- Norges Bank Investment Management’s Bitcoin exposure rose 83% in Q2 2025.

- Primarily achieved through investments in Strategy and Metaplanet.

- Signals institutional confidence without direct market impact.

Norges Bank Investment Management’s Bitcoin exposure soared by 83% in Q2 2025, primarily through increased stakes in Strategy shares, without impacting the BTC spot price.

This move highlights expanding institutional interest in Bitcoin as a hedge, reflecting broader investment trends despite regulatory caution.

Norges Bank’s Bitcoin Exposure Surges 83% in Q2 2025

Norges Bank Investment Management, the world’s largest sovereign wealth fund, augmented its Bitcoin exposure by 83% in Q2 2025. This was chiefly facilitated by acquiring additional shares in Strategy (formerly MicroStrategy), bolstering the crypto sector’s stature through indirect allocations.

No direct commentary or public disclosure has been issued by NBIM or Strategy’s executive management concerning this increased exposure. Market analysts indicate this approach mirrors a broader institutional trend of using equities rather than spot acquisitions to manage risk,

Reactions from industry stakeholders remain speculative as no significant public statements from the major entities involved were recorded. However, this notable change in holdings could resonate within institutional circles, potentially encouraging further indirect investments.

Conservative Strategy Reflects Institutional Caution in Crypto

Did you know? Despite the 83% increase in holdings, Norges Bank’s exposure to Bitcoin remains indirect, showcasing a continued preference among sovereign funds for crypto-linked equities over direct holdings.

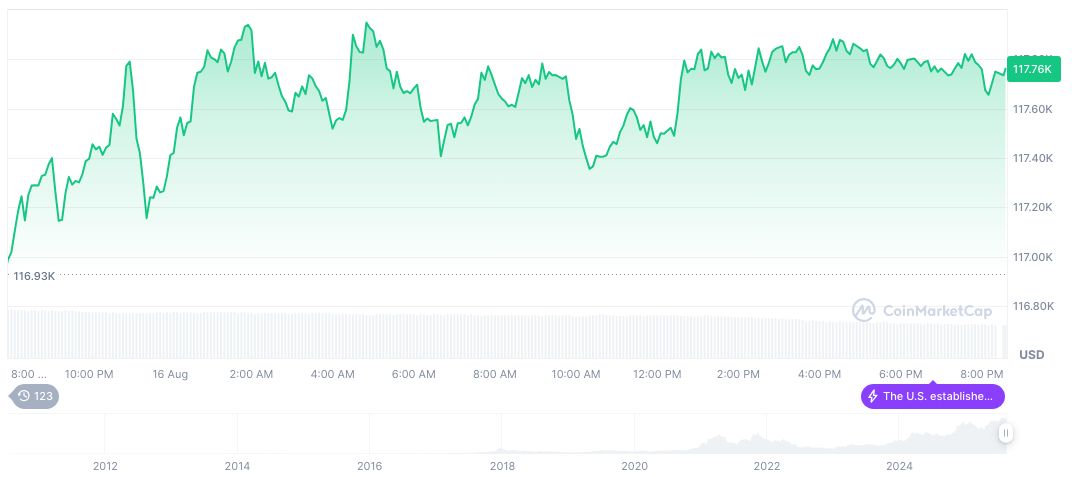

Bitcoin currently trades at $117,341.94, with a market cap of $2.34 trillion and a dominance of 58.86%. Over the past 90 days, Bitcoin’s price experienced an 11.38% increase, according to CoinMarketCap.

According to the Coincu research team, the strategy of obtaining Bitcoin exposure through corporate equities like Strategy reflects a conservative approach prevalent among institutional players. Such tactics are likely shaped by evolving regulatory landscapes and technological adoption, offering stable returns while mitigating direct crypto volatility.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/norwegian-fund-bitcoin-q2-increase/