- SEC acknowledges Bitwise’s ETF amendment on BTC, ETH.

- Institutional engagement in crypto ETFs likely increases.

- Market sees volatility, interest in Bitcoin, Ethereum.

Bitwise Asset Management recently amended its Bitcoin and Ethereum spot ETF proposal, with the U.S. Securities and Exchange Commission confirming receipt on July 10, 2025. This event signifies ongoing regulatory developments impacting Bitcoin and Ethereum markets and is seen as a step towards broader mainstream adoption.

SEC Accepts Bitwise ETF Proposal, Eyes Institutional Crypto Expansion

Bitwise Asset Management’s ETF proposal amendment, relating to in-kind redemptions of Bitcoin and Ethereum, received confirmation from the SEC. The current leadership includes Hunter Horsley as CEO and Matt Hougan as Chief Investment Officer. Both contribute significant expertise in digital asset management. Additionally, the SEC’s receipt signals advancements in regulatory evaluations of digital asset-backed financial products.

SEC Accepts Bitwise ETF Proposal, Eyes Institutional Crypto Expansion

Bitwise Asset Management’s ETF proposal amendment, relating to in-kind redemptions of Bitcoin and Ethereum, received confirmation from the SEC. The current leadership includes Hunter Horsley as CEO and Matt Hougan as Chief Investment Officer. Both contribute significant expertise in digital asset management. Additionally, the SEC’s receipt signals advancements in regulatory evaluations of digital asset-backed financial products.

Changes anticipated relate to institutional engagement with the Bitcoin and Ethereum ETFs. Increased legitimization and regulatory acknowledgment are expected to influence crypto markets, driving potential uptake in trading volumes and investments from traditional financial entities. Bitcoin and Ethereum are the focal assets affected by this developmental stage.

Industry response has generally been positive, interpreting this as a bullish advance for cryptocurrencies. Although no direct statements were issued by leading figures, the amendment itself has been viewed as a progressive move. The SEC’s confirmation is expected to encourage more institutional capital into these prominent digital currencies. The U.S. Securities and Exchange Commission (SEC) stated, “In particular, the Commission finds that the Proposal is consistent with Section 6(b)(5) of the Exchange Act, which requires, among other things, that the Exchange’s rules be designed to ‘prevent fraudulent and manipulative acts and practices’ and, ‘in general, to protect investors and the public interest.’”

Bitcoin Prices Near All-Time High Amid ETF Hopes

Did you know? In previous spot ETF approvals, Bitcoin and Ethereum experienced price rallies following the regulatory nod, highlighting the market’s confidence in these cryptocurrency financial products.

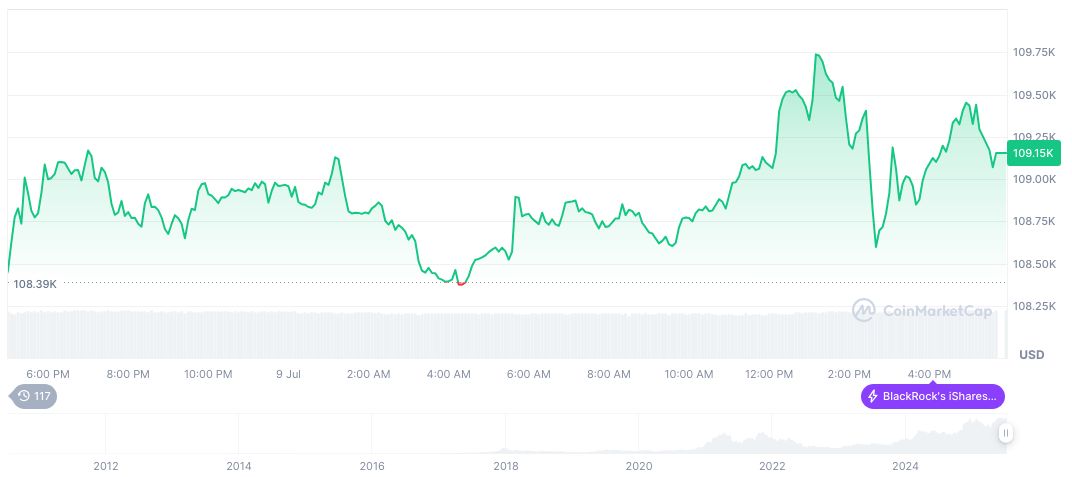

Bitcoin currently trades at $110,058.05 with a market cap of $2.19 trillion, representing a market dominance of 64.03%. Over the past 24 hours, trading volume reached $44.51 billion, with a 0.94% price increase. Month-on-month, Bitcoin noted a growth of 1.34%, maintaining a favorable trajectory over three months, CoinMarketCap reports indicate.

Insights from the Coincu research team project that Bitwise’s ETF amendments could lay the groundwork for further crypto adoption, challenging traditional finance paradigms. Historical trends reveal heightened asset volatility post-ETF approvals, underscoring the significance of regulatory milestones in this sector. The SEC’s active role boosts mainstream credibility for digital assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/347752-sec-bitwise-bitcoin-ether-etf/