Key Takeaways

Why did Bitcoin see increased volatility in the past 24 hours?

The price of Bitcoin dipped by 3% over the past day due to selling from long-term holders and a short pullback before the FOMC meeting.

Why is the $110k support vital?

It was the realized price for the 3-6 month age band, and this realized price was being retested for the third time in ten days.

Over the past 30 days, long-term holders (LTHs) have shed 325,600 Bitcoin [BTC], noted crypto analyst Maartun.

In a post on X (formerly Twitter), the analyst revealed that this was the sharpest monthly drawdown since July 2025.

Source: Maartun on X

The selling pressure from long-term holders was not what investors would be hoping for after the liquidation event of the 10th of October.

A recent AMBCrypto report showed that 270k Bitcoin, which had been dormant for 7+ years, had moved in 2025.

This was likely driven mostly by profit-taking activity from LTHs. Some movement was also possible for security purposes or internal reorganizations.

With BTC prices above the $100k psychological level since the 24th of June, a run of 128 days, the profit-taking tendency revealed weakened LTH bullish conviction.

Source: Maartun on X

Analyst Maartun observed a flurry of movement from coins dormant for 3-5 years, which was the third such spike in just the past two days. In the most recent uptick, 4.7k BTC were moved.

Will this sustained selling force Bitcoin into a downtrend?

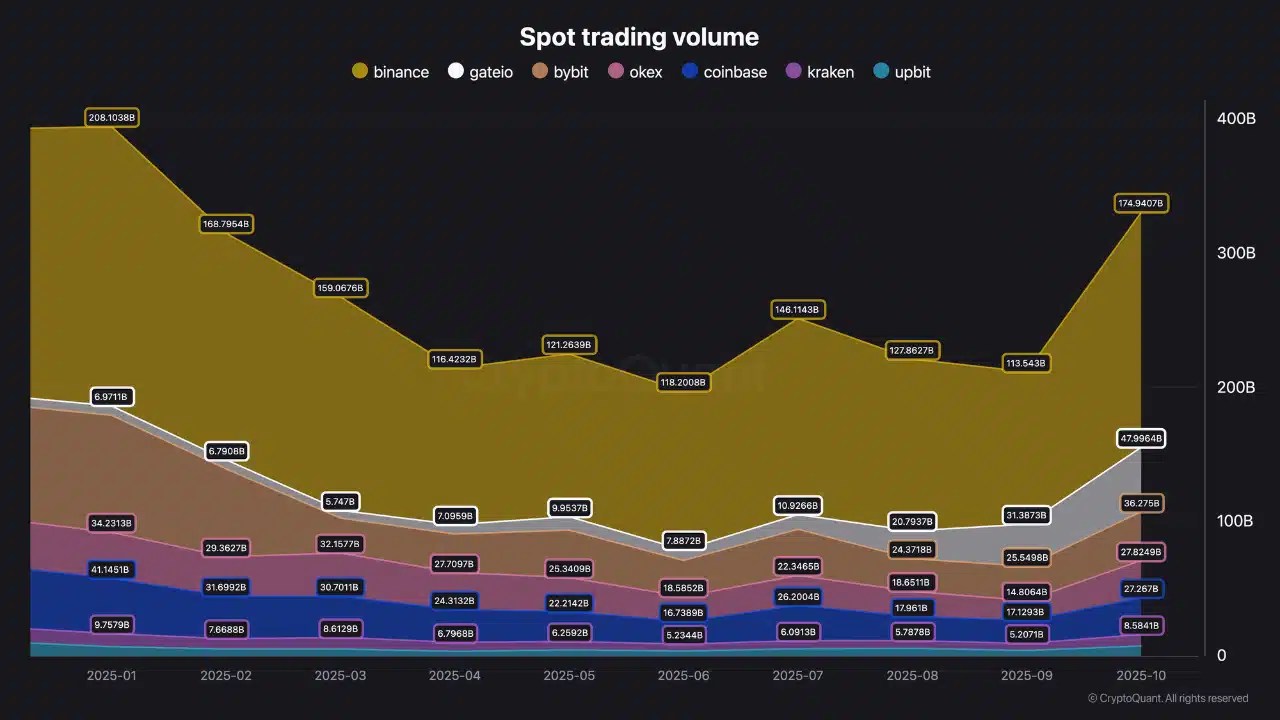

Source: CryptoQuant

In a CryptoQuant Insights post, analyst Darkfost pointed to the increased spot trading volume as a sign of market health.

After the violent deleveraging earlier in October, an increased spot trading volume was a welcome sign that investors see leverage as risky.

A spot-driven rally would be stronger and less volatile than one that pulls in a lot of speculative interest and high Open Interest.

The build-up of liquidation levels around the price would induce liquidity hunts and higher volatility.

However, given the range-bound price action of Bitcoin, market participants must remember that high spot volume does not automatically equate to buyer dominance.

Source: CryptoQuant

At the time of writing, Bitcoin was testing the realized price of $110.1k (cyan) for the 3-6 month age band. This was a critical support level, and has already been tested twice before within the past ten days.

A price move below $110k by the Thursday daily session close would be an alarming short-term signal.

The next realized price support (yellow), for investors who bought and held BTC in the past 6–12 months, is at $93.3k. This marked it as an important on-chain support level to watch.

Source: https://ambcrypto.com/navigating-bitcoins-price-drop-what-next-after-a-3-slump-in-24-hours/