Key Highlights:

- MicroStrategy might be removed by MSCI from major indices due to its Bitcoin-heavy balance sheet.

- JPMorgan warns of $2.8B-$8.8B in potential fund outflows, if MicroStrategy is removed from the indices.

- Strategy faces a tough choice, to sell Bitcoin or to hold and risk removal from MSCI.

MicroStrategy, now known as Strategy with its recent rebranding, is facing a critical challenge as MSCI is considering excluding it from key indices as its Bitcoin holdings exceed 50% of total assets. The final decision is expected to be out by January 15, 2026, and has the possibility to redefine the company’s place in traditional financial markets. MSCI’s new methodology is focusing on excluding companies that primarily hold volatile digital assets rather than operate fundamentally as enterprises, with Strategy squarely in the spotlight due to its heavy Bitcoin asset allocation.

比特币再度暴跌,Strategy(微策略)陷入市场FUD风波。

根据摩根大通的研报,如果Strategy被从MSCI指数中剔除,预计将导致28亿美元资金流出,进一步加剧市场恐慌。… pic.twitter.com/pPEntbFfHR

— PANews (@PANews) November 24, 2025

JPMorgan Warns of Billions in Potential Fund Outflows

JPMorgan analysts warn that the exclusion could trigger a $2.8 billion of forced selling by passive index-tracking funds, with broader outflows possibly surging to $8.8 billion if other index providers follow MSCI’s lead. These outflows can easily affect liquidity and price of MicroStrategy’s stock, which currently is trading near the net asset value of its Bitcoin holdings, indicating diminished confidence in its premium valuation.

Michael Saylor Responds to Market Fears and Strategic Dilemma

Michael Saylor, Co-founder of Strategy, says that the market has already factored in most of the risk. He also stressed that the company will stick to its long-term Bitcoin strategy. Strategy is now facing a difficult decision, if it should sell some Bitcoin (this could give rise to a huge BTC selling and push the prices down) or keep its current holdings and risk being removed from the index (this could lead to fund outflows and the stock prices could drop).

Impact on Bitcoin Prices and Market Confidence

If MicroStrategy is removed from the MSCI index, it can hurt the stock prices of the company and can also affect the stability of Bitcoin. Many of the institutions use MicroStrategy as a way to get Bitcoin exposure, so forced selling of its assets could worsen the recent weakness in Bitcoin and increase short-selling pressure. This could also shake confidence across the crypto market.

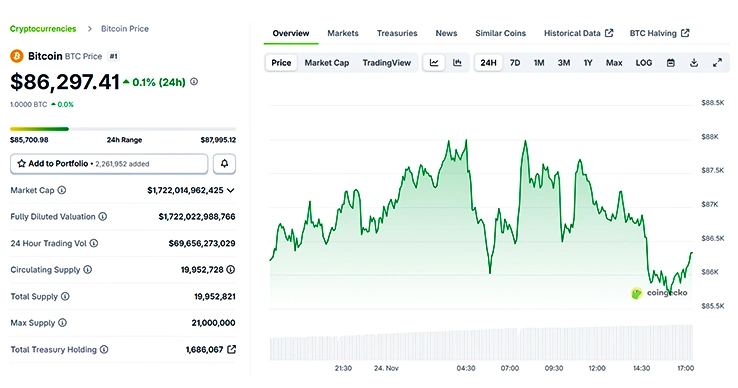

At press time, the price of the token stands at $86,297.41 with an uptick of 0.1% in the last 24-hours as per CoinGecko.

The Role of MicroStrategy in Institutional Bitcoin Exposure

MicroStrategy is a great way through which Wall Street could invest in Bitcoin without having to buy Bitcoin and holding on to it. However, now, because of this MSCI issue, MicroStrategy’s role might take a turn. Bitcoin was supposed to act like a proxy but now it is becoming part of a risk-management decision. This shows how hard it is for investors to handle crypto’s ups and downs while still following normal investing rules.

Broader Implications for Crypto-Heavy Companies and Indices

This review by MSCI will potentially affect dozens of firms that hold a crypto treasury. This signals a structural change in how digital asset holdings are classified in mainstream equity benchmarks and could prompt corporations to rethink treasury management to align with index eligibility rules.

What Investors Should Watch Amid Uncertainty

As the decision will be revealed soon, investors need to watch out for how much Bitcoin MicroStrategy holds and whether index providers change their rules or not. Whatever happens will indefinitely affect MicroStrategy’s stock and how smoothly Bitcoin continues to fit into mainstream investing as we move into 2026.

Also Read: We Won’t Back Down, Says Strategy’s Michael Saylor

Source: https://www.cryptonewsz.com/msci-review-microstrategy-risk-btc-exposure/