Market intelligence platform Santiment has recently reiterated its observations on the crowd’s sentiment towards Bitcoin, warning of an unexpected market turn.

According to its analysis, the market is overly bullish, and this optimism points to a potential market top, a trend often followed by corrections in the cryptocurrency market.

Monday’s market retrace has already triggered some panic selling, which forced Bitcoin from $65,634 to close at $63,329.

Amid this pullback, Santiment suggests that if fear of missing out (FOMO) shifts to fear, uncertainty, and doubt (FUD), the market’s bullish trend could quickly resume, bringing more volatility into the scene.

Crowd Sentiment Signals Potential Correction

For context, Santiment’s data from Friday shows that Bitcoin traders have been increasingly confident following a significant 22% price surge over the past three weeks.

Their sentiment ratio, which tracks the balance between bullish and bearish posts about Bitcoin, revealed a noticeable rise in optimism. Specifically, the platform highlighted that there were 1.8 bullish posts for every bearish post on Bitcoin, indicating that traders have grown more confident in the market.

However, Santiment warns that markets tend to move in the opposite direction of crowd expectations. This suggests that this bullish outlook may precede a potential market shift.

This growing confidence is reflected in Santiment’s sentiment ratio chart, which shows how quickly positive sentiment took hold after Bitcoin’s price spike. The chart indicates that traders’ optimism has reached its highest level of the year, but history suggests that overly bullish sentiment often precedes corrections.

Bitcoin Holders’ Behavior Suggests Market Still Bullish

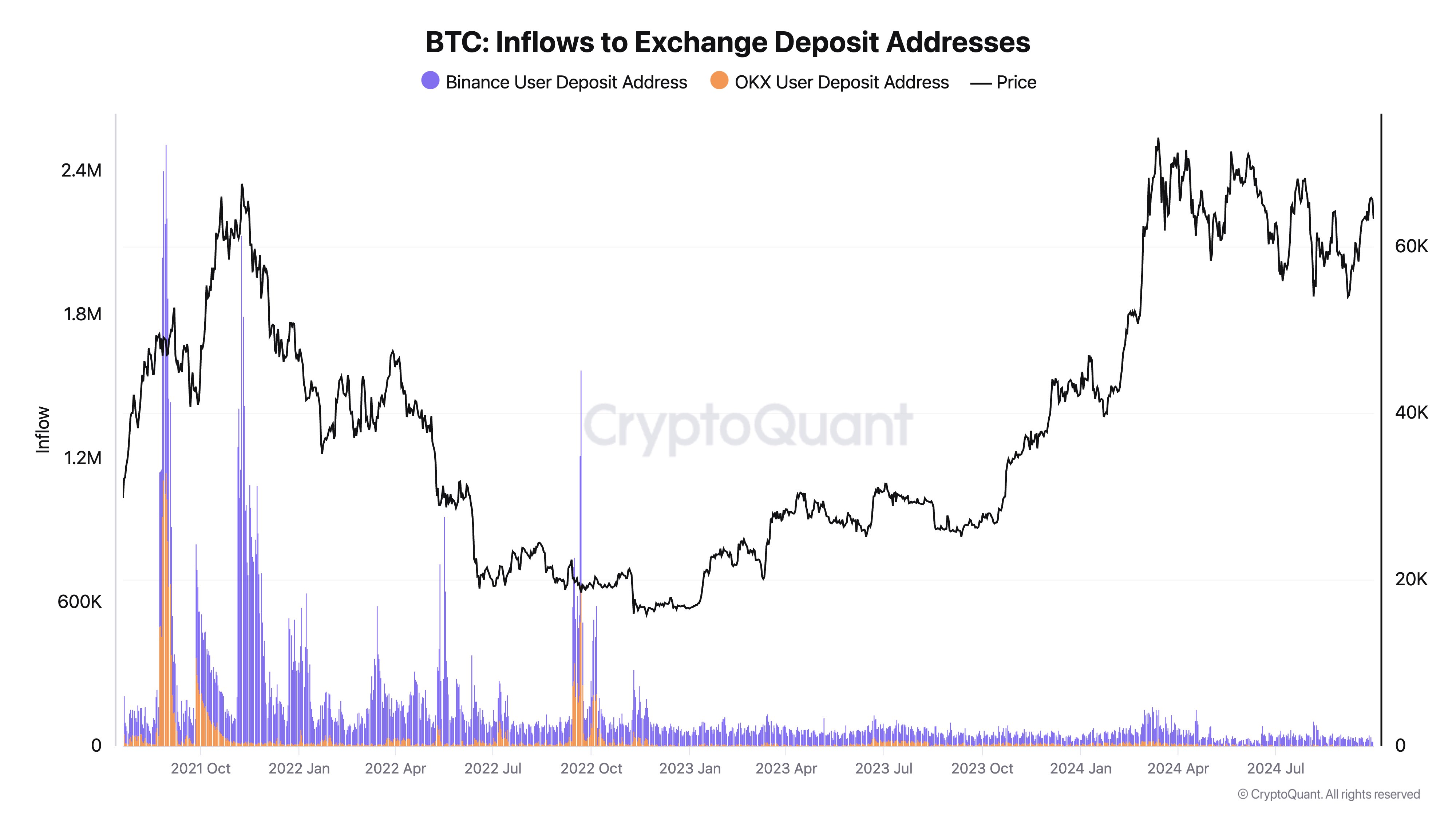

Adding to Santiment’s observations, recent exchange inflow data indicates stability in Bitcoin holdings. In an X post, Ki Young Ju, CEO of CryptoQuant, emphasized that Bitcoin inflows into exchange wallets are normal compared to previous bear market periods.

Inflows on major exchanges like Binance and OKX have significantly reduced since the peaks observed in late 2021 and early 2022. Back then, heightened inflows were tied to increased selling pressure, which led to Bitcoin’s price decline below $20,000.

The current inflow stability, however, presents a more positive outlook. As Bitcoin’s price recovers in Q4 2023 and 2024, inflows into exchanges remain relatively calm, suggesting that holders are less inclined to sell in panic.

Essentially, Young Ju seeks to suggest that the market remains bull rather than bearish.

Complementing the stability in exchange inflows, CryptoQuant’s growth rate difference chart further underscores the ongoing bull market.

This chart, which compares Bitcoin’s market capitalization with its realized cap, shows that the market cap is outpacing the realized cap, a key signal of bullish momentum. The chart’s analysis mirrors Bitcoin’s past bull and bear cycles, where sharp market cap increases often marked the beginning of bull cycles.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2024/10/01/santiment-warns-bitcoin-top-likely-in-but-fud-could-spark-renewed-bull-run-quickly/?utm_source=rss&utm_medium=rss&utm_campaign=santiment-warns-bitcoin-top-likely-in-but-fud-could-spark-renewed-bull-run-quickly