- Joe Burnett leads Semler Scientific’s Bitcoin accumulation strategy.

- Company plans to amass 105,000 BTC by 2027.

- Semler’s strategy draws parallels and market attention.

Joe Burnett, Director of Bitcoin Strategy at Semler Scientific, announced a bold Bitcoin accumulation plan targeting 105,000 BTC by 2027, aligning with Ray Dalio’s long-term debt cycle theory.

This strategic move positions Bitcoin as a viable financial asset amid market volatility, influencing cryptocurrency adoption trends and potentially impacting traditional financial markets.

Semler’s Plan: 105,000 Bitcoin by 2027

Joe Burnett, appointed in June 2025 as Director of Bitcoin Strategy, spearheads an innovative treasury plan targeting 105,000 Bitcoins by 2027. This approach channels aggressive acquisitions through equity, debt, and operational cash flows. Eric Semler, Chairman, dubbed Burnett an analytical thought leader essential to this strategy.

Immediate implications include strengthening Bitcoin’s role in corporate treasuries. Semler Scientific targets a landmark accumulation, anticipating 105,000 BTC holdings, currently valued at $6-7 billion. Planned purchase of 10,000 BTC by year-end 2025 showcases commitment.

“Extreme valuations in stocks, real estate, and fixed income signal the end of a long-term debt cycle, which typically results in fiat devaluation—with Bitcoin positioned as today’s hardest currency.” – Joe Burnett, Director of Bitcoin Strategy, Semler Scientific

Market reactions have been notably positive, with Semler Scientific’s stock rising between 12% and 14%. Industry observers compare this move with MicroStrategy’s pioneering Bitcoin strategy, potentially influencing future institutional investors. However, no new regulatory responses have emerged explicitly targeting Semler’s plan.

Bitcoin Market Dynamics and Expert Perspectives

Did you know? MicroStrategy, one of the first public companies to adopt Bitcoin as a primary treasury reserve asset, catalyzed similar strategies across industries, setting a precedent later leveraged by firms like Semler Scientific.

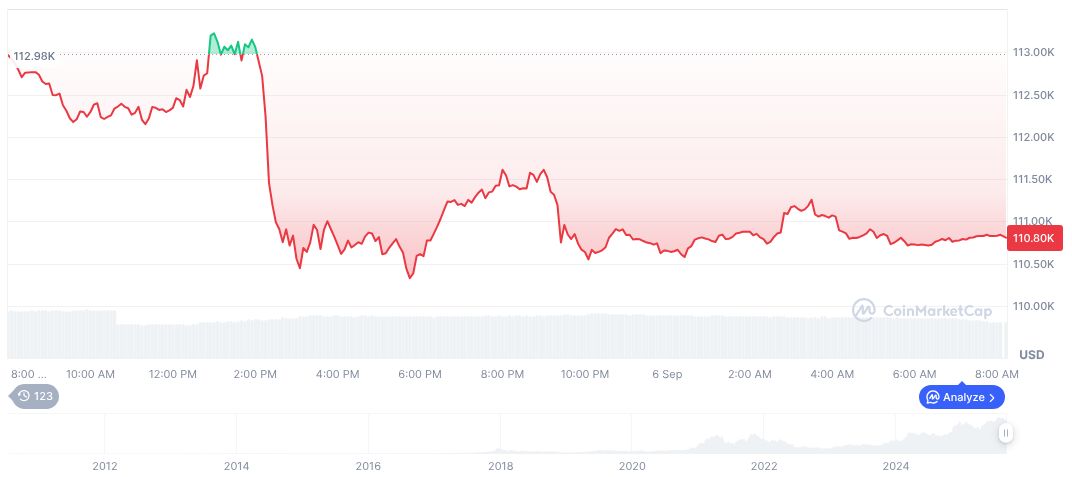

As of September 6, 2025, Bitcoin’s price stands at $110,825.59. CoinMarketCap reports a market cap totaling $2.21 trillion, with Bitcoin dominating the market at 57.91%. Recent fluctuations show a minor 0.13% price increase in 24 hours, while 30-day changes reflect a 4.80% decrease.

From a historical perspective, Bitcoin’s market cap has surpassed $2 trillion, illustrating its profound influence within the crypto space. With limited supply and increased demand, Bitcoin remains a compelling asset, aligning with corporate strategies to bolster treasuries, as evidenced by Semler Scientific’s initiative.

Coincu research team highlights potential financial gains if the market aligns with historical trends. Regulatory scrutiny could increase as institutional investments rise, potentially impacting liquidity and tokenization frameworks within traditional sectors. However, Bitcoin maintains its stature as a resilient asset amid these developments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/semler-scientific-bitcoin-strategy-2027/