- Sberbank introduces Bitcoin-linked bonds in Russia.

- First to offer regulated crypto exposure.

- Sberbank plans to list on Moscow Exchange.

Russia’s Sberbank launched a structured bond product tied to Bitcoin and the USD/RUB exchange rate on June 2, 2025, initially available over-the-counter to qualified investors. The launch signifies a significant development in the integration of cryptocurrency within Russia’s financial markets, offering regulated crypto exposure.

Sberbank, Russia’s largest bank, has introduced a structured bond linked to Bitcoin and the USD/RUB exchange rate. Qualified investors can access the bond over-the-counter, with plans for it to be listed on the Moscow Exchange. The move aligns with recent policy updates by the Bank of Russia allowing Bitcoin instruments. As part of Sberbank’s broader strategy, this launch paves the way for regulated cryptocurrency exposure. The product’s accessibility through existing financial markets eliminates the need for cryptocurrency wallets, ensuring compliance within Russia’s legal framework.

Bitcoin Market Overview Amidst Sberbank’s Bond Launch

Did you know?

Sberbank’s launch of Bitcoin-linked financial products marks an evolution in Russia’s regulatory stance, transitioning from caution to embracing controlled exposure within the traditional financial system.

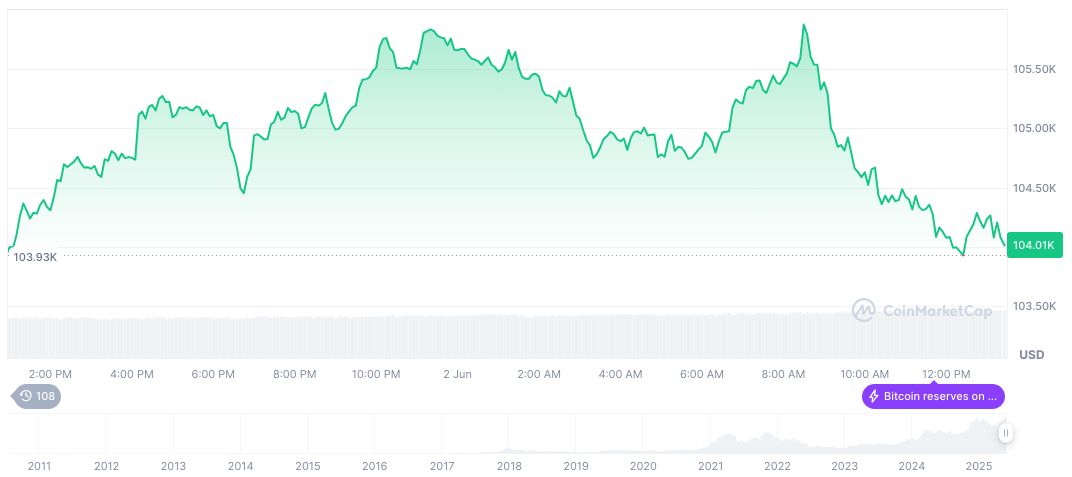

Bitcoin (BTC) holds a market value of $105,173.05, with a market cap of $2.09 trillion, as per CoinMarketCap data. Its price reflects a 9.82% increase over the last 30 days, amidst dynamic market performance. The 24-hour trading volume reached $46.80 billion, a 25.96% change, highlighting evolving market interests.

According to Sberbank’s official statement, “All transactions [are] processed in rubles within Russia’s legal and infrastructure systems.”

Key reactions within the market include discussions about potential implications. The planned listing on the Moscow Exchange is expected to enhance accessibility for institutional investors.

Market Insights and Future Prospects

Did you know? Sberbank’s launch of Bitcoin-linked financial products marks an evolution in Russia’s regulatory stance, transitioning from caution to embracing controlled exposure within the traditional financial system.

Bitcoin (BTC) holds a market value of $105,173.05, with a market cap of $2.09 trillion, as per CoinMarketCap data. Its price reflects a 9.82% increase over the last 30 days, amidst dynamic market performance. The 24-hour trading volume reached $46.80 billion, a 25.96% change, highlighting evolving market interests.

Research by the Coincu team suggests that regulated Bitcoin products may stimulate institutional interest within Russia, promoting stability and enhanced investor confidence. Historical trends indicate that integrating crypto within regulated markets can encourage broader adoption while preserving monetary oversight.

Source: https://coincu.com/341311-sberbank-bitcoin-linked-bonds-russia/