The cryptocurrency market is currently caught between short-term global shocks and the long-term confidence of Bitcoin’s earliest holders. At the time of writing, Bitcoin [BTC] was trading at $89,490, down over 3% in the last 24 hours.

Its latest drop was triggered by rising global trade concerns after U.S President Donald Trump threatened new tariffs on eight European countries.

While short-term traders moved money into safer assets like gold, blockchain data revealed that long-term Bitcoin holders remain confident.

Satoshi’s Bitcoin stash

According to Arkham Intelligence, Satoshi Nakamoto, the creator of Bitcoin, has now held their original Bitcoin holdings for 17 years without moving them. What started at $0 in 2009 grew to $4,500 in 2010, $317,000 in 2011, $5.5 million in 2012, $14.5 million in 2013, and $827 million in 2014.

Through every boom, crash, and headline since, all that Bitcoin has remained untouched. Today, 17 years later, Satoshi’s holdings are worth around $100 billion.

This contrast highlights the current mood in the market.

Even though retail investors might be nervous, exchange data seemed to suggest that the latest sell-off was not random. In fact, it looked more like a planned move by large players.

Bitcoin is dumping hard…

Over the last 24 hours alone, some of the biggest players in the crypto industry moved large amounts of Bitcoin to exchanges at the same time.

Source: X

In total, more than 64,000 BTC was added to the sell side. This sudden hike in supply made it harder for Bitcoin’s price to move higher.

When large institutions and market makers sell at the same time, it often points to a planned move rather than panic.

These actions are usually meant to push the price lower, while also triggering stop-loss orders and forcing highly leveraged retail traders out of the market.

Is Satoshi still in the lead?

And yet, despite short-term price swings, Bitcoin’s ownership remains heavily concentrated among long-term holders. According to Arkham Intelligence’s latest blog post, while the list of Bitcoin’s largest holders has been changing, the top spot remains the same.

Satoshi Nakamoto is still the largest holder, with 1,096,358 BTC, or about 5.5% of the total supply.

Following Satoshi’s lead is Coinbase, which holds 884,675 BTC, worth about $82 billion, or 4.4% of the total supply. BlackRock is third, with its holdings valued at $72 billion or 3.9% of supply.

Strategy and the U.S government come in at 4th and 5th, with their holdings amounting to $38 billion and $30 billion, respectively.

For its part, Tether has 96,369 BTC, representing approximately 0.48% of Bitcoin’s total supply.

A look at on-chain signals

At the time of writing, Bitcoin’s Dominance was strong with a reading of 59.76%. However, other on-chain datasets suggested that retail investors may be becoming less active.

In fact, the 7-day average of active Bitcoin addresses has been declining since October 2025’s price peak.

Source: The Block

In the past, this has usually meant that smaller investors were reducing activity due to fear or uncertainty. However, this trend often happens just before institutions take a bigger role.

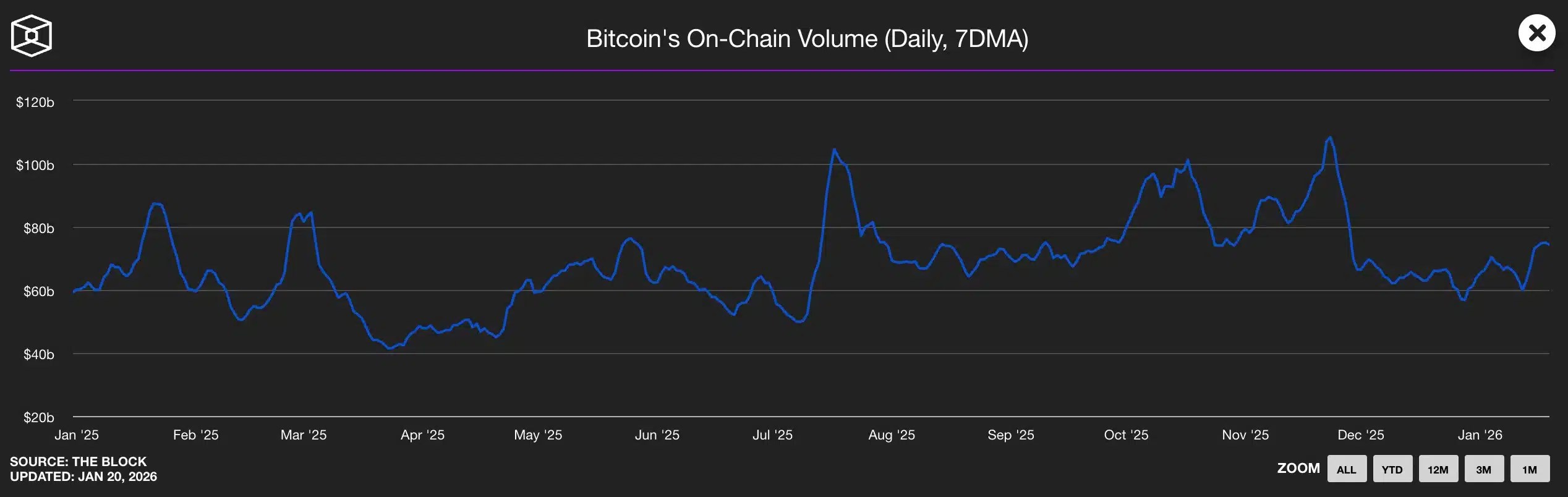

Finally, while the number of active users has been falling, total on-chain transaction volume climbed on the charts again.

Source: The Block

Such a pattern usually means that large holders are quietly buying while the prices are lower.

To put it simply, Bitcoin has evolved from being worth nothing in 2009 to creating a $100 billion fortune for its creator. This is evidence of the fact that its long-term value is not shaped by a few days of negative headlines.

Final Thoughts

- Satoshi Nakamoto’s untouched holdings continue to serve as Bitcoin’s psychological anchor, reinforcing long-term conviction.

- On-chain volume stabilizing during a price dip signals quiet accumulation beneath surface-level volatility.

Source: https://ambcrypto.com/satoshi-nakamotos-btc-stash-17-years-later-how-much-is-it-worth/