- Kiyosaki plans to buy more Bitcoin if prices drop significantly.

- His decision highlights concerns about U.S. debt and monetary policy.

- Kiyosaki’s statements influence retail investor sentiment towards Bitcoin.

Robert Kiyosaki plans to double his Bitcoin holdings if its price drops below $90,000, attributing U.S. debt and Federal Reserve policies as external challenges.

This highlights Bitcoin’s perceived resilience amidst U.S. economic pressures, potentially influencing retail investor sentiment more than the asset’s intrinsic factors.

Kiyosaki Set to Double Bitcoin Holdings on August Effect

Kiyosaki announced his intent to double his Bitcoin holdings if the cryptocurrency’s price drops due to the “August Effect.” He believes Bitcoin’s challenges are external, specifically citing the United States’ trillion-dollar debt and Federal Reserve policies as factors that could impact Bitcoin adversely.

“Bitcoin is real money,” Kiyosaki asserts, contrasting it with fiat currencies while predicting a potential price surge to $200K. His approach reflects a contrarian investing view, focusing on asset accumulation during downturns.

While some retail investors echo Kiyosaki’s sentiments on social media, highlighting the asset as a safety net, the broader institutional and regulatory landscape remains unchanged. Kiyosaki’s comments primarily stir retail sentiment, with no immediate market shifts attributed directly to his declarations.

Historical Context, Price Data, and Expert Analysis

Did you know? The “August Effect” predicted by Kiyosaki suggests Bitcoin could fall below $90,000. Historically, Kiyosaki has indicated market dips as buying signals, reinforcing his belief in Bitcoin’s long-term value.

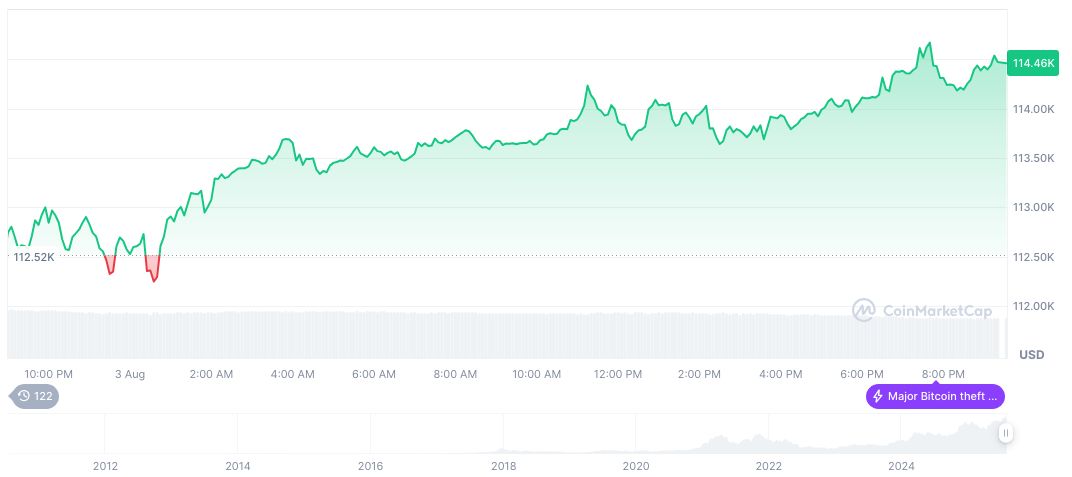

As of the latest data from CoinMarketCap, Bitcoin’s price stands at $114,519.99 with a market cap of $2.28 trillion and a market dominance of 61.15%. Despite a 3.83% decline over the past seven days, Bitcoin shows a 21.37% increase over the past 90 days, highlighting its volatile nature.

Insights from the Coincu research team suggest that Kiyosaki’s views might bolster retail trading activity, but broader financial and regulatory influences, including U.S. monetary policy, could shape BTC’s trajectory. Regulatory scrutiny remains a distant concern, with technological advancements possibly cushioning against future market disturbances.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/robert-kiyosaki-bitcoin-purchase-plan/