- Mubadala raises stake in BlackRock Bitcoin ETF amid US-UAE talks.

- Investment reflects confidence in cryptocurrency assets.

- Bitcoin’s rise reinforces institutional interest in crypto.

Abu Dhabi’s Mubadala, a prominent sovereign wealth fund, has expanded its holdings in BlackRock’s spot Bitcoin ETF to 8.727 million shares, valued at approximately $408.5 million, according to a recent 13F SEC filing.

This investment arguably signifies Mubadala’s growing confidence in cryptocurrency as an asset. It aligns with ongoing discussions between US and UAE officials regarding digital currency policies.

Mubadala Expands Bitcoin Holdings Amid Market Surge

Mubadala’s decision to increase its shares in BlackRock’s spot Bitcoin ETF (IBIT) underscores its strategic approach to digital assets. The recent 13F SEC filing reports 8.727 million shares, an increase from December 2024. Mubadala remains committed to diversifying its investment portfolio.

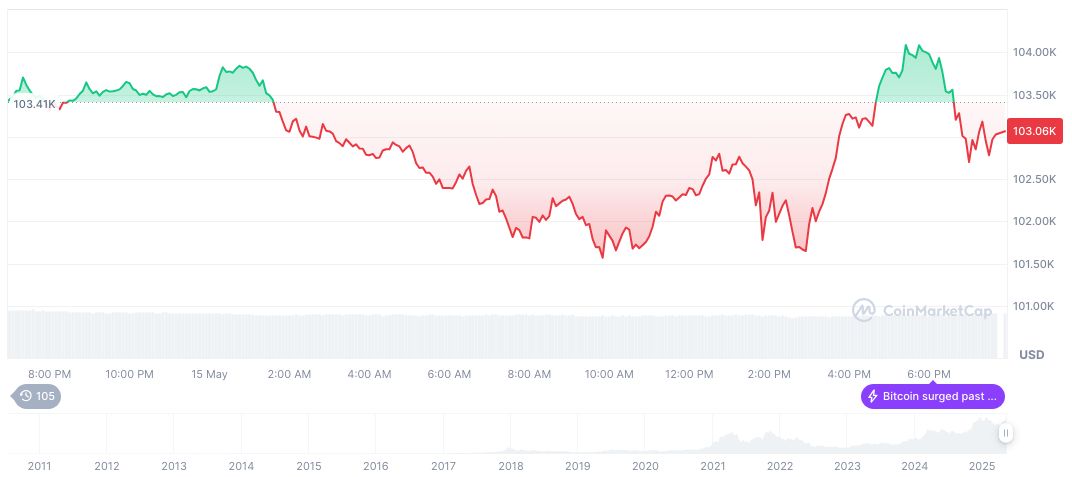

Bitcoin’s strengthening price has caught attention. It surged over the past year, rising 86%, as reported by CoinMarketCap. The continued rise in value led to Mubadala increasing its stake, reflecting institutional confidence in digital currencies amid heightened global discussions. “With Bitcoin’s price surging over 86% recently, Mubadala’s strategy seems well-timed, reflecting an evolving attitude toward digital assets,” remarked a Financial Analyst at CoinDesk.

David Sacks’ meeting with UAE officials on March 20 further underlines the importance of a collaborative approach. While institutional investors embrace cryptocurrency, Wisconsin’s divestment from IBIT adds contrasting views to the narrative.

Bitcoin Hits $100K, Institutional Investments Climb

Did you know? Bitcoin was created in 2009 and has since grown to become a major asset class, influencing global financial markets.

As of May 16, 2025, Bitcoin (BTC) holds a price of $103,927.13, with a market capitalization of $2.06 trillion and a market dominance of 62.34%. CoinMarketCap notes a 24-hour trading volume increase of 11.86%, hitting $50.75 billion. Its circulating supply reached 19.86 million against a max supply of 21 million.

Coincu’s research team emphasizes Bitcoin’s robust performance as a catalyst for further institutional investments. However, regulatory challenges and technological developments like AI integration will shape its future trajectory, as evidenced by their extensive research. These dynamics necessitate cautious optimism among investors.

Source: https://coincu.com/337845-mubadala-increases-blackrock-etf-stake/