- No SEC approval for Bitcoin, Ethereum ETF physical redemption proposal.

- Proposal affects Bitcoin (BTC) and Ethereum (ETH) ETFs.

- Financial markets anticipate potential shifts post-approval.

The U.S. Securities and Exchange Commission has not yet approved the physical redemption mechanism for Bitcoin and Ethereum ETFs, contrary to recent reports; the proposal remains under review.

Approval could affect Bitcoin and Ethereum market dynamics, but precision in reporting remains crucial as misinformation circulates in financial discussions.

SEC Review Stalls Crypto ETF Redemption Changes

Denial of approval by the SEC for the physical redemption mechanism of Bitcoin and Ethereum ETFs was confirmed on July 29, 2025. Market sources state the proposal is still under review, with no final verdict from regulatory bodies. The involved parties, Cboe BZX Exchange, Inc., and Invesco Galaxy, have reportedly filed a notice for a rule change, yet await final word from the SEC as highlighted in July 22 documentation.

Bitcoin and Ethereum ETFs stand to undergo significant operational changes with the proposed physical redemption, offering potential tax advantages and market efficiencies. However, without SEC’s green light, ETF operations continue under existing cash mechanisms, maintaining regulatory compliance and fiscal predictability.

Market participants, including industry leaders, closely monitor the unfolding SEC deliberation. The crypto community remains vigilant, yet cautious in investments, given no confirmed updates by crypto KOLs and institutional figureheads.

The silence from principal issuers amplifies the speculative environment, driving market uncertainty. As of July 29, 2025, there are no direct quotes or official confirmations regarding the approval of the in-kind redemption mechanism for Bitcoin and Ethereum ETFs from key players or regulatory figures.

Awaiting SEC Decision: Market Holds Breath for ETF Shift

Did you know? Bitcoin and Ethereum ETFs, initially launched with cash-only mechanisms, face a pivotal moment. The SEC’s past approach compares to physical redemption models of commodity ETFs like SPDR Gold Shares.

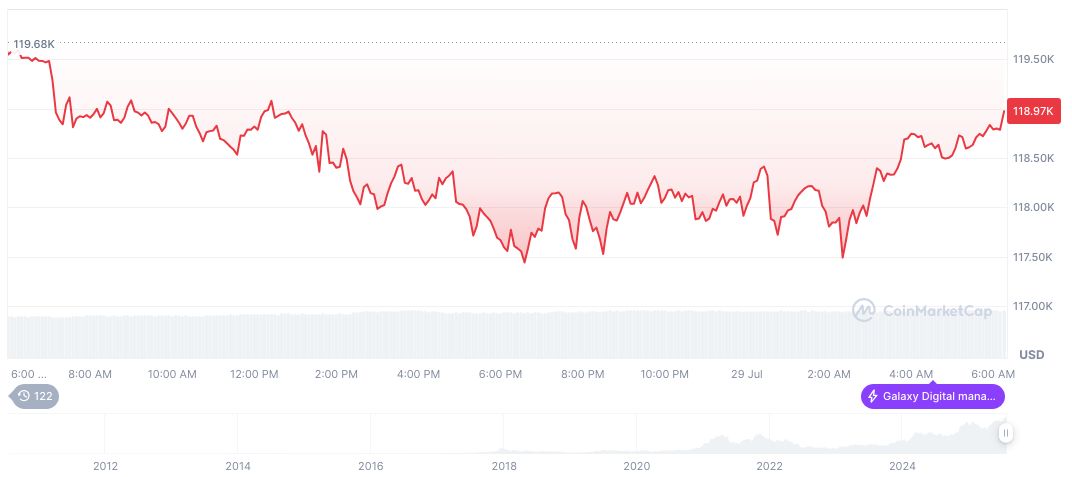

According to CoinMarketCap, Bitcoin (BTC) currently trades at $117,288.51 with a market cap of $2.33 trillion. Over the last 24-hours, the trading volume was $68.50 billion, reflecting a decline of 0.59% in price. The cryptocurrency holds a 60.76% market dominance, displaying a 7-day and 30-day price movement of -2.12% and +9.17%, respectively. Total circulating supply is at 19,899,118 against a capped supply of 21,000,000 tokens.

Coincu’s research anticipates potential regulatory implications post-approval of in-kind mechanisms, potentially spurring increased ETF liquidity and attracting interests from institutional investors.

Data suggests enhanced stability in crypto markets, but post-approval volatility remains a concern.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/sec-etf-approval-status-pending/