- Parataxis Holdings merges with SilverBox Corp IV to list on the NYSE.

- Plans to raise up to $640 million in capital.

- Immediate $31 million allocated for Bitcoin purchase.

Parataxis Holdings is set to merge with SilverBox Corp IV SPAC to list on the NYSE as ‘PRTX’, targeting $640 million for expanding its Bitcoin fund management strategy.

This merger signals a strategic push towards institutional Bitcoin adoption, potentially enhancing market interest and liquidity for Bitcoin as a reserve asset, mirroring MicroStrategy’s treasury approach.

Parataxis-SilverBox SPAC Merger Targets $640 Million

Parataxis Holdings combines with SilverBox Corp IV SPAC to launch a Bitcoin-focused firm on the NYSE. This aims to raise up to $640 million, with $31 million for direct Bitcoin acquisition. Key figures include Edward Chin, Parataxis CEO, who emphasizes institutional priorities, and Joe Reece, SBXD founding partner, praising the fund’s strategy.

The merger is a significant move in the crypto financial landscape, setting a precedent with Bitcoin as a treasury reserve asset. The transaction aims to enhance liquidity and institutional participation, focusing on the U.S. and South Korean markets.

Community and industry reactions are positive, with key stakeholders endorsing the fund’s potential. Edward Chin noted the strategic importance of Bitcoin, and analysts foresee greater institutional engagement in digital assets.

“The deal will enable the firm to be well-capitalized for executing a BTC treasury strategy in the United States, bolstered by the yield generation capabilities of an institutional asset manager.” – Edward Chin, Founder & CEO, Parataxis Holdings

Bitcoin Market Metrics Show Resilience Amid Mergers

Did you know? The use of SPAC structures for launching crypto-focused companies is rare; this merger places Parataxis alongside only a few in the industry, modeling after blockchain pioneer MicroStrategy’s treasury strategies.

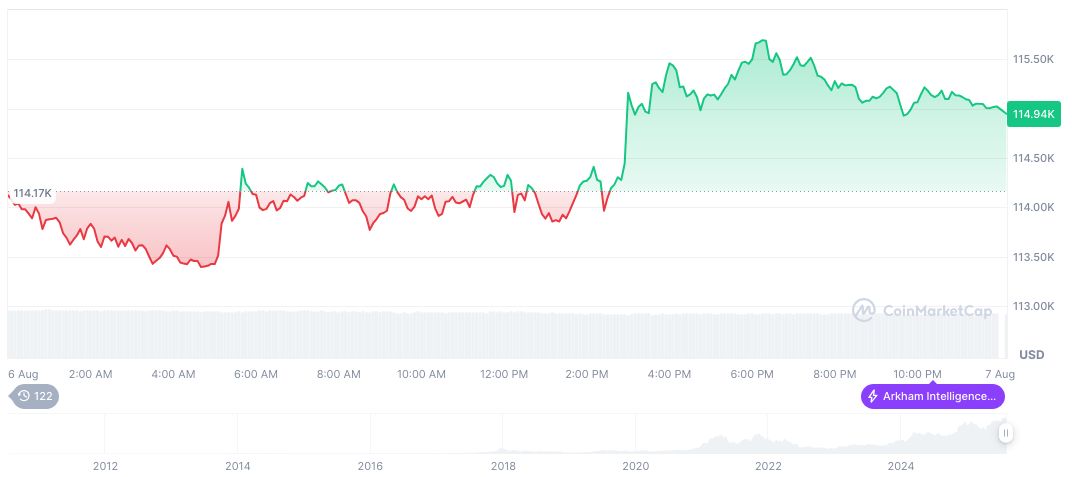

Bitcoin (BTC) maintains a robust market presence, boasting a price of $115,050.38 and a market cap of $2.29 trillion. The 24-hour trading volume is $54.59 billion with a slight downturn of 6.22%, as reported by CoinMarketCap. Recent changes show a 0.97% gain over 24 hours and an 11.06% rise over 90 days, indicating positive market movement.

Coincu research team suggests the Parataxis and SilverBox Corp setup could bolster Bitcoin’s role as a primary investment vehicle in digital assets. This merger may cement BTC’s standing in corporate finance, signaling new capital access methods across the cryptocurrency sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/parataxis-spac-bitcoin-fund-nyse/