- A 2012-era Bitcoin whale resurfaces, moving $35.8 million in BTC.

- Early adopters’ movements highlight their enduring influence on market dynamics.

A Bitcoin [BTC] whale from Satoshi Nakamoto-era has reemerged, creating major buzz within the community. The wallet, which remained dormant for over a decade, holds an impressive 400 BTC – worth just $2,091 at the time of acquisition.

This raises questions about the motives and implications of such moves by early adopters, whose holdings date back to the era when Bitcoin’s enigmatic creator, Satoshi Nakamoto, was still active.

Satoshi Nakamoto era BTC whale resurfaces

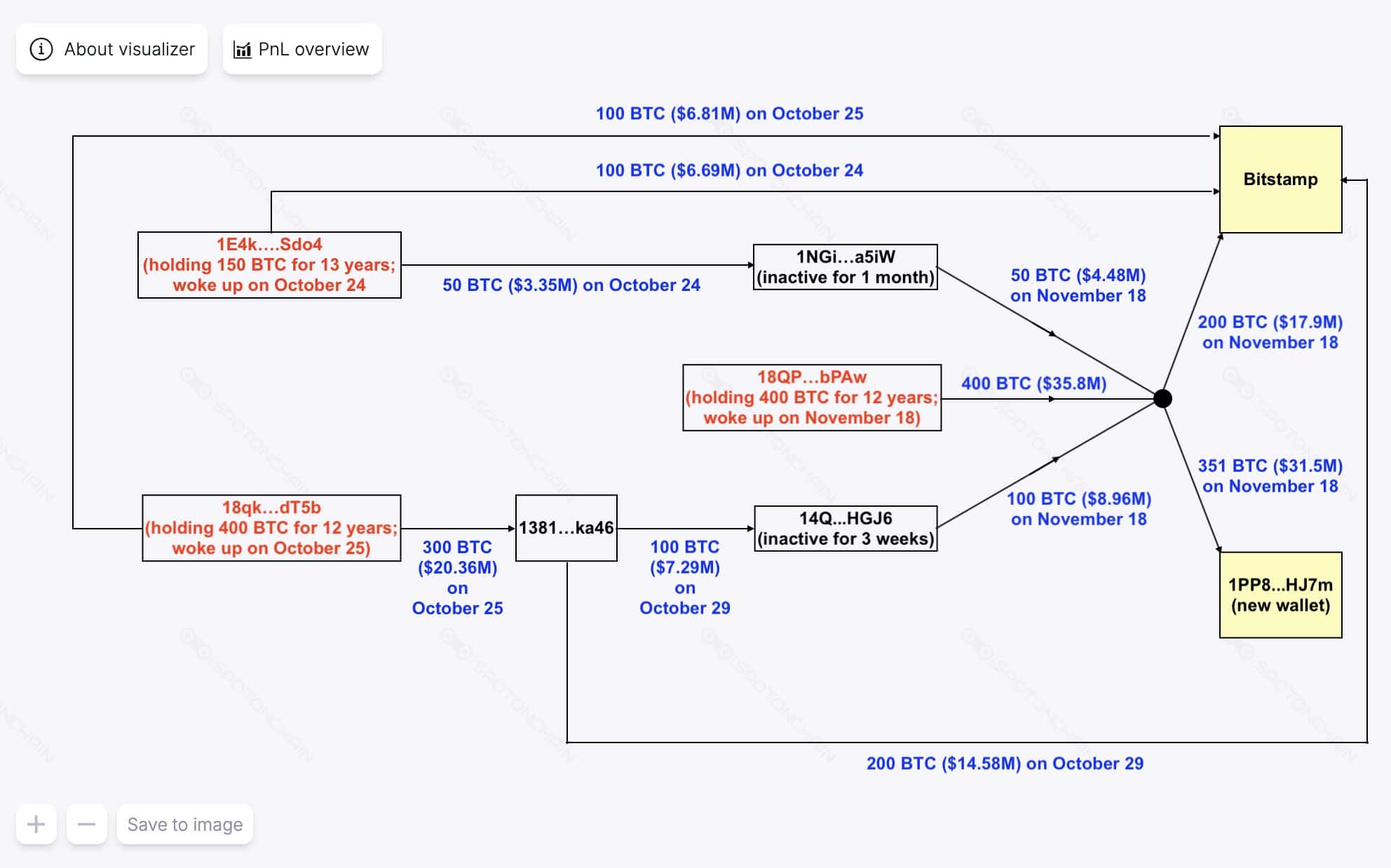

According to Spot On Chain, a dormant Bitcoin whale moved 400 BTC, currently valued at $35.8 million. The entity originally acquired the holdings for just $2,091, realizing an astronomical profit of 1,712,099%.

On-chain analytics reveal that the whale deposited 200 BTC (worth $17.9 million) into Bitstamp, one of the oldest cryptocurrency exchanges, while transferring 351 BTC ($31.5 million) to a new wallet.

Source: X

This wallet, inactive for over a decade, dates back to Bitcoin’s early days when its creator, Satoshi Nakamoto, was still active online. The activity is part of a growing trend of early Bitcoin adopters resurfacing and repositioning their holdings.

Early adopters like these played a pivotal role in Bitcoin’s growth by driving its adoption and securing the network in its nascent stages. Their reemergence now brings intrigue and potential volatility to the modern market.

Dormant wallet movements spark market vigilance

Market reactions to movements from long-dormant wallets are typically marked by heightened scrutiny and mixed sentiment. Large transfers to exchanges, such as the 200 BTC deposited into Bitstamp, often raise concerns about potential sell-offs, which could temporarily pressure Bitcoin’s price.

However, BTC’s price has shown resilience, with strong demand absorbing these inflows. It has also been noted that when significant portions – 351 BTC in this case – are moved to private wallets, it may signal continued long-term holding rather than an intent to liquidate.

These activities often trigger spikes in on-chain metrics like transaction volume and wallet activity, reflecting the market’s vigilance toward such movements.

Sell-off risk vs strategic holding

When dormant whales move assets, two primary scenarios emerge. A large-scale sell-off can inject significant supply into the market, potentially driving down prices if demand fails to match. However, such events are less likely in strong markets where institutional demand and liquidity remain robust.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Conversely, transfers to new wallets often signal strategic repositioning or preparation for long-term holding, reflecting confidence in Bitcoin’s future value. This duality underscores the uncertainty tied to whale activity – markets must weigh immediate selling pressures against the possibility of continued accumulation.

In either case, these movements by early adopters reinforce their capacity to influence market trends and investor sentiment significantly.

Source: https://ambcrypto.com/old-bitcoin-new-moves-all-about-satoshi-nakamoto-era-whales-35-8m-transfer/