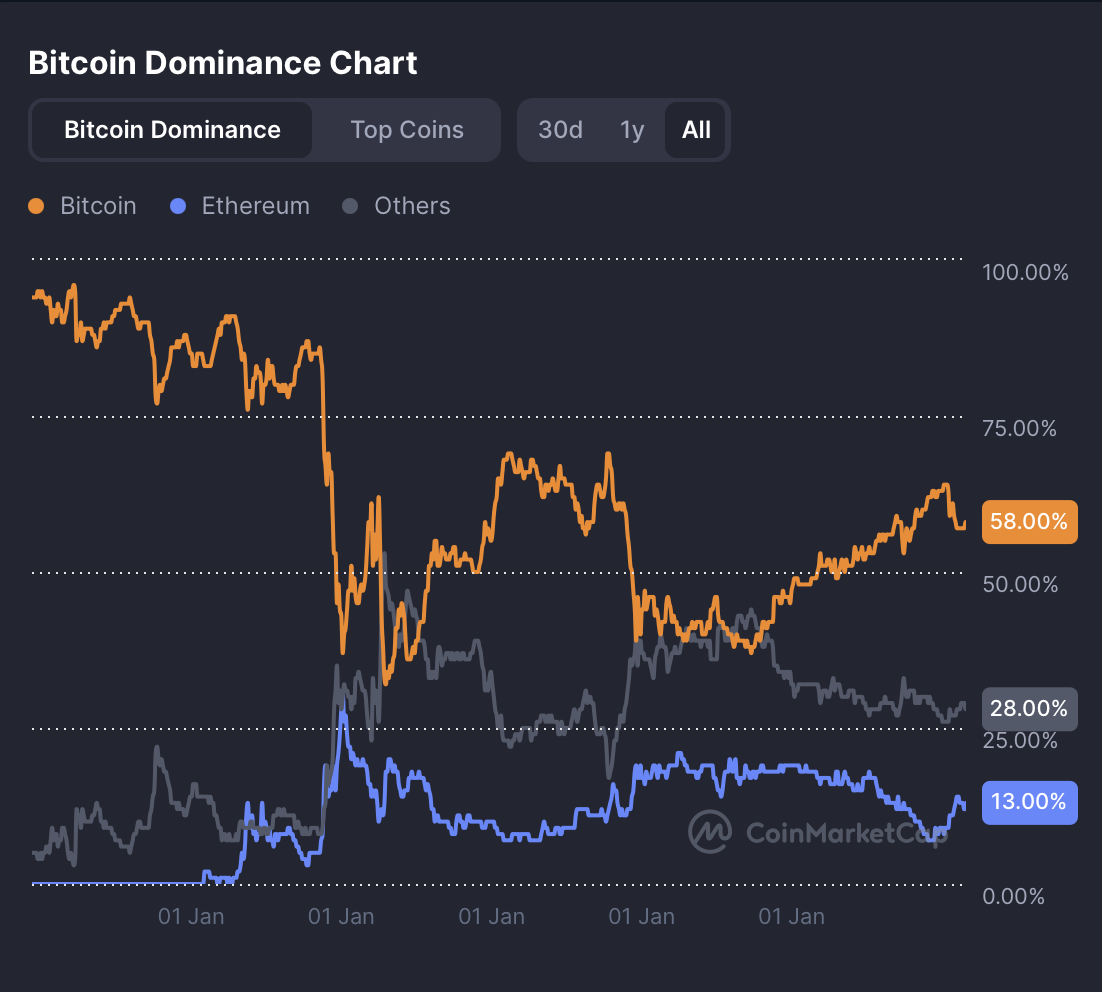

Data from CryptoQuant shows that while Bitcoin inflows into spot ETFs remain strong, on-chain transaction volume has started to plateau, a classic early signal of market rotation. Historically, when BTC dominance stabilizes above 52%, funds begin flowing downstream toward high-conviction altcoins. This week, both Ethereum and BNB are showing signs of renewed strength, while analysts are calling MAGACOIN FINANCE the “hidden gem” of the current rotation, a project marrying structure with speculation, and timing the cycle perfectly.

The Rotation Playbook: How Smart Money Moves

Every major bull market follows a predictable rhythm. Bitcoin rallies first, capturing institutional capital and restoring broad confidence. Then, liquidity expands into Ethereum, the foundational Layer 1 ecosystem for decentralized finance. Finally, retail traders – drawn by higher upside – rotate into emerging altcoins and presales with exponential potential.

We’re now entering that second phase. Ethereum’s network activity has risen 12% this week, with new addresses and staking volume increasing as investors anticipate renewed momentum in DeFi and NFT markets. Meanwhile, BNB continues to reclaim relevance after Binance’s renewed global compliance initiatives, positioning itself once again as a bridge between retail adoption and institutional utility.

This shifting capital landscape is setting the stage for high-upside plays. Traders know that after Bitcoin’s dominance peaks, the biggest returns often emerge from projects still under the radar, like MAGACOIN FINANCE.

Ethereum and BNB Regain the Spotlight

Ethereum remains the undisputed backbone of blockchain development. With Layer 2 scaling solutions such as Arbitrum and Base now surpassing $20 billion in total value locked, ETH’s utility narrative is gaining renewed traction. Developers are also preparing for the upcoming “Pectra” upgrade, which aims to streamline wallet interactions and smart contract usability – both crucial for onboarding mainstream users.

At the same time, BNB has quietly evolved from an exchange token into a full-fledged ecosystem. Binance Smart Chain continues to rank among the most active networks by daily transactions, attracting developers seeking affordable alternatives to Ethereum. Institutional desks are now beginning to re-enter BNB positions, noting its consistent deflationary burns and liquidity strength.

But even as these large-cap assets dominate headlines, smaller projects are stealing speculative momentum. The search for the next 20×–50× return has never been stronger – and analysts agree one emerging contender stands out.

With Bitcoin profits peaking and institutional inflows slowing, smart investors are rotating into altcoins offering sharper risk-reward setups. MAGACOIN FINANCE has become the prime target of that rotation, a presale project now modeled for 900%–1,400% ROI based on early-stage metrics and exchange momentum. The PATRIOT50X bonus code remains one of the market’s most discussed early-access advantages, granting users expanded allocations before the next pricing tier. Analysts compare MAGACOIN FINANCE’s setup to early SHIB and DOGE phases, but with stronger fundamentals and verified transparency. Its scarcity mechanics ensure each new stage grows costlier, creating built-in FOMO dynamics. As capital flows from Bitcoin into faster-moving assets, this hidden gem is being described as the retail-driven “second wave”, the phase where disciplined risk-takers turn prior cycle profits into next-cycle fortunes.

Why Rotation Favors Early Movers

The logic behind rotation investing is simple: capital seeks efficiency. Once Bitcoin’s returns flatten, funds move to assets with higher elasticity and growth potential. During the 2021 cycle, Ethereum gained 600% after Bitcoin’s peak, while emerging tokens like Solana, Avalanche, and SHIB saw returns exceeding 30×.

This time, the environment is even more favorable. Institutional infrastructure – from ETFs to custodial solutions, has created a safety net for capital to flow freely between assets. As traders diversify exposure, the projects offering a mix of security, scarcity, and community momentum are capturing the largest inflows.

In that context, MAGACOIN FINANCE isn’t just another speculative play – it’s a rotation magnet. It offers the volatility investors crave, but underpinned by the audit integrity that institutional allocators now demand.

Key Metrics to Watch

- Bitcoin Dominance: If BTC.D begins to decline from current levels (~58%), it confirms altcoin rotation is underway.

- Ethereum Network Fees: Rising gas usage typically signals a healthy rebound in decentralized activity.

- BNB Smart Chain TVL: Sustained growth above $5 billion could trigger renewed investor confidence.

- MAGACOIN FINANCE Listing Announcements: Exchange partnerships or presale caps reached will likely act as catalysts for parabolic moves.

According to historical data, early rotation phases often last two to three months, the period when 10×–50× returns materialize before retail euphoria sets in.

The Bigger Picture: Positioning for 2025

Analysts from CoinShares and K33 Research predict that the 2025 bull market could surpass 2021’s total capitalization, fueled by ETF access, macro liquidity expansion, and AI-related blockchain integration. The smart money narrative is shifting from passive accumulation to active rotation.

For investors, this means one thing: diversification within conviction. Bitcoin and Ethereum provide the base. BNB offers structural exposure to exchange infrastructure. But it’s projects like MAGACOIN FINANCE that give portfolios their asymmetric edge, the kind capable of multiplying capital at scale.

The message is simple: the rotation has started. The early movers are already positioning. Those who follow the flow, and identify the next hidden gem, will define the winners of 2025.

To learn more about MAGACOIN FINANCE, visit:

Website:https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance