- Philippe Laffont highlights Bitcoin’s reduced volatility and rising legitimacy.

- Bitcoin gained nearly 13% so far in 2025.

- Institutional players like BlackRock push Bitcoin spot ETFs.

Philippe Laffont, founder of Coatue Management, discussed Bitcoin’s evolving role at the Coinbase Crypto State Summit in New York City, June 2025.

Bitcoin’s reduced volatility and institutional backing, including BlackRock’s push for spot ETFs, indicate a shift from speculative to mature investment asset.

Bitcoin’s Volatility Declines Alongside Institutional ETF Interest

Philippe Laffont of Coatue Management addressed the changing landscape for Bitcoin investments at the Coinbase Crypto State Summit. He pointed out Bitcoin’s past significant price fluctuations that deterred many investors. Nonetheless, the rise in institutional interest highlights a transformation. Laffont noted the narrowing Beta value of Bitcoin, which indicates decreased volatility and a more balanced risk profile. This change is crucial as it makes Bitcoin a more attractive component in mainstream portfolios.

BlackRock’s role as a pioneer in pushing for Bitcoin spot ETFs reflects this trend, illustrating a shift towards institutional acceptance. Additionally, the 14% drop in Bitcoin exchange balances signals increasing long-term holding behavior.

“What interests me is that perhaps… the cost of entering Bitcoin is becoming smaller. If its Beta value (measuring an asset’s volatility relative to the market) narrows, that would be very meaningful.” — Philippe Laffont, Founder, Coatue Management

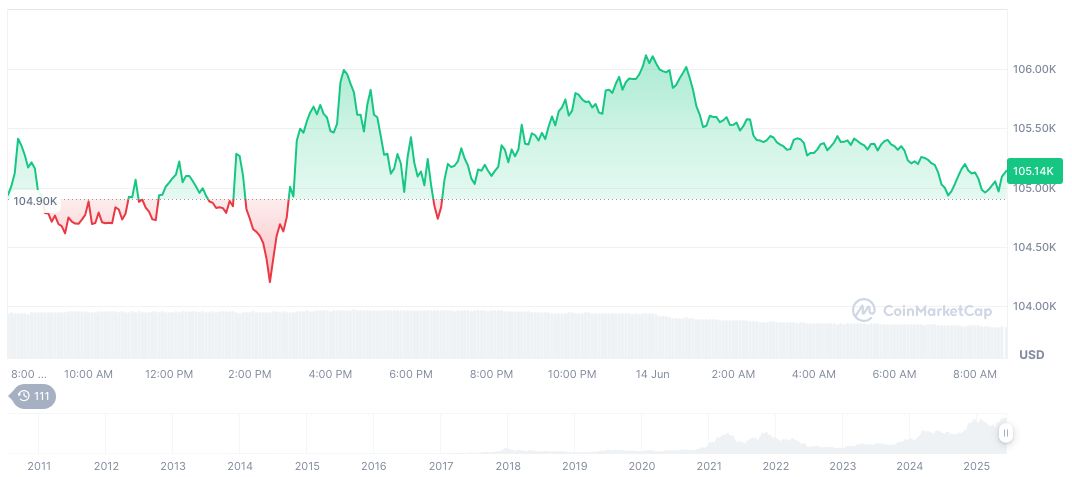

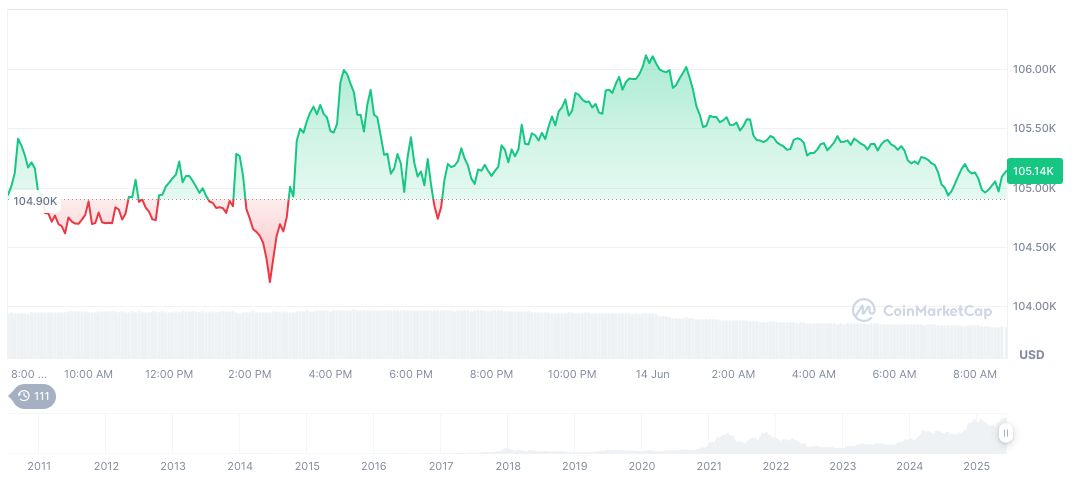

The broader market reactions have been substantial, with Bitcoin gaining close to 13% in 2025, nearing its all-time high. This reflects an improved sentiment among investors, underlined by major financial players expressing confidence in digital assets.

Bitcoin Approaches All-Time High as Market Cap Surges

Did you know? Bitcoin’s transition to a more stable asset mirrors previous cycles when features like ETF launches marked significant shifts toward mainstream financial acceptance.

Bitcoin (BTC) reached $104,465.45, a notable figure close to its all-time high. According to CoinMarketCap, Bitcoin’s market cap stands at 2.08 trillion, retaining a market dominance of 63.97%. Despite experiencing a 0.32% decline over 24 hours, Bitcoin has enjoyed a 24.50% increase over 90 days, reflecting strong interest and confidence in the asset’s potential.

Insights from the Coincu research team reveal that as Bitcoin’s volatility continues to decrease, its attractiveness to institutional investors strengthens. Regulatory advances, such as potential Bitcoin spot ETFs, may play a significant role in further solidifying Bitcoin’s status as a recognized portfolio asset. This could influence financial decisions and technological developments in the cryptocurrency sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/343313-bitcoin-volatility-mainstream-portfolios/