Renowned economist and BTC critic Peter Schiff has boldly claimed that Bitcoin is nothing like gold and went on to explain why he thinks so. His latest criticism of the flagship crypto comes amid JPMorgan’s prediction that BTC will outperform the precious metal.

Peter Schiff Says Bitcoin Is The Opposite Of Gold

In an X post, the market expert asserted that Bitcoin is nothing similar to gold despite BTC’s tagline as ‘digital gold.’ He explained that BTC rallied with other risk assets as investors’ recession and inflation fears subsided. As such, he believes that the flagship crypto isn’t a haven, unlike gold, which typically surges when macro fundamentals are negative.

However, contrary to Schiff’s theory, the BTC price surged even while tensions were still high between the US and China in the ongoing trade war. Prior to China revealing that trade negotiations would take place on May 10, the flagship crypto was already trading just below $100,000.

Schiff’s statement comes just as JPMorgan analysts predicted that Bitcoin will outperform gold in the second half of the year. They expect this to happen thanks to catalysts such as growing demand from institutional investors and the push by US states to create a Strategic Bitcoin Reserve. Firms like Strategy continue to accumulate BTC at an impressive pace.

JP Morgan analyst Nikolaos Panigirtzoglou said,

We expect the year-to-date zero-sum game between gold and Bitcoin to extend to the remainder of the year, but are biased towards crypto-specific catalysts creating more upside for Bitcoin over gold into the second half of the year

The Next Move For The BTC Price

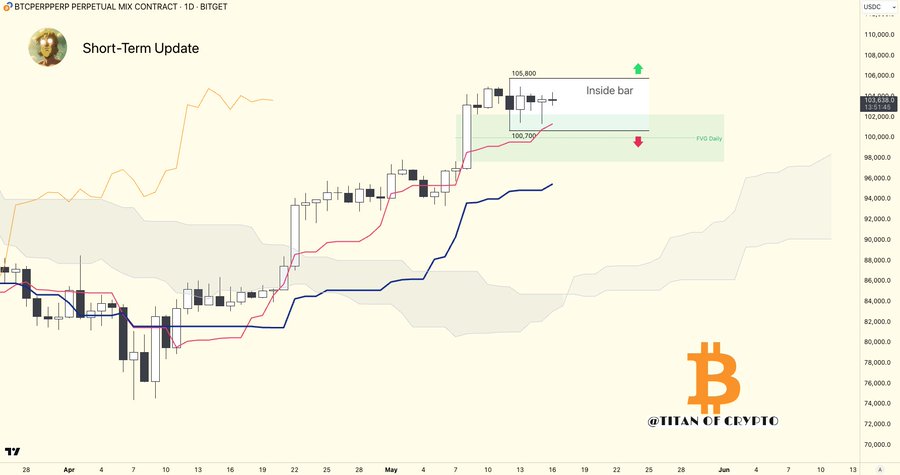

Crypto analyst Titan of Crypto stated that $125,000 is still in play for the Bitcoin price. He highlighted an inverse Head and Shoulders pattern on BTC’s chart, which is developing. Based on this, he asserted that the target remains valid.

In another update on the current price action, Titan of Crypto noted that BTC held strong, with great reaction from the daily Fair Value Gap at $100,000 despite calls for much lower prices. He added that the setup remains bullish as long as that zone holds.

In an X post, crypto analyst Ali Martinez stated that $98,732 is a major demand zone, where 1.19 million wallets accumulated over 1 million BTC. He also revealed that there has been a lot of profit-taking this week, with whales selling over 30,000 BTC in the last 72 hours.

However, while whales are selling, companies like Basel Medical Group are looking to gain exposure to Bitcoin. As CoinGape reported, the company announced plans to acquire $1 billion BTC for its Treasury reserves.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source: https://coingape.com/peter-schiff-claims-bitcoin-is-the-opposite-of-gold-amid-jpmorgans-bold-prediction/

✓ Share: