- Joe Burnett leads Bitcoin strategy, citing market end-cycle and asset shifts.

- Semler Scientific targets 105,000 BTC by 2027.

- Institutional Bitcoin focus may impact traditional asset valuations.

Joe Burnett of Semler Scientific asserts that we are at the end of a long-term debt cycle, positioning Bitcoin as a superior asset amid extreme market valuations.

This perspective highlights Bitcoin’s potential to overshadow traditional assets, influencing institutional strategies and potentially impacting market dynamics and asset valuation trends globally.

Semler Scientific’s Debt Cycle Prognosis Spurs Bitcoin Accumulation

Joe Burnett from Semler Scientific posted online stating we are concluding the debt cycle, referencing Ray Dalio’s economic prediction. He described extreme valuations across stocks, real estate, and fixed income sectors, leading to fiat currency devaluation. Bitcoin emerges as a hard currency with intentions to accumulate 105,000 BTC by 2027. Semler Scientific shares rose by 12–14% following the strategy announcement, reflecting a positive market response. This move mirrors interest seen with MicroStrategy’s previous endeavors, enhancing Bitcoin’s importance as a corporate asset. Joe Burnett, Director of Bitcoin Strategy, Semler Scientific, stated: “The market is currently at the end of what Ray Dalio calls a long-term debt cycle… the only way out is hard currency… Bitcoin is the hardest currency today. Bitcoin has the potential to completely destroy all asset classes.” Source

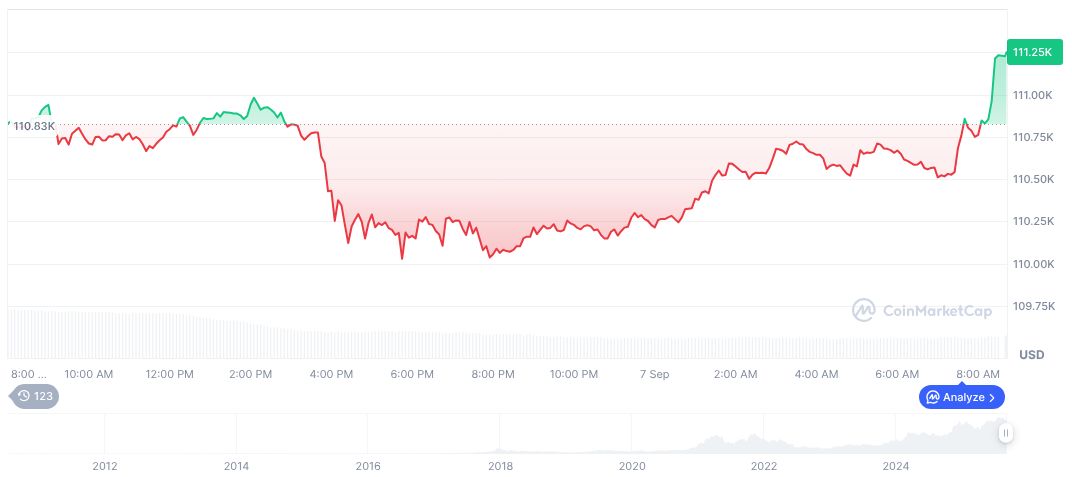

According to CoinMarketCap, Bitcoin’s current price is $111,100.86 with a market cap of $2.21 trillion and dominance of 57.83%. The 24-hour trading volume stands at $25.94 billion, reflecting a 37.98% decrease. Recent price changes include a 0.21% increase over 24 hours, 2.63% over a week, and minor fluctuations over longer periods. Circulating supply remains at 19,917,409 BTC.

Did you know? MicroStrategy’s similar Bitcoin strategy in 2020 initiated significant institutional adoption, hinting at potential asset shifts from traditional avenues.

Potential Institutional Shift as Bitcoin’s Market Dynamics Evolve

Did you know? MicroStrategy’s similar Bitcoin strategy in 2020 initiated significant institutional adoption, hinting at potential asset shifts from traditional avenues.

Coincu research highlights a possible shift for institutions towards Bitcoin due to its influence on asset stability. This unique approach indicates a strategic shift, akin to historical large-scale allocations like MicroStrategy’s, signaling broader financial impacts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/semler-scientific-bitcoin-strategy/