- Mubadala increases holdings in BlackRock’s Bitcoin ETF, boosting market confidence.

- Valued at $408.5 million, reflecting a 6% increase.

- Signals rising confidence in Bitcoin as a significant institutional asset.

On May 16, Mubadala, Abu Dhabi’s sovereign wealth fund, reported an increase in its holdings in BlackRock’s Bitcoin spot ETF (IBIT) to 8.73 million shares, valued at $408.5 million. This marks a 6% rise from December 2024.

The fund’s decision underscores the increasing acceptance of Bitcoin as an institutional asset, reflecting a broader market confidence and regulatory acceptance.

Mubadala’s 6% Boost in Bitcoin ETF: Implications and Trends

Mubadala’s increased participation signals a strong vote of confidence in Bitcoin from a major global sovereign fund. The organization’s holdings in BlackRock’s iShares Bitcoin Trust (IBIT) now total 8,727,000 shares, marking a 6% increase from the previous quarter’s 8,235,533 shares. This action reflects a deepening engagement with digital assets, aligning with Tahnoon Bin Zayed Al Nahyan’s comments on AI and crypto’s transformative potential. “I explored with David Sacks, the Special Advisor on AI and Crypto, the transformative effects… the expanding role of digital currencies… and the investment opportunities emerging at their convergence…”

Market implications include increased confidence in Bitcoin, which could catalyze a positive sentiment among other institutional investors. This move highlights the appeal of Bitcoin as a key component in diversified portfolios, potentially paving the way for similar actions from other sovereign wealth funds.

Tahnoon Bin Zayed Al Nahyan, National Security Adviser and key figure behind Mubadala’s strategy, emphasized the importance of digital currencies to future financial systems. His discourse with David Sacks hints at the balanced interplay of AI and crypto investments, suggesting a strategic vision for long-term growth. Further details on Bitcoin-related activities from Mubadala can be found through SEC’s Edgar database.

Bitcoin’s Market Context and Institutional Influence

Did you know? Mubadala’s 6% increase in BlackRock’s Bitcoin ETF shares follows a precedent set by other large institutional investors, echoing similar moves from public pensions like the Wisconsin Investment Board, setting a trend in sovereign-funded digital asset allocations.

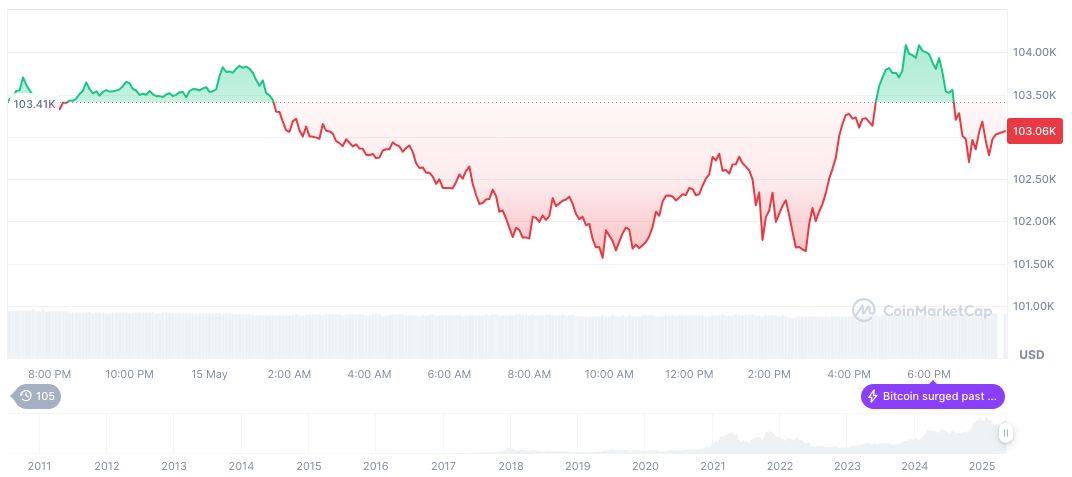

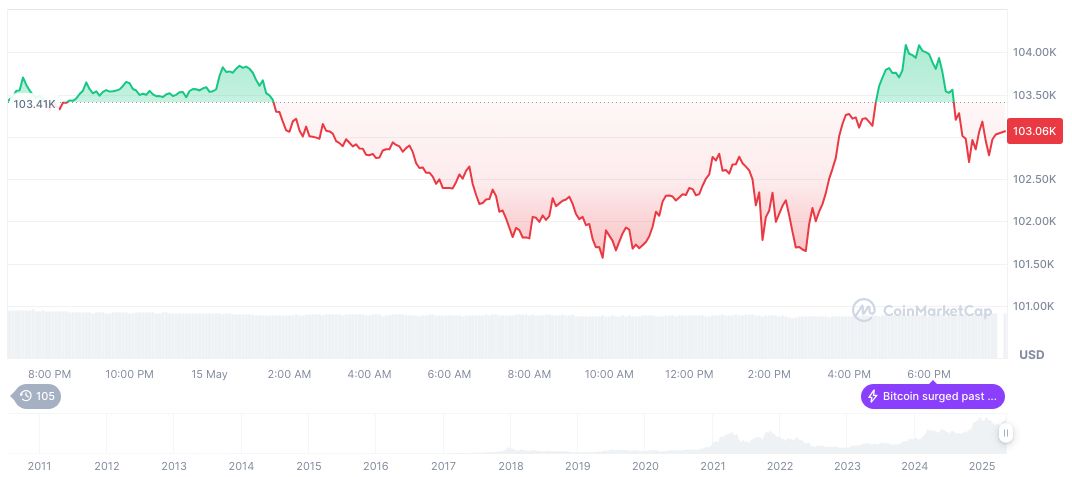

Bitcoin (BTC) currently trades at $103,496.92 with a market cap of approximately $2.06 trillion, commanding a dominance of 62.15%. The last 24 hours saw a trading volume approximating $48.74 billion, marking a decrease of 0.17% in price. CoinMarketCap data highlights a 24.11% rise in the past 30 days.

Insights from Coincu’s research team suggest that the growing institutional interest in Bitcoin could further stabilize regulatory frameworks around crypto investments. Historical trends indicate that sustained institutional adoption, such as Mubadala’s, elevates Bitcoin’s legitimacy as a valuable asset class.

Source: https://coincu.com/337851-mubadala-increases-blackrock-bitcoin-etf/