- Nordea Bank announces Bitcoin-linked ETP trading.

- Reflects a shift due to a mature regulatory environment.

- Increased institutional participation expected in crypto.

Nordea Bank Abp, one of the largest Nordic financial institutions, announced it is now allowing customers to trade Bitcoin-linked exchange-traded products amid a maturing market.

This marks a significant shift in Nordea’s strategy, reflecting broader acceptance and regulatory confidence in cryptocurrency markets.

Market Implications and Expert Analysis

Nordea Bank has broken from its previous conservative stance by enabling Bitcoin-linked ETPs on its trading platform, a decision influenced by a more mature regulatory environment. This marks a first for the bank, having maintained a cautious approach to cryptocurrencies until now.

The bank’s decision will allow customers to engage with Bitcoin-linked products, although Nordea emphasizes it will not provide any investment advice related to these offerings. Demand for virtual currencies has been cited as a key factor in this decision.

“As the European regulatory environment for cryptocurrencies has matured and the demand for virtual currencies and cryptocurrencies is growing across the Nordics, Nordea has decided to allow customers to trade in a crypto-linked product on its platforms.” – Frank Vang-Jensen, President and Group CEO, Nordea Bank

Market Data

Did you know? Nordea Bank’s decision to offer Bitcoin ETP trading echoes similar developments in Swiss and German banks from 2021–2023, which led to increased access and spikes in ETP trading volumes.

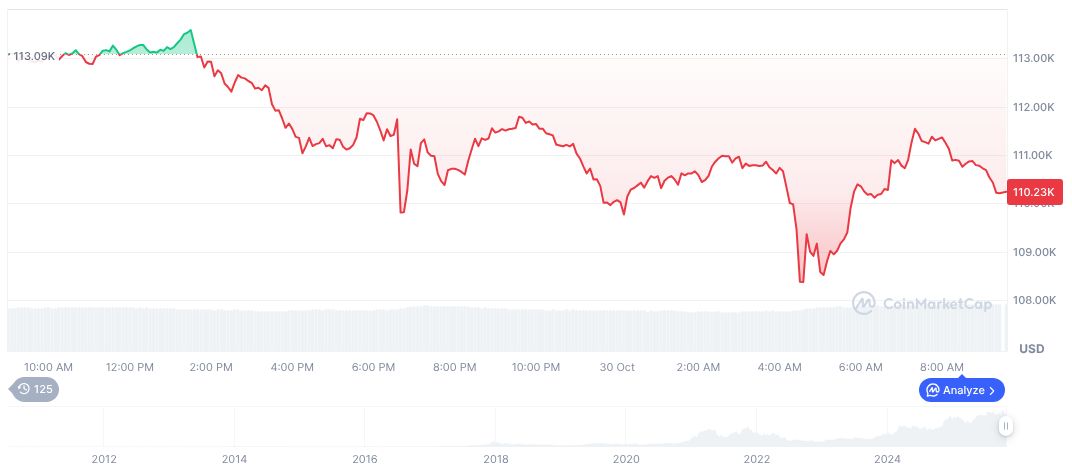

Bitcoin (BTC), priced currently at $107797.13, maintains a market cap of $2.15 trillion and a market dominance of 59.08%. Its 24-hour trading volume reached $76.31 billion, reflecting a 23.24% shift. BTC price has fluctuated, showing a 3.84% decrease over 24 hours and a 6.09% drop over 90 days, based on CoinMarketCap data.

Expert insights suggest that Nordea’s move could pave the way for increased institutional participation in the crypto space. This integration of Bitcoin ETPs into traditional financial products may drive further acceptance and utilization of cryptocurrencies in regulated markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/nordea-bank-bitcoin-etp-trading/