- Inspired by Casey Rodarmor’s Ordinals Protocol, the ORDI token dropped by over 14% on Jan. 23 to a new monthly low as Bitcoin plunged below $40,000.

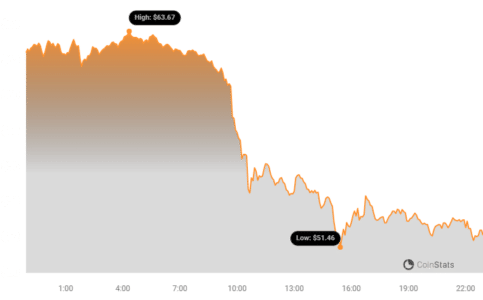

Bitcoin-centric cryptocurrency ORDI dropped below $52.33 for the first time since December last year, thanks to a broad market downturn seemingly caused by spot BTC ETF outflows.

Speculations suggest that ORDI’s nosedive is due to Bitcoin’s (BTC) price movement amid a sweeping dip in the cryptocurrency markets and daily outflows from Grayscale spot Bitcoin ETF, the biggest and most liquid BTC-focused fund approved for trading on Jan. 10.

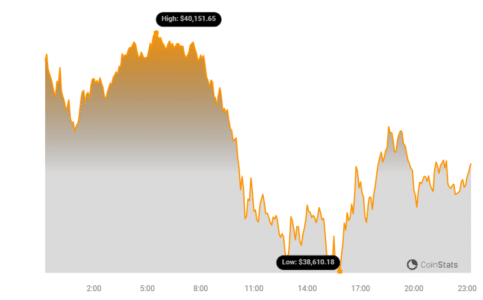

This decline occurred hours after crypto’s largest token retraced under $40,000 less than two weeks following a decision to allow spot BTC ETFs from the United States Securities and Exchange Commission (SEC).

Outflows from Grayscale’s ETF resulted in sell pressure on Bitcoin’s price, as the asset manager must liquidate actual BTC to support redemptions and enable traders to book profits.

See Also: LUNC Price Drops As Crypto.com Announced Plan To Delist LUNC

According to a close report, Grayscale offloaded over $2.1 billion worth of BTC since the SEC’s approval announcement and recorded $2 billion in exits from its funds.

Around half was attributed to bankrupt crypto exchange FTX, which recently dismissed a lawsuit against Grayscale and parent company Digital Currency Group.

In that same period, Bitcoin plunged more than 20% and is down 10% this month as the token traded for $39,218.17at press time.

While Grayscale’s ETF is currently the largest with a market cap north of $20 billion and a BTC portfolio of 558,280 Bitcoins, issuers from BlackRock to Franklin Templeton have each increased BTC holdings since the ETFs officially launched on Jan. 11.

According to Arkham Intelligence, BlackRock, Bitwise, Fidelity, and Franklin Templeton now command over 80,000 BTC worth nearly $5 billion.

LATEST: The Great GBTC Gouge hit record -$640m on Monday, the Nine did their best to offset but fell short w/ a $553m haul. ROLLING NET FLOWS still healthy at +$1b but ongoing battle. The Nine now have a 20% share vs GBTC. Volume also remains very high for new launches in 2nd wk pic.twitter.com/ng0BU8mi6L

— Eric Balchunas (@EricBalchunas) January 23, 2024

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Source: https://bitcoinworld.co.in/ordi-dropped-15-after-bitcoin-plunged-below-40k/