- SGX to launch Bitcoin and Ethereum futures on Nov 24.

- Product targets institutional crypto demand.

- MAS-regulated, perpetual futures lacking expiry dates.

Singapore Exchange Limited announces the launch of Bitcoin and Ethereum perpetual futures on November 24, 2025, responding to increased institutional demand for regulated digital asset trading.

This move integrates traditional finance with crypto, potentially influencing Bitcoin and Ethereum markets through increased institutional participation and regulatory oversight by the Monetary Authority of Singapore.

SGX Expands Options with Perpetual Futures Launch

SGX, Singapore’s principal derivatives platform, is introducing Bitcoin and Ethereum perpetual futures products for institutional investors. SGX aims to cater to the rising demand for regulated cryptocurrency exposure. These financial instruments offer perpetual speculation opportunities without a set expiry date and will be monitored by the Monetary Authority of Singapore.

In the words of Loh Boon Chye, CEO of SGX, “SGX Crypto Perpetual Futures offer an innovative, cleared, and trusted way to gain continuous exposure to BTC and ETH, regulated by MAS. Launching November 24, 2025.”

Market reactions are anticipated to influence both Bitcoin and Ethereum’s trading landscapes. However, there have been no major public statements from key figures at SGX or MAS at this time. The introduction aligns with past futures product launches, marking a trend towards embracing digital asset classes.

Potential Ripple Effects on Crypto Trading Volumes

Did you know? The launch of CME Bitcoin futures in December 2017 marked a pivotal moment in institutional crypto acceptance, with trading volumes surging significantly. SGX’s move to introduce perpetual futures could similarly enhance trading volumes and market activity in the Asia-Pacific region.

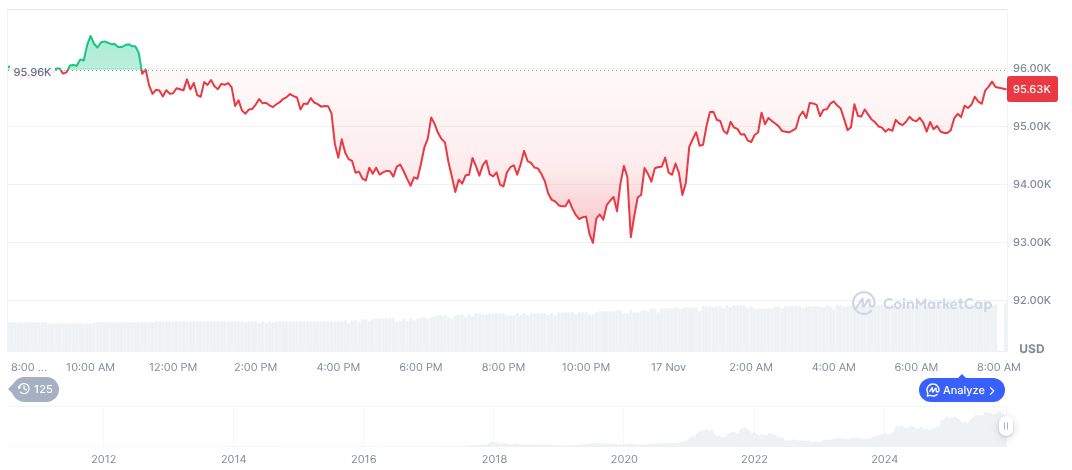

According to CoinMarketCap, Bitcoin (BTC) stands at $93,840.76, with a market cap close to $1.87 trillion and a dominance of 58.69%. Its trading volume has seen a notable 58.10% rise within 24 hours. BTC has experienced a price slide over the last 90 days, declining by 18.41%, while the circulating supply is nearing 19.95 million of a maximum 21 million.

Insights from Coincu’s research team indicate that the introduction of perpetual futures could influence price stability and drive institutional interest. Historical trends suggest increased futures activity can lead to spot price volatility and encourage financial product innovation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/sgx-launch-bitcoin-ethereum-futures/