Key Takeaways

Why is Bitcoin being called the new American Dream?

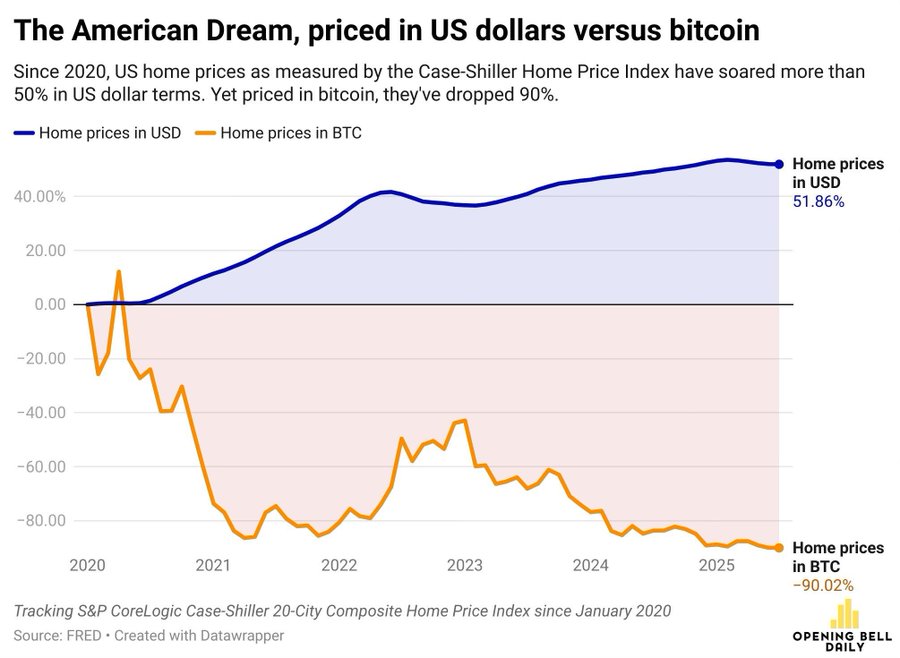

Home prices are up 50% since 2020 but down 90% in BTC terms, with BTC hitting a new ATH of $126K.

What’s driving BTC’s momentum?

Strong holder sentiment, renewed ETF inflows, and historical Q4 strength are fueling expectations.

Bitcoin [BTC] hit a new all-time high of $126,296 on 06 October. However, its real story isn’t about another record, it’s about what that record means.

As home prices rise and affordability declines, BTC’s surge is rewriting the definition of the American Dream. In an economy where owning a home has become unattainable for millions, holding BTC now offers the kind of financial freedom real estate once symbolized.

Homes soar in USD, collapse in BTC

According to the S&P CoreLogic Case-Shiller Home Price Index, U.S home prices have climbed by over 50% since 2020. However, Bitcoin’s value has risen more than 500% over the same period.

And yet, when home prices are measured in BTC, they’ve fallen by about 90% – Meaning that it takes far fewer Bitcoins to buy a home today than it did five years ago.

Source: X

In 2020, a typical U.S home cost around 40 BTC. Today, it costs fewer than 5 BTC.

Such a divergence highlights the growing wealth gap between traditional asset holders and crypto investors. It also means that Bitcoin, not real estate, may now be the more attainable “dream” for the digital generation.

BTC holders stay bullish at record highs

Analysis of TradingView data revealed that Bitcoin climbed to a high of $126,296, before consolidating above $125,000 at press time. This, on the back of bullish momentum building throughout late September.

Source: TradingView

The Holders’ Sentiment index, which recently flipped to positive (6.77), seemed to confirm growing investor confidence after weeks of neutral-to-bearish conditions at press time.

The strong rebound from the $110,000-zone, coupled with increasing volume, is evidence of renewed institutional inflows following ETF accumulation and broader market optimism. If momentum holds, Bitcoin could attempt a move towards the next resistance near $130,000–$135,000, marking the start of a new price discovery phase.

From bricks to bytes – Shifting the wealth paradigm

The idea that Bitcoin could replace homeownership as the foundation of financial security was once unthinkable. However, as housing affordability erodes and asset inflation widens generational divides, digital property has emerged as a modern alternative to physical real estate.

For millennials and Gen Z, Bitcoin offers liquidity, borderless ownership, and yield opportunities through financial products like ETFs and staking derivatives — Features that real estate cannot match in an era of high interest rates and declining purchasing power.

Analysts eye strong Q4 performance

As Bitcoin enters the final quarter of 2025, market analysts remain broadly bullish. In fact, historical data suggests that Q4 has consistently been Bitcoin’s strongest stretch, with October and November delivering some of the highest average monthly returns in previous cycles.

Source: X

While some traders are anticipating a cooling period after the ongoing rally, others believe that BTC could hit $150,000–$180,000 by year-end if institutional momentum continues.

Source: X

Source: https://ambcrypto.com/owning-bitcoin-not-a-home-is-the-real-american-dream-after-btc-hits-126k/