- Stablecoin supply surges to a record $236.6 billion.

- Bitcoin leads the rally with a 10% weekly surge as the altcoins market cap surges by 16%.

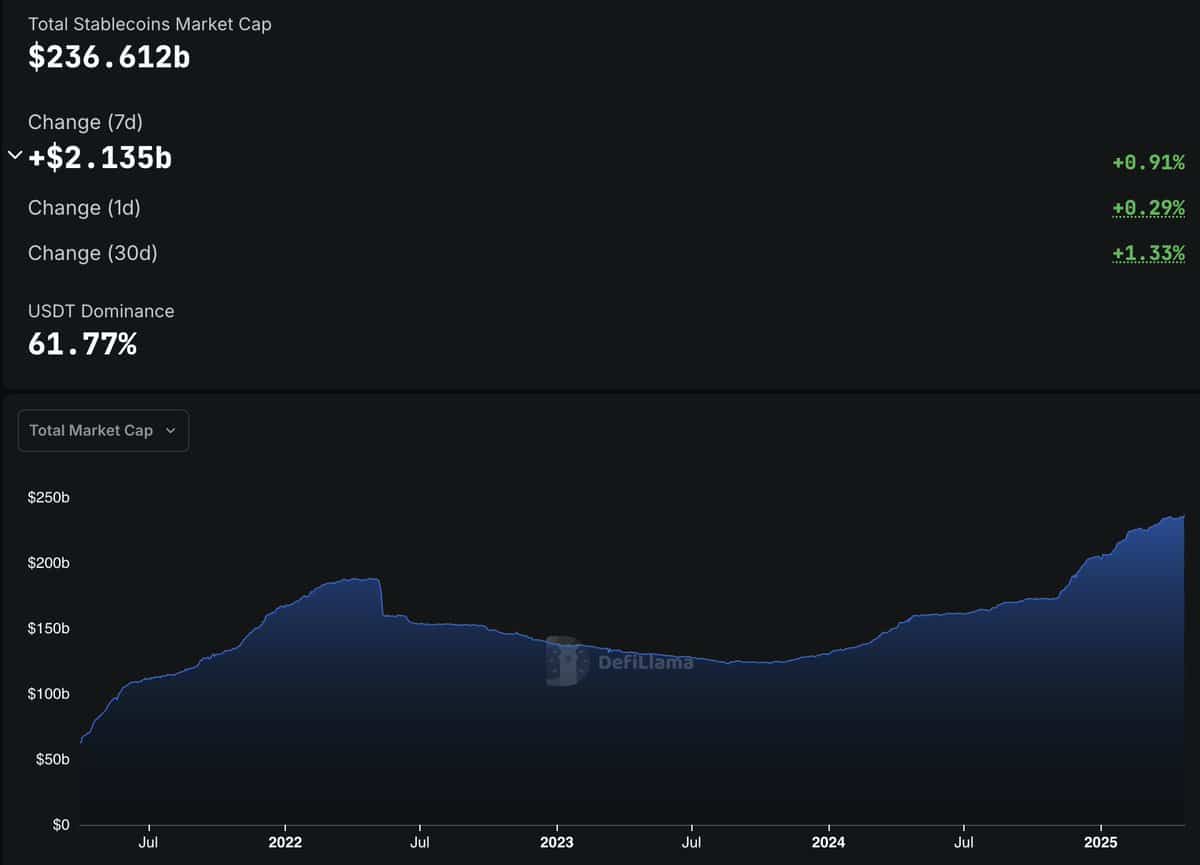

According to DefiLlama data, the total supply of stablecoins increased by $2.135 billion in the past week, bringing the cumulative supply to a record-breaking $236.6 billion.

The consistent inflow of stablecoins indicates rising liquidity, which can be seen as dry powder ready to enter risk assets like Bitcoin [BTC] and altcoins.

Historically, a rise in stablecoin supply has often preceded market rallies, as it reflects increased buying power on the altcoins and BTC.

Source: DeFiLlama

Bitcoin rallies 10% as bullish momentum holds

Bitcoin surged by 10% to $93K over the past week, driven by a strong rebound from a critical technical support zone.

Naturally, market sentiment around BTC stayed bullish, with participants now aiming for the $100K psychological milestone. This rally is not just technical, as the growing capital inflows have their leg in.

The inverse correlation between BTC and stablecoin supply also supports the view that more investors are diversifying their portfolios to take Bitcoin long positions.

Altcoin market follows BTC’s lead

The broader altcoin market has not been left behind. Since bouncing from a weekly demand zone, the total altcoin market cap surged by 16% on weekly charts.

At the time of writing, the total altcoin market cap, excluding Ethereum [ETH] and BTC, stood at $821 billion.

In fact, the heavy rebound mirrored Bitcoin’s strength and underlined the altcoin market’s reliance on BTC’s directional bias.

While altcoins may lag at first, they usually catch up once Bitcoin stabilizes or consolidates. The setup currently suggests that if BTC continues to carry momentum, a stronger altcoin season may be on the horizon.

Source: TradingView

Market sentiment turns bullish

With Bitcoin leading and stablecoin reserves at record levels, the overall market sentiment leans bullish. Market participants appear more positive, and capital rotation into crypto assets is picking up pace.

While Bitcoin charged toward $100K, altcoins appeared poised to ride the secondary wave.

Having said that, the interplay between stablecoin inflows, Bitcoin dominance, and altcoin activity would be critical in the coming weeks.

If the past cycle repeats, the current speed might mark the beginning of a broader altcoin rally—one that thrives under the shadow of Bitcoin’s dominance.

Source: https://ambcrypto.com/record-236b-stablecoins-pile-up-will-this-send-btc-toward-100k/