- Hedge fund legend Ray Dalio warns the US faces a “debt-induced economic heart attack” due to its debt

- He points to a $2T annual deficit and waning foreign demand for US treasuries as key risk factors

- Dalio sees hard assets with a limited supply, like Gold and Bitcoin, as “attractive alternatives”

Billionaire investor and hedge fund legend Ray Dalio has issued a stark warning about the U.S. economy, predicting a “debt-induced economic heart attack” fueled by unsustainable government spending.

In a detailed post refuting a Financial Times article, he laid out the case for why the U.S. debt crisis is reaching a critical stage and why assets like Gold and Bitcoin are becoming essential alternatives for investors.

$2 Trillion Deficit and a Supply-Demand Crisis

Dalio’s core argument is that the U.S. is “late in the big debt cycle,” and its fiscal situation is becoming untenable.

What are the numbers behind the debt crisis?

He points out that the Federal government is set to spend $7 trillion in the next year but will only raise $5 trillion in taxes. This leaves a $2 trillion deficit that must be financed by issuing more debt, pushing the national debt over $37 trillion and the debt-to-GDP ratio to nearly 120%.

Related: Debt, Deficits, and the Dollar: Why Bitcoin and Crypto Could Thrive Amid U.S. Fiscal Woes

Why is there a “supply and demand problem” for U.S. debt?

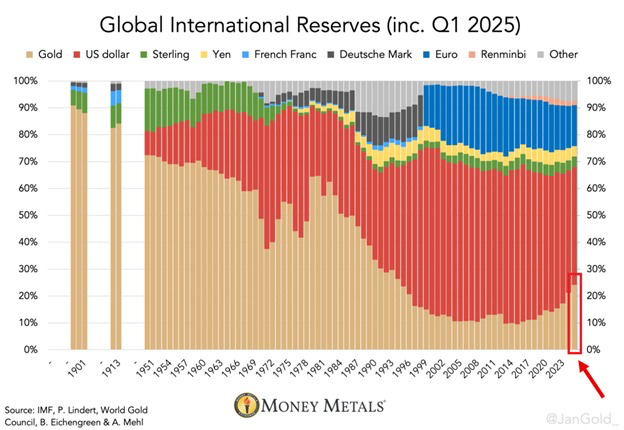

At the same time as the U.S. is issuing record amounts of debt, the largest foreign buyers are selling. Major holders of U.S. treasuries, like China and Japan, have been significantly reducing their holdings. This dwindling demand, combined with exploding supply, is the recipe for what Dalio calls the “economic heart attack.”

Why Dalio is Bullish on Gold and Crypto

With the value of government debt and fiat currencies at risk, Dalio points to two clear alternatives for investors seeking to preserve their wealth.

Why does Dalio see value in Gold and Bitcoin?

Dalio argues that hard assets with a limited supply, like Gold and Bitcoin, are becoming increasingly attractive as governments are forced to print more money to cover their debts.

He stated, “…if the supply of dollar money rises and/or the demand for it falls, that would likely make crypto an attractive alternative currency.”

This view is echoed by firms like JPMorgan, which have also pointed to Bitcoin as being undervalued relative to Gold.

Related: JPMorgan Says Bitcoin Is Undervalued, Sets $126K Fair Value vs. Gold

Can stablecoins help solve the problem?

Dalio notes an interesting exception: he believes that well-regulated stablecoins, which are often backed by U.S. treasuries, could actually increase the demand for U.S. debt from the crypto ecosystem, a view supported by the recently enacted GENIUS Act under the Trump administration.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/ray-dalio-warns-debt-crisis-points-to-bitcoin-as-alternative/