TLDR

- BTC struggles below ATH near $109,588 with selling pressure; support at $105K is being tested.

- ETH stalls at $2,738 resistance, showing signs of slowing momentum and potential short-term distribution.

- XRP faces bearish pressure, rejecting $2.65 and forming lower highs in a mid-term downtrend.

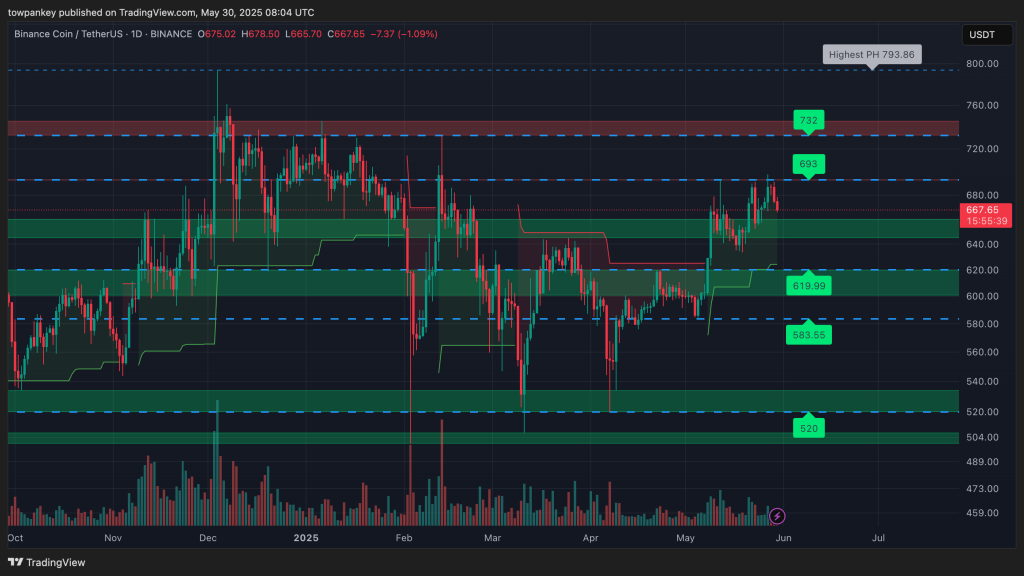

- BNB consolidates below $693, with volume spikes hinting at accumulation or temporary exhaustion.

- SOL pulls back from $180, testing $159 with red candles and increased sell volume indicating possible local top.

BTC shows signs of a pullback after reaching a new high, testing key support, while ETH stalls near resistance, and XRP faces bearish pressure amidst its downtrend.

BTC’s struggle near its ATH with selling pressure hints at a local top unless it surpasses $109,588. ETH’s hesitation beneath $2738 suggests weakening momentum. XRP’s rejection from $2.65 raises bearish concerns.

Bitcoin (BTC) Price Prediction

Bitcoin’s current price at $105,153.58 reflects a 24-hour decrease of 2.46%, with a market dominance of 63.06% and trading volume at $59,806,768,253, emphasizing market consolidation amid a 7-day decline of 5.03%.

BTC is in a broad uptrend, recently pulling back after making a new high at $109,588. It’s testing the upper boundary of a key resistance-turned-support zone near $105,000.

Recent candles show upper shadows and red bodies just below the ATH, signaling selling pressure and a possible local top. Volume remains moderate without signs of aggressive accumulation.

- Bullish: If price breaks and closes above $109,588, rally to $115,000 or higher is likely

- Bearish: If support at $99,475 breaks, BTC could retrace to $88,765

- Neutral: Consolidation likely between $105,000–$109,000 if volume remains flat

Ethereum (ETH) (Price Prediction

Ethereum saw a 4.11% dip in 24 hours, at $2,612.86, amid $24,520,084,421 in trading volume, 9.52% market dominance, and a 1.56% weekly decline with neutral momentum.

ETH is stalling beneath the $2738 resistance after a strong rally from $1537. The uptrend is still intact, but recent rejection near the supply zone signals short-term hesitation.

Bearish rejection wicks are forming near $2738 with decreasing bullish volume. This suggests weakening upward momentum and potential distribution below key resistance.

- Bullish: If price breaks above $2738, next leg could target $3437

- Bearish: If price loses $2104 support, expect retracement to $1537

- Neutral: Consolidation likely between $2600–$2738 if volume remains weak

XRP (XRP) Price Prediction

XRP witnesses a 24-hour price dip of 4.04%, trading at $2.19 with a significant 28.70% spike in volume to $3,361,497,703 and an overall 9.85% decline in the past week.

XRP remains in a mid-term downtrend, currently rejecting from the $2.65 supply zone and testing key support near $2.08. The structure shows consistently lower highs.

Strong red candles with lower wicks signal rejection attempts; recent drop on rising volume suggests bearish pressure gaining momentum below resistance.

BNB (BNB) Price Prediction

Despite a 24-hour price drop of 2.51% to $667.97, BNB‘s trading volume surged by 10.57%, reaching $2,026,471,247.69, with a recent weekly performance of -2.08% signalling potential continuation.

BNB is attempting a bullish continuation after reclaiming $620 and retesting above it. Price is consolidating below the key resistance at $693, within a potential accumulation before breakout.

Recent candles show long upper wicks and small bodies near resistance, implying seller absorption at $693. Volume spike during the last push suggests temporary exhaustion.

- Bullish: If price breaks and closes above $109,588, rally to $115,000 or higher is likely

- Bearish: If support at $99,475 breaks, BTC could retrace to $88,765

- Neutral: Consolidation likely between $105,000–$109,000 if volume remains flat

Solana (SOL) Price Prediction

Solana’s current price is at $162.63, a 24-hour price decrease of 5.50%, and a trading volume of $3,906,790,234 with a volume spike of 3.37%.

SOL is currently pulling back from the $180 resistance zone and testing the prior breakout level near $159. Price remains in a bullish recovery structure but shows signs of short-term weakness.

Recent red candles with strong closes and rising sell volume reflect a rejection near the supply zone and possible local top formation. Wicks show selling dominance.

- Bullish: If price breaks and closes above $109,588, rally to $115,000 or higher is likely

- Bearish: If support at $99,475 breaks, BTC could retrace to $88,765

- Neutral: Consolidation likely between $105,000–$109,000 if volume remains flat

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/340645-price-predictions-5-30-btc-eth-xrp-bnb-sol/