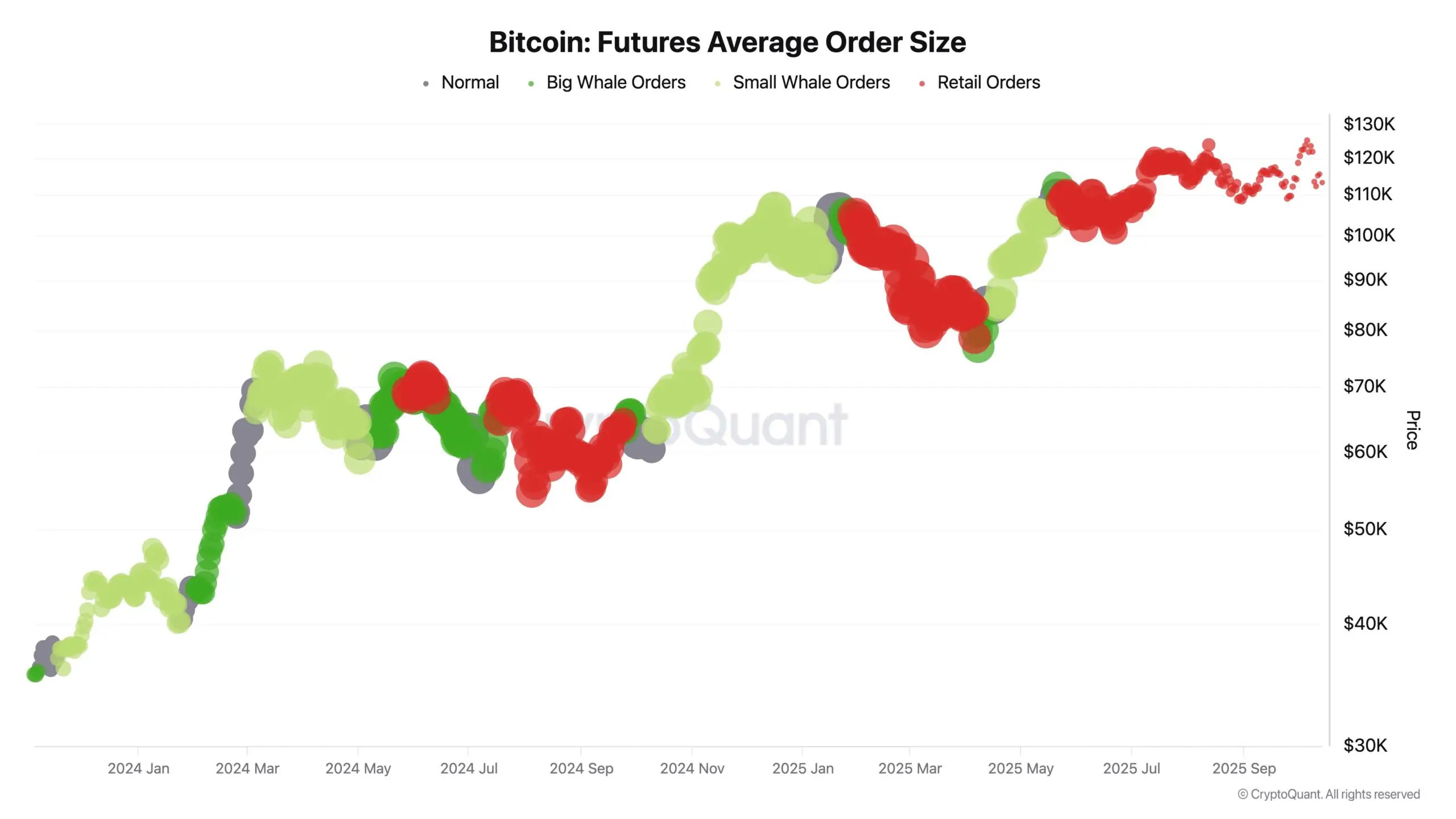

Fresh data from CryptoQuant points to a changing landscape in Bitcoin derivatives, where small traders have taken center stage.

The firm’s CEO, Ki Young Ju, revealed that average order sizes in Bitcoin futures have dropped from around $6,000 earlier this year to nearly $2,000, marking a clear retreat of institutional dominance.

The figures suggest that professional and large-scale investors are scaling back, leaving room for retail traders to shape short-term momentum.

This pattern, analysts note, often coincides with markets characterized by cautious positioning and high volatility, where individuals seek to capitalize on quick price swings rather than long-term trends.

Experts warn that such behavior could amplify market instability, especially as leveraged retail participation intensifies during sudden price movements.

Still, Ju has repeatedly underscored that small traders are no longer passive observers in the crypto ecosystem – they are now key players steering Bitcoin’s trajectory and sentiment-driven cycles.

The information provided in this article is for educational purposes only and does not constitute financial, investment, or trading advice. Coindoo.com does not endorse or recommend any specific investment strategy or cryptocurrency. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions.

Source: https://coindoo.com/bitcoin-news-retail-traders-take-control-of-btc-futures-market/