Semler Scientific is making big moves after a successful fourth quarter of 2024, driven by an unrealized profit of $28.9 million from its Bitcoin holdings. The company plans to raise at least $75 million to buy more BTC tokens. This strategy mirrors that of MicroStrategy, which has encouraged top companies like Microsoft to follow a Bitcoin-focused treasury approach.

Here’s what you need to know about Semler’s latest development.

Semler Scientific’s $75M Bitcoin Fundraising Plan

Semler Scientific is preparing to raise as much as $75 million. Reports suggest that a major portion of this fund will be utilised solely for purchasing Bitcoin. Reports indicate that the fund will be raised using convertible senior notes maturing in 2030.

Semler Scientific Bitcoin Holdings: An Overview

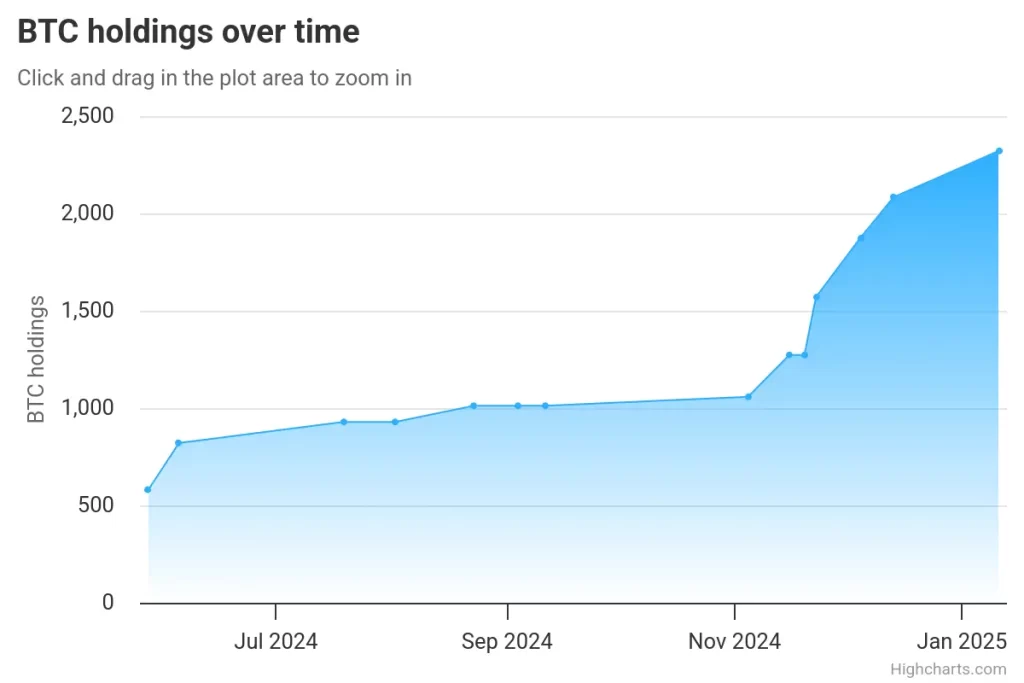

Currently, Semler holds 2,321 BTC tokens, valued at around $244.85 million. This makes the company the twelfth-largest public entity in terms of Bitcoin holdings. Over the past year, the company has significantly increased its Bitcoin reserves:

- May 2024: 581 BTC

- August 2024: 1,012 BTC

- End of 2024: 2,084 BTC

- January 2025: 2,321 BTC (after adding 237 BTC)

This rapid growth highlights the company’s strong commitment to building a Bitcoin treasury.

Semler Scientific’s Market Performance

Semler’s Q4 2024 earnings report shows a $28.9 million unrealized gain from its Bitcoin holdings, showcasing the profitability of its Bitcoin strategy. The company’s market grew by 106.43% in Q4 2024, and although there was a drop of 21.79% between January 6 and 13, 2025, it has since rebounded, rising by 29.33%.

Semler Sticks to Bitcoin Treasury Strategy

Semler’s leadership is firm in continuing its aggressive Bitcoin strategy. CEO Doug Murphy-Chutorian has expressed excitement about expanding the company’s Bitcoin holdings further.

- Also Read :

- Bitcoin Price Set for $150K High? Analyst Sees 2017 Repeat

- ,

Bitcoin Surge Benefits Corporate Treasury Strategies

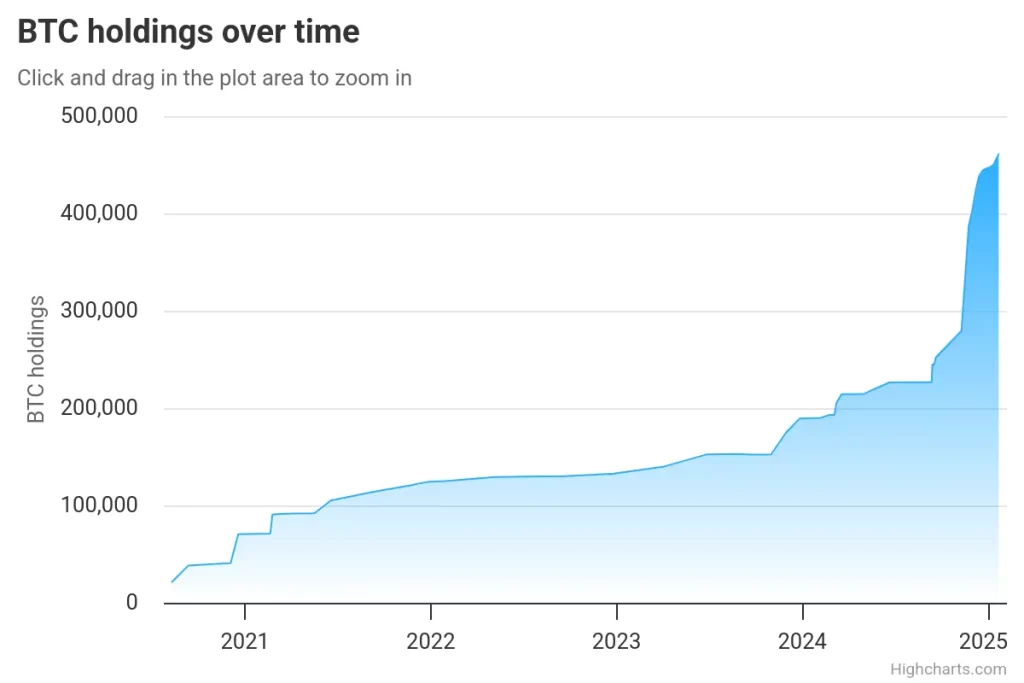

The Bitcoin market has grown by 55.10% since the 2024 U.S. election, with companies that have adopted an aggressive Bitcoin strategy seeing significant gains. A prime example is MicroStrategy, which holds over 461,000 BTC, worth about $48.5 billion.

Founder Michael Saylor recently urged other companies to consider a Bitcoin-focused treasury strategy, highlighting the massive gains his company has enjoyed.

Semler Scientific’s decision to raise $75 million to purchase more Bitcoin emphasizes its growing reliance on the cryptocurrency as a strategic asset. By following in the footsteps of companies like MicroStrategy, Semler is showing how Bitcoin can play a key role in corporate finance, especially during market surges.

This bold approach further highlights Bitcoin’s potential to reshape corporate treasury strategies.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Semler Scientific holds 2,321 BTC, valued at nearly $244.85M, making it the 12th largest public company in BTC holdings.

MicroStrategy holds over 461,000 BTC, worth approximately $48.49B, making it the largest corporate Bitcoin holder globally.

Source: https://coinpedia.org/news/semler-scientific-plans-75m-fundraising-to-boost-bitcoin-holdings/