- Bitcoin trades near $122,000, consolidating after rejection at $124,000 while holding key $118K support.

- On-chain flows show $39.5M outflow, signaling light accumulation as traders balance profit-taking with long-term positioning.

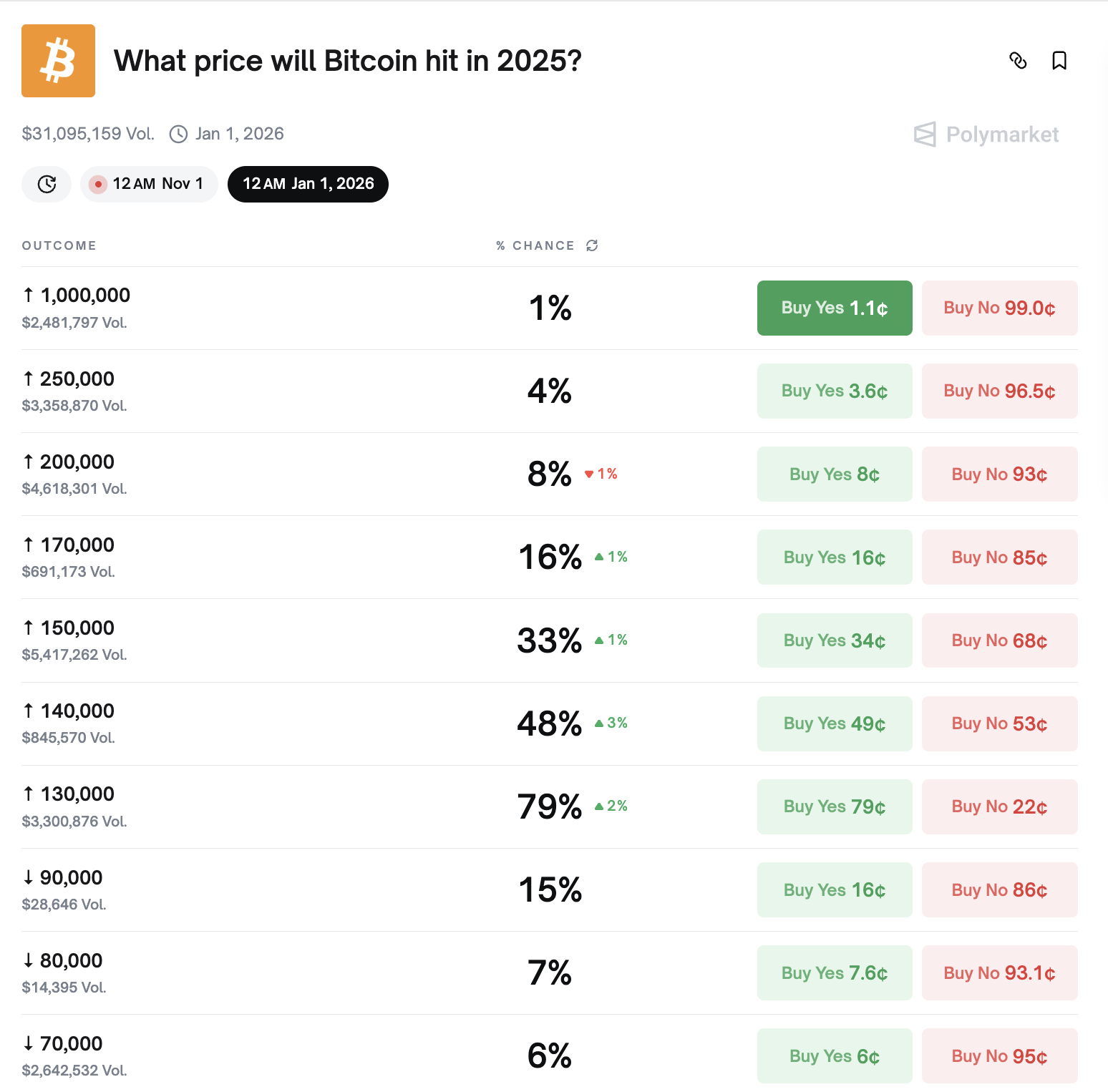

- Market sentiment lifted by David Marcus’ $1.3M Bitcoin forecast and Polymarket’s 79% odds for $130K this year.

Bitcoin price today trades around $122,000, slipping slightly after rejection at the $124,000 ceiling. The move follows a sharp rebound from $110,000, with buyers now defending the $118,000–$119,000 zone supported by the 20-day EMA.

Bitcoin Price Tests Resistance At $124,000

Bitcoin remains locked in a consolidation range after failing to clear resistance near $124,000. The chart shows a broad ascending structure, with the top of the channel aligned with this ceiling. Support sits at $118,587, while the next major defense levels are $116,000 and $113,500 along the 50- and 100-day EMAs.

A break above $124,000 would confirm bullish continuation toward $128,000–$130,000. RSI has cooled from overbought readings, and MACD lines are flattening, hinting at a pause before the next move.

On-Chain Data Shows Light Accumulation

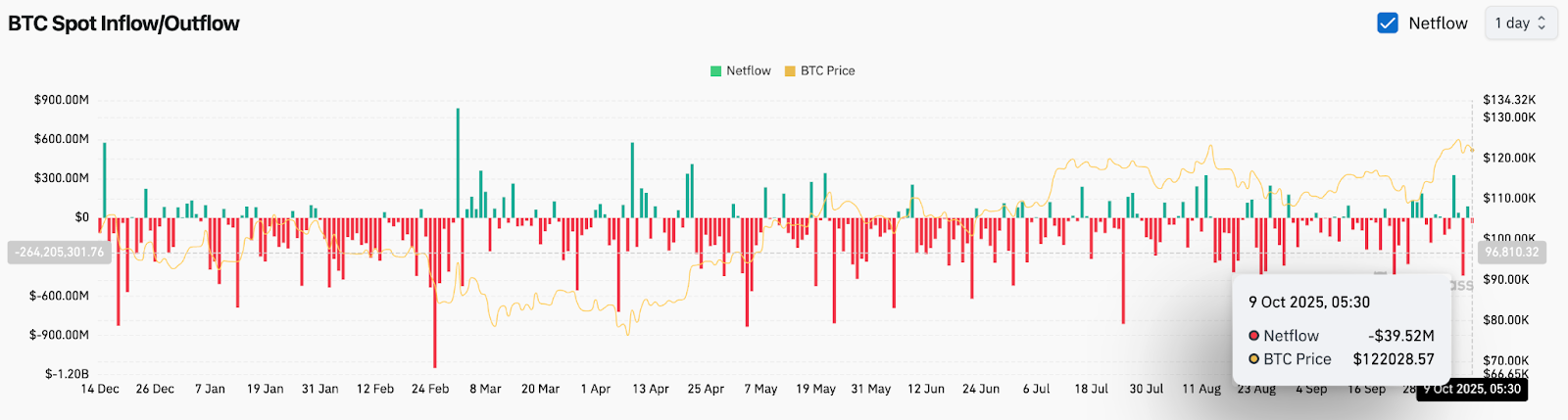

Coinglass data shows a $39.5 million net outflow on October 9, signaling light accumulation after a week of mixed activity. The current pace is far below the September highs when outflows exceeded $100 million, suggesting that short-term traders are taking profits while long-term holders continue to accumulate.

Related: PancakeSwap (CAKE) Price Prediction 2025–2030: Can Deflationary Tokenomics Drive Growth?

Despite reduced volume, Bitcoin price action remains stable above its breakout zone. Alternating inflows and outflows reflect a cautious market mood, but overall, supply leaving exchanges supports the medium-term bullish view.

Market Confidence Strengthened By Bold Predictions

Optimism surged after former PayPal president David Marcus predicted on Bloomberg that Bitcoin could reach $1.3 million, calling it “the internet of money.” His comments have fueled long-term confidence among fintech investors, reinforcing the narrative that institutional adoption remains in early stages.

Meanwhile, Polymarket data shows traders assigning a 79% probability of Bitcoin surpassing $130,000 by year-end, with 33% odds for $150,000 and rising speculative bets for $170,000. These probabilities mirror the conviction that the broader uptrend is intact even as price consolidates.

Outlook. Will Bitcoin Go Up?

The immediate question is whether buyers can reclaim $124,000 before momentum fades. Bitcoin price today is consolidating, with on-chain data still favoring outflows and long-term accumulation. Sentiment remains optimistic, driven by macro forecasts and institutional commentary.

Related: Dogecoin Price Prediction: DOGE Holds $0.25 as CleanCore Buys 710M Coins

If buyers defend $118,000, Bitcoin could retest $124,000 and break toward $130,000. Below $118,000, focus shifts to $113,000–$108,000. The market remains structurally bullish, with consolidation likely to precede another breakout attempt later this month.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/bitcoin-price-prediction-polymarket-and-ex-paypal-chief-see-1-3m-btc/