The recent Bitcoin price action has sparked mixed reactions among investors, but on-chain metrics suggest the market still has room to grow.

Bitcoin hit an all-time high of $109,110 this week but has since dropped to $101,257. While it has rebounded, the repeated cycle of fluctuations and recoveries continues to create uncertainty among market participants about the current bull season. Some have even suggested that the market top may be in.

However, Bitcoin’s on-chain data indicates that there’s still potential for growth before it enters overbought territory.

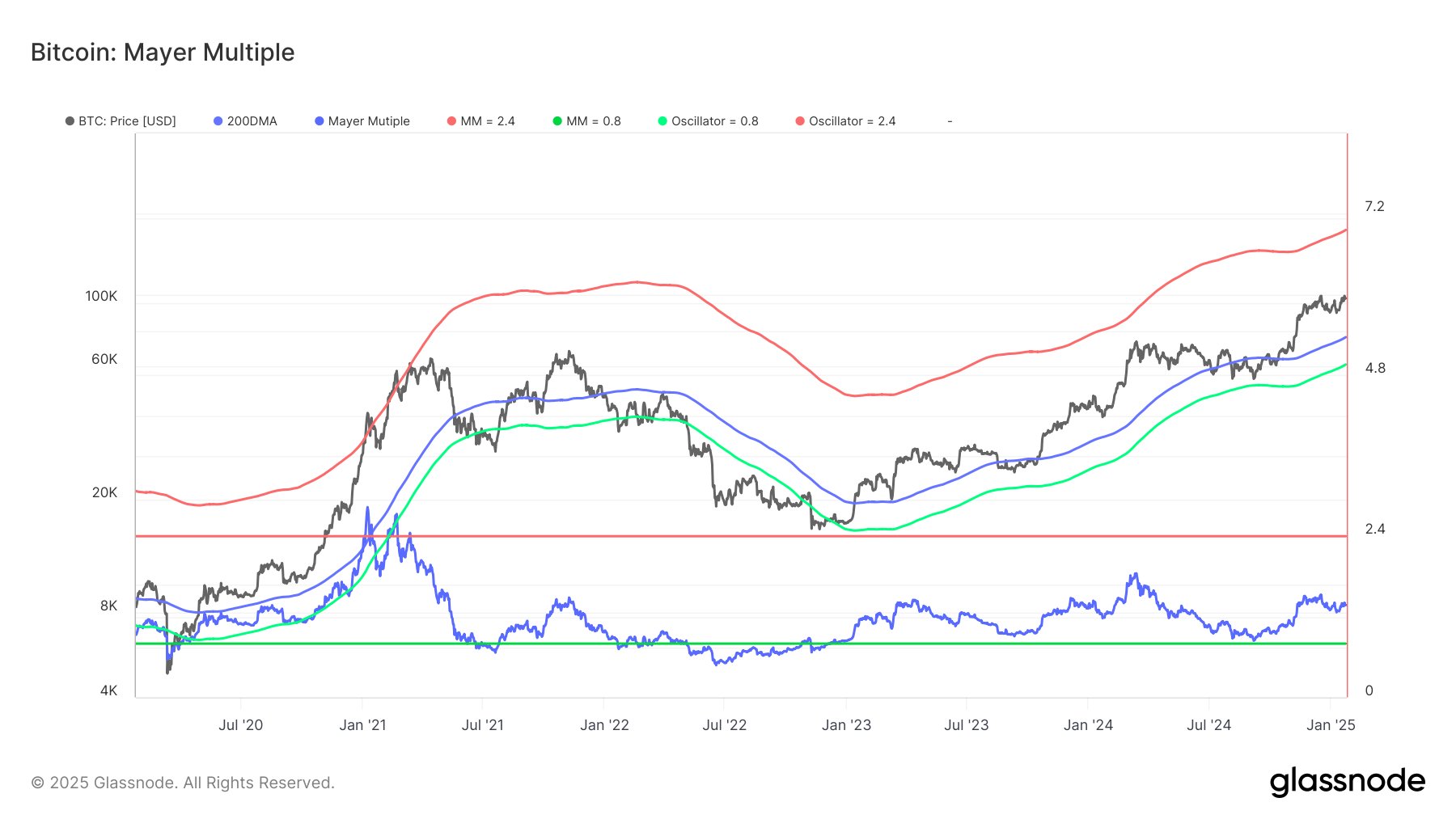

Specifically, the Mayer Multiple (MM), a key indicator for assessing Bitcoin’s price relative to its 200-day moving average (200DMA), presents important insights into the current bull market trajectory.

Understanding the Bitcoin Mayer Multiple

The Mayer Multiple is calculated by dividing Bitcoin’s price by its 200DMA and has historically been used to identify key moments in Bitcoin’s market cycles. MM values above 2.4 signal overbought conditions, while values below 0.8 indicate oversold levels.

According to the analytics platform Glassnode, these metrics have proven reliable indicators of price extremes, helping investors navigate macro trends.

Currently, Glassnode’s data shows Bitcoin’s Mayer Multiple at 1.37. This means that while its price is 37% above its 200DMA, it is still well below the overbought threshold.

Notably, Bitcoin will enter the overbought zone when its price exceeds $181K—nearly 74% higher than its current price of $104K.

Room for Bitcoin to Rally to $181K

Essentially, despite Bitcoin trading above $100K, its uptrend remains far from overheating.

Notably, Bitcoin’s oversold threshold is at $60K, providing a safety margin in the event of a market correction. For context, reaching this level would require Bitcoin’s value to drop by 42% from its current price.

Additionally, the MM’s neutrality at 1.0 aligns with a $75K price, indicating a strong support level for the ongoing rally.

With the overbought threshold still distant, investors remain optimistic about Bitcoin’s ability to scale new heights in the months ahead. An earlier analysis by The Crypto Basic suggests the market still has a window of up to 250 days before the bull market may officially come to an end.

Ultimately, technical data points to the Bitcoin bull market remaining intact, with $181K serving as the next key milestone for investors to watch.

DisClamier: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

Source: https://thecryptobasic.com/2025/01/24/on-chain-data-shows-bitcoin-has-74-room-to-grow-before-entering-overbought-territory/?utm_source=rss&utm_medium=rss&utm_campaign=on-chain-data-shows-bitcoin-has-74-room-to-grow-before-entering-overbought-territory