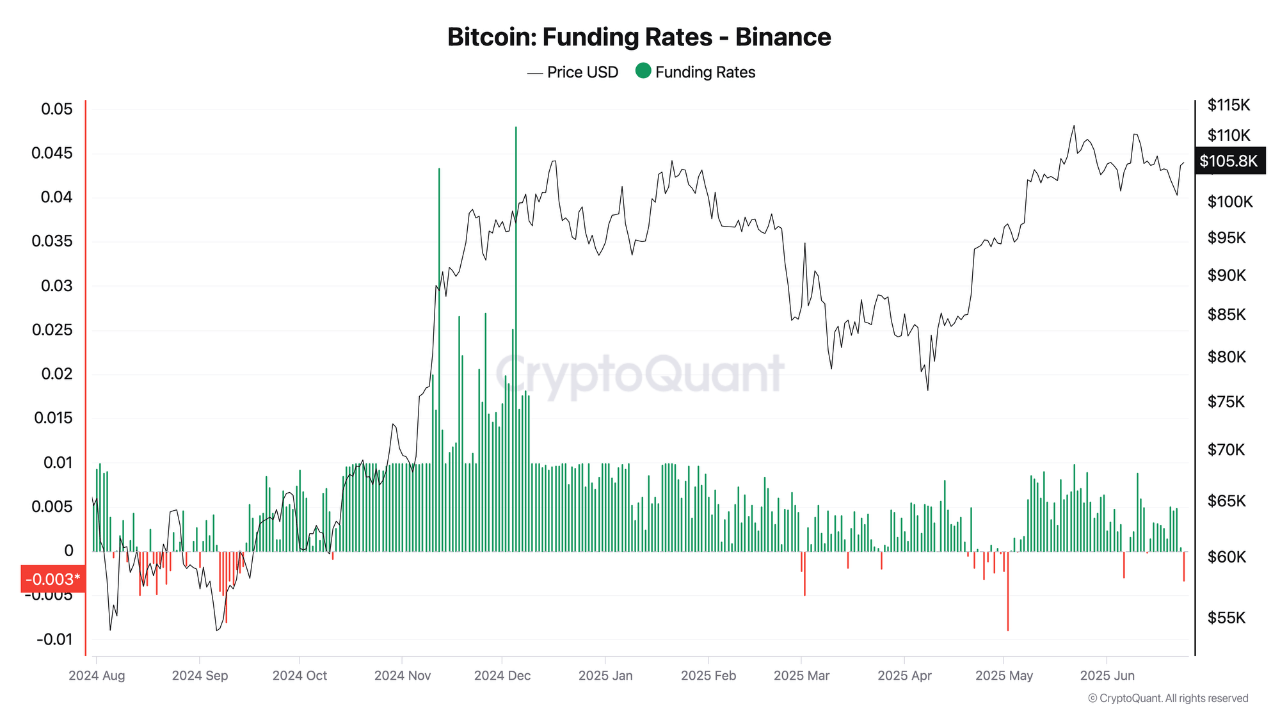

A new, shared by CryptoQuant highlights an intriguing shift in Binance funding rates, suggesting that Bitcoin’s recent bounce could extend further—precisely because many traders are betting against it.

As of this week, funding rates on Binance have turned noticeably negative at -0.0033, right after Bitcoin sharply rebounded from last weekend’s lows. This means the majority of open positions are short, as traders appear skeptical that the rally can hold.

“While this might look bearish at first glance, the market often moves against the crowd—especially when the short side gets overcrowded,” the report explains.

Traders Are Usually Biased Toward Longs—So This Shift Matters

CryptoQuant’s analyst notes that traders generally lean bullish by nature, preferring to long Bitcoin. That’s what makes this funding flip particularly noteworthy.

The current negative rates suggest a strong contrarian signal, with many betting against the rally despite recent price strength.

Historical Patterns Show Market Moves Against the Shorts

The report references similar setups from September 2024, when Binance funding rates dipped into negative territory. In nearly every case, the market moved higher shortly after, defying the bearish positioning. The only exception came during a brief period of macro disruption tied to new U.S. tariff announcements.

If history repeats, today’s positioning could act as rocket fuel for Bitcoin, especially if more short positions pile on. As the squeeze builds, short liquidations could help accelerate the upside in the coming days.

Source: https://coindoo.com/negative-binance-funding-rates-may-signal-a-bitcoin-rebound/