- Morgan Stanley’s Bitcoin ETF purchase underscores its growing interest in digital assets.

- Morgan Stanley acquires $188 million in Bitcoin ETFs in Q2.

- Broader trend of increased institutional investments in Bitcoin ETFs observed.

Morgan Stanley disclosed a $188 million Bitcoin ETF purchase in the second quarter, reinforcing institutional interest in digital assets, as noted by The Bitcoin Historian on September 3, 2025.

This investment indicates a growing trend in institutional cryptocurrency adoption, aligning with a broader market shift that saw ETF assets under management rising to $33.4 billion in Q2.

Morgan Stanley’s $188 Million Bet on Bitcoin ETFs

Morgan Stanley’s acquisition of $188 million worth of Bitcoin exchange-traded funds in the second quarter of 2025 highlights increased institutional interest in digital asset investment products. This action aligns with the bank’s historical yet cautious approach to offering limited digital asset exposure to wealthy clients. As of now, there are no public statements from senior executives concerning this purchase.

The bank’s latest move signifies a noticeable shift in institutional involvement, as the second quarter saw an overall rise of 57% in US Bitcoin ETF holdings. While this trend highlights broad institutional interest, it remains an off-chain event with no direct impact on Bitcoin’s on-chain metrics.

“Buying, selling, and transacting in Bitcoin, Ethereum or other digital assets (‘Digital Assets’), and related funds and products, is highly speculative and may result in a loss of the entire investment.” Source: Morgan Stanley Q2 2025 Market Commentary

Market analysts observed this trend as indicative of growing confidence among traditional financial institutions in crypto assets. Although there are no official comments from key industry figures regarding this purchase, the action solidifies Bitcoin’s position as an appealing asset class for large investors.

Bitcoin ETF Holdings Surge 57% in Q2 2025

Did you know? The second quarter of 2025 saw a 57% increase in Bitcoin ETF holdings among institutional investors, reflecting a growing acceptance of cryptocurrencies within traditional financial circles.

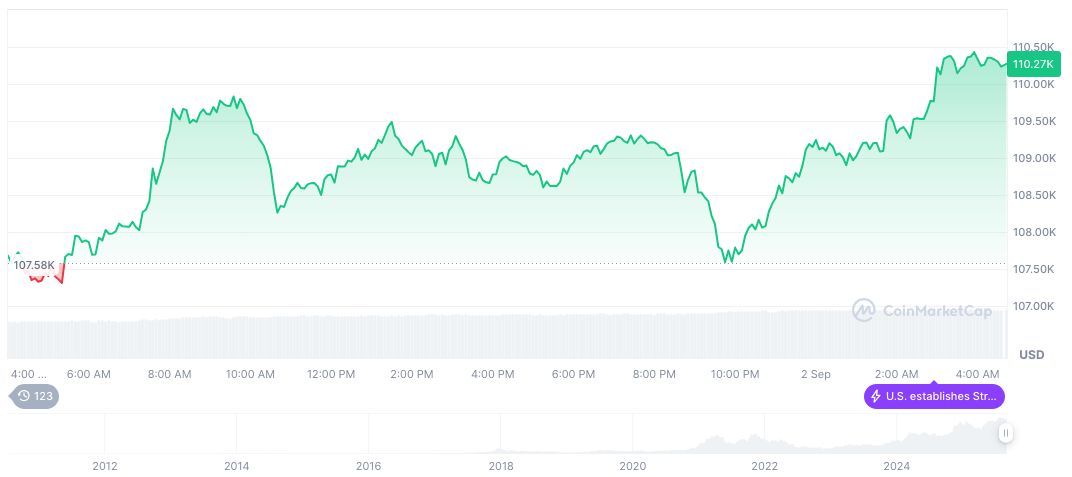

According to CoinMarketCap, Bitcoin is trading at $111,235.23 with a circulating supply of 19,915,362 BTC. Holding a market cap of $2.22 trillion and 57.95% dominance, Bitcoin saw a 1.83% price rise over 24 hours and a 5.83% increase over 90 days. The cryptocurrency’s trading volume surged to $74.3 billion, reflecting significant market activity.

The Coincu research team suggests that the recent increase in institutional Bitcoin ETF investments is anticipated to influence regulatory perspectives, potentially encouraging a more amenable regulatory environment. Historical data suggest that as institutional confidence grows, the market could witness heightened technological adoption and integration.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/morgan-stanley-bitcoin-etf-purchase-q2/