Bitcoin’s value remains surprisingly stable, even after Mt. Gox, the defunct crypto exchange, transferred 13,265 BTC. These BTC are approximately worth $782 million.

Specifically, this transaction includes 12,000 BTC shifted into a new wallet and 1,265 BTC to an internal wallet.

Bitcoin Trades Near $60,000 Despite Mt. Gox Transfers

Previously, on August 14, Mt. Gox made another substantial move by transferring 33,140 BTC, valued at nearly $1.97 billion, into two new wallets. Of this, only 111.3 BTC found its way to major crypto exchanges OKX and Binance, likely part of an effort to repay creditors.

According to Spot On Chain, since July 5, Mt. Gox has reallocated 61,670 BTC, equivalent to $4.04 billion, to exchanges such as Bitstamp, SBI VC Trade, and Kraken for similar purposes. Currently, Mt. Gox’s holdings include approximately 79,186 BTC, which amounts to about $4.67 billion.

Despite these large transactions, market experts, such as Alex Thorn, do not foresee significant selling pressure.

“We now think that of the 13,265 BTC moved in this transaction, only 1,265 ($74.5 million) is meant to distribute, with 12,000 going to estate fresh cold storage so, very small,” Thorn, the head of research at Galaxy Digital stated.

As of writing, Bitcoin is trading at $59,659, experiencing a modest decline of 2.3% in the last 24 hours.

Read more: Top Crypto Bankruptcies: What You Need To Know

However, various market indicators hint at an upcoming bullish trend. Analysts at K33 Research anticipate a potential short squeeze, which could propel Bitcoin prices upward.

They highlight the current low funding rates for Bitcoin perpetual futures, which have reached their nadir since the US banking crisis in March 2023. Furthermore, the analysts Vetle Lunde and David Zimmerman suggest that the conditions are ripe for a notable market movement.

“Perpetual swap funding rates have averaged at negative levels over the past week, while open interest has sharply increased. This suggests aggressive shorting, structurally creating a setup ripe for a short squeeze,” K33 analysts said.

This scenario would force quick-profit traders to abandon their bearish bets, further boosting the price surge.

Additionally, the global stock markets are approaching record highs, with gold prices achieving new all-time highs. Meanwhile, Bitcoin has been lagging slightly, potentially setting the stage for a rebound.

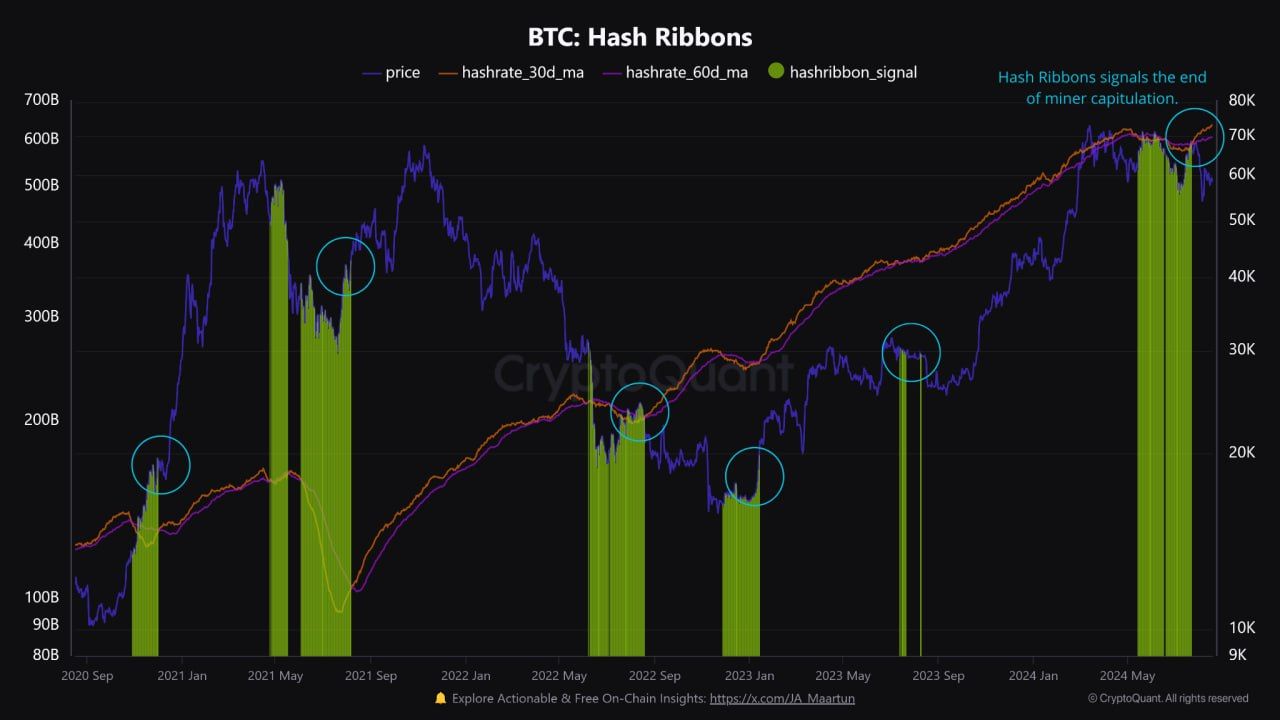

Moreover, the crypto mining sector displays signs of recovery. The Hash Ribbons indicator from CryptoQuant, which monitors the 30 and 60-day averages of the Hash Rate, recently signaled the end of miner capitulation. Concurrently, the Hash Rate has reached a new peak of 638 exahash per second.

Read more: Bitcoin Halving History: Everything You Need To Know

This recovery is particularly important as it follows a Bitcoin halving event, which typically precedes substantial price increases.

“Miner capitulations after the halvings have been followed by large price rallies (4x-6x increase in 2016 and 2020), although the price rally is not necessarily a direct result of the miner capitulation event,” Julio Moreno, Head of Research at CryptoQuant told BeInCrypto.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Source: https://beincrypto.com/bitcoin-steady-mt-gox-moves-funds/